Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN: 9781337395083

Author: Eugene F. Brigham, Phillip R. Daves

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

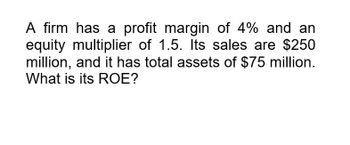

What is its ROE on these financial Accounting Question? Do not use

Transcribed Image Text:A firm has a profit margin of 4% and an

equity multiplier of 1.5. Its sales are $250

million, and it has total assets of $75 million.

What is its ROE?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- A firm has a profit margin of 2% and an equity multiplier of 2.0. Its sales are $100 million, and it has total assets of $50 million. What is its ROE?arrow_forwardWhat is the firms ROE?arrow_forwardThe value of a firm's invested capital is 300 million. Its return on invested capital is 12%, and its WACC is 10.5%. What is the economic value added/economic profit?arrow_forward

- Mari Mari Berhad has sales of RM29,000, total assets of RM17,500, and total debt of RM6,300. If the Net Profit Margin is 9%; a) What is the Net Income ? b) What is the Return on Asset ? c) What is the Return on Equities ?arrow_forwardA firm has a tax burden ratio of .75, a leverage ratio of 1.25, an interest burden of .6, and a return on sales of 10%. The firm generates $2.40 in sales per dollar of assets. What is the firm’s ROE?arrow_forwardA company has a profit margin of 6.5% and an equity multiplier of 2.8. Its sales are $750 million, and it has total assets of $250 million. What is its ROE?arrow_forward

- Provide answerarrow_forwardButtack Eyes, Inc., has sales of $19 million, total assets of $15.6 million, and total debt of $6.3 million. If the profit margin is 8 percent, what is net income? What is ROA?arrow_forwardA firm has sales of R40 million, total assets of R50 million and total debt of R9 million. The net profit margin is 8%. a) What is the net profit? b) ROEarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning