Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN: 9781337115773

Author: Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

None

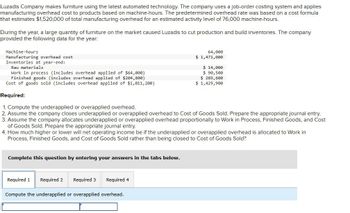

Transcribed Image Text:Luzadis Company makes furniture using the latest automated technology. The company uses a job-order costing system and applies

manufacturing overhead cost to products based on machine-hours. The predetermined overhead rate was based on a cost formula

that estimates $1,520,000 of total manufacturing overhead for an estimated activity level of 76,000 machine-hours.

During the year, a large quantity of furniture on the market caused Luzadis to cut production and build inventories. The company

provided the following data for the year:

Machine-hours

Manufacturing overhead cost

Inventories at year-end:

Raw materials

Work in process (includes overhead applied of $64,000)

Finished goods (includes overhead applied of $204,800)

Cost of goods sold (includes overhead applied of $1,011,200)

Required:

1. Compute the underapplied or overapplied overhead.

64,000

$ 1,471,000

$ 14,000

$ 90,500

$ 289,600

$ 1,429,900

2. Assume the company closes underapplied or overapplied overhead to Cost of Goods Sold. Prepare the appropriate journal entry.

3. Assume the company allocates underapplied or overapplied overhead proportionally to Work in Process, Finished Goods, and Cost

of Goods Sold. Prepare the appropriate journal entry.

4. How much higher or lower will net operating income be if the underapplied or overapplied overhead is allocated to Work in

Process, Finished Goods, and Cost of Goods Sold rather than being closed to Cost of Goods Sold?

Complete this question by entering your answers in the tabs below.

Required 1 Required 2 Required 3

Required 4

Compute the underapplied or overapplied overhead.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- Brees, Inc., a manufacturer of golf carts, has just received an offer from a supplier to provide 2,600 units of a component used in its main product. The component is a track assembly that is currently produced internally. The supplier has offered to sell the track assembly for 66 per unit. Brees is currently using a traditional, unit-based costing system that assigns overhead to jobs on the basis of direct labor hours. The estimated traditional full cost of producing the track assembly is as follows: Prior to making a decision, the companys CEO commissioned a special study to see whether there would be any decrease in the fixed overhead costs. The results of the study revealed the following: 3 setups1,160 each (The setups would be avoided, and total spending could be reduced by 1,160 per setup.) One half-time inspector is needed. The company already uses part-time inspectors hired through a temporary employment agency. The yearly cost of the part-time inspectors for the track assembly operation is 12,300 and could be totally avoided if the part were purchased. Engineering work: 470 hours, 45/hour. (Although the work decreases by 470 hours, the engineer assigned to the track assembly line also spends time on other products, and there would be no reduction in his salary.) 75 fewer material moves at 30 per move. Required: 1. Ignore the special study, and determine whether the track assembly should be produced internally or purchased from the supplier. 2. Now, using the special study data, repeat the analysis. 3. Discuss the qualitative factors that would affect the decision, including strategic implications. 4. After reviewing the special study, the controller made the following remark: This study ignores the additional activity demands that purchasing would cause. For example, although the demand for inspecting the part on the production floor decreases, we may need to inspect the incoming parts in the receiving area. Will we actually save any inspection costs? Is the controller right?arrow_forwardCleanCom Company specializes in cleaning commercial buildings and construction sites. Each building and site is different, requiring amounts and types of supplies and labor for each job. CleanCom estimated the following for the year: During the year, the following actual amounts were experienced: If CleanCom uses a normal costing system and overhead is applied on the basis of direct labor hours, what is the cost of cleaning a construction site that takes 140 of direct materials and 21 direct labor hours? a. 455 b. 508 c. 648 d. 644arrow_forwardRulers Company is a neon sign company that estimated overhead will be $60,000, consisting of 1,500 machine hours. The cost to make Job 416 is $95 in neon, 15 hours of labor at $13 per hour, and five machine hours. During the month, it incurs $95 in indirect material cost, $130 in administrative labor, $320 in utilities, and $350 in depreciation expense. What is the predetermined overhead rate if machine hours are considered the cost driver? What is the cost of Job 416? What is the overhead incurred during the month?arrow_forward

- Kenkel, Ltd. uses backflush costing to account for its manufacturing costs. The trigger points are the purchase of materials, the completion of goods, and the sale of goods. Prepare journal entries to account for the following: a. Purchased raw materials, on account, 80,000. b. Requisitioned raw materials to production, 80,000. c. Distributed direct labor costs, 10,000. d. Factory overhead costs incurred, 60,000. (Use Various Credits for the account in the credit part of the entry.) e. Completed all of the production started. f. Sold the completed production for 225,000, on account.arrow_forwardDavis Co. uses backflush costing to account for its manufacturing costs. The trigger points are the purchase of materials, the completion of goods, and the sale of goods. Prepare journal entries to account for the following: a. Purchased raw materials, on account, 70,000. b. Requisitioned raw materials to production, 70,000. c. Distributed direct labor costs, 15,000. d. Factory overhead costs incurred, 45,000. (Use Various Credits for the account in the credit part of the entry.) e. Completed all of the production started. f. Sold the completed production for 195,000, on account. (Hint: Use a single account for raw materials and work in process.)arrow_forwardMott Company recently implemented a JIT manufacturing system. After one year of operation, Heidi Burrows, president of the company, wanted to compare product cost under the JIT system with product cost under the old system. Motts two products are weed eaters and lawn edgers. The unit prime costs under the old system are as follows: Under the old manufacturing system, the company operated three service centers and two production departments. Overhead was applied using departmental overhead rates. The direct overhead costs associated with each department for the year preceding the installation of JIT are as follows: Under the old system, the overhead costs of the service departments were allocated directly to the producing departments and then to the products passing through them. (Both products passed through each producing department.) The overhead rate for the Machining Department was based on machine hours, and the overhead rate for assembly was based on direct labor hours. During the last year of operations for the old system, the Machining Department used 80,000 machine hours, and the Assembly Department used 20,000 direct labor hours. Each weed eater required 1.0 machine hour in Machining and 0.25 direct labor hour in Assembly. Each lawn edger required 2.0 machine hours in Machining and 0.5 hour in Assembly. Bases for allocation of the service costs are as follows: Upon implementing JIT, a manufacturing cell for each product was created to replace the departmental structure. Each cell occupied 40,000 square feet. Maintenance and materials handling were both decentralized to the cell level. Essentially, cell workers were trained to operate the machines in each cell, assemble the components, maintain the machines, and move the partially completed units from one point to the next within the cell. During the first year of the JIT system, the company produced and sold 20,000 weed eaters and 30,000 lawn edgers. This output was identical to that for the last year of operations under the old system. The following costs have been assigned to the manufacturing cells: Required: 1. Compute the unit cost for each product under the old manufacturing system. 2. Compute the unit cost for each product under the JIT system. 3. Which of the unit costs is more accurate? Explain. Include in your explanation a discussion of how the computational approaches differ. 4. Calculate the decrease in overhead costs under JIT, and provide some possible reasons that explain the decrease.arrow_forward

- SmokeCity, Inc., manufactures barbeque smokers. Based on past experience, SmokeCity has found that its total annual overhead costs can be represented by the following formula: Overhead cost = 543,000 + 1.34X, where X equals number of smokers. Last year, SmokeCity produced 20,000 smokers. Actual overhead costs for the year were as expected. Required: 1. What is the driver for the overhead activity? 2. What is the total overhead cost incurred by SmokeCity last year? 3. What is the total fixed overhead cost incurred by SmokeCity last year? 4. What is the total variable overhead cost incurred by SmokeCity last year? 5. What is the overhead cost per unit produced? 6. What is the fixed overhead cost per unit? 7. What is the variable overhead cost per unit? 8. Recalculate Requirements 5, 6, and 7 for the following levels of production: (a) 19,500 units and (b) 21,600 units. (Round your answers to the nearest cent.) Explain this outcome.arrow_forwardLuzadis Company makes furniture using the latest automated technology. The company uses a job - order costing system and applies manufacturing overhead cost to products based on machine - hours. The predetermined overhead rate was based on a cost formula that estimates $1, 520,000 of total manufacturing overhead for an estimated activity level of 76, 000 machine - hours. During the year, a large quantity of furniture on the market caused Luzadis to cut production and build inventories. The company provided the following data for the year: Machine - hours 64, 000 Manufacturing overhead cost $ 1, 471,000 Inventories at year - end: Raw materials S 14,000 Work in process (includes overhead applied of $64, 000) $ 90,500 Finished goods (includes overhead applied of $204, 800) S 289,600 Cost of goods sold (includes overhead applied of $1, 011, 200) $ 1,429, 900 Required: Compute the underapplied or overapplied overhead. Assume the company closes underapplied or overapplied overhead to Cost of…arrow_forwardLuzadis Company makes furniture using the latest automated technology. The company uses a job-order costing system and applies manufacturing overhead cost to products based on machine-hours. The predetermined overhead rate was based on a cost formula that estimates $765,000 of total manufacturing overhead for an estimated activity level of 85,000 machine-hours. During the year, a large quantity of furniture on the market caused Luzadis to cut production and build inventories. The company provided the following data for the year: Machine-hours Manufacturing overhead cost Inventories at year-end: Raw materials Work in process (includes overhead applied of $62,100) Finished goods (includes overhead applied of $105,570) Cost of goods sold (includes overhead applied of $453,330) Required: 1. Compute the underapplied or overapplied overhead. 69,000 $ 719,000 $ 14,000 $ 183,000 $ 311,100 $ 1,335,900 2. Assume the company closes underapplied or overapplied overhead to Cost of Goods Sold.…arrow_forward

- Luzadis Company makes furniture using the latest automated technology. The company uses a job-order costing system and applies manufacturing overhead cost to products based on machine-hours. The predetermined overhead rate was based on a cost formula that estimates $900,000 of total manufacturing overhead for an estimated activity level of 75,000 machine-hours. During the year, a large quantity of furniture on the market caused Luzadis to cut production and build inventories. The company provided the following data for the year: Machine-hours Manufacturing overhead cost Inventories at year-end: 60,000 $ 850,000 Raw materials Work in process (includes overhead applied of $36,000) Finished goods (includes overhead applied of $180,000) Cost of goods sold (includes overhead applied of $504,000) Required: 1. Compute the underapplied or overapplied overhead. 2. Assume the company closes underapplied or overapplied overhead to Cost of Goods Sold. Prepare the appropriate journal entry. 3.…arrow_forwardLuzadis Company makes furniture using the latest automated technology. The company uses a job-order costing system and applies manufacturing overhead cost to products on the basis of machine-hours. The predetermined overhead rate was based on a cost formula that estimates $1,368,000 of total manufacturing overhead for an estimated activity level of 72,000 machine-hours. During the year, a large quantity of furniture on the market resulted in cutting back production and a buildup of furniture in the company’s warehouse. The company’s cost records revealed the following actual cost and operating data for the year: Machine-hours 61,000 Manufacturing overhead cost $ 1,324,000 Inventories at year-end: Raw materials $ 16,000 Work in process (includes overhead applied of $115,900) $ 188,000 Finished goods (includes overhead applied of $208,620) $ 338,400 Cost of goods sold (includes overhead applied of $834,480) $ 1,353,600 Required: 1. Compute the underapplied or…arrow_forwardLuzadis Company makes furniture using the latest automated technology. The company uses a job-order costing system and applies manufacturing overhead cost to products on the basis of machine-hours. The predetermined overhead rate was based on a cost formula that estimates $1,368,000 of total manufacturing overhead for an estimated activity level of 72,000 machine-hours. During the year, a large quantity of furniture on the market resulted in cutting back production and a buildup of furniture in the company’s warehouse. The company’s cost records revealed the following actual cost and operating data for the year: Machine-hours 61,000 Manufacturing overhead cost $ 1,324,000 Inventories at year-end: Raw materials $ 16,000 Work in process (includes overhead applied of $115,900) $ 188,000 Finished goods (includes overhead applied of $208,620) $ 338,400 Cost of goods sold (includes overhead applied of $834,480) $ 1,353,600 Required: 1. Compute the underapplied or…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning