Cornerstones of Financial Accounting

4th Edition

ISBN: 9781337690881

Author: Jay Rich, Jeff Jones

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

harsh.3

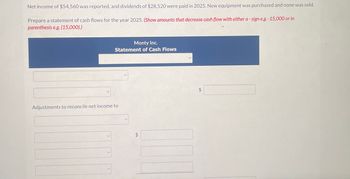

Transcribed Image Text:Net income of $54,560 was reported, and dividends of $28,520 were paid in 2025. New equipment was purchased and none was sold.

Prepare a statement of cash flows for the year 2025. (Show amounts that decrease cash flow with either a - sign e.g. -15,000 or in

parenthesis e.g. (15,000).)

Monty Inc.

Statement of Cash Flows

Adjustments to reconcile net income to

EA

$

$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- In the current year, Harrisburg Corporation had net income of 35,000, a 9,000 decrease in accounts receivable, a 7,000 increase in inventory, an 8,000 increase in salaries payable, a 13,000 decrease in accounts payable, and 10,000 in depreciation expense. Using the indirect method, prepare the operating activities section of its statement of cash flows based on this information.arrow_forwardUse the following information from Birch Companys balance sheets to determine net cash flows from operating activities (indirect method), assuming net income for 2018 of $122,000.arrow_forwardUse the following excerpts from Indigo Companys balance sheets to determine net cash flows from operating activities (indirect method), assuming net income for 2018 of $225,000.arrow_forward

- Statement of Cash Flows The following are Mueller Companys cash flow activities: a. Net income, 68,000 b. Increase in accounts receivable, 4,400 c. Receipt from sale of common stock, 12,300 d. Depreciation expense, 11,300 e. Dividends paid, 24,500 f. Payment for purchase of building, 65,000 g. Bond discount amortization, 2,700 h. Receipt from sale of long-term investments at cost, 10,600 i. Payment for purchase of equipment, 8,000 j. Receipt from sale of preferred stock, 20,000 k. Increase in income taxes payable, 3,500 l. Payment for purchase of land, 9,700 m. Decrease in accounts payable, 2,900 n. Increase in inventories, 10,300 o. Beginning cash balance, 18,000 Required: Prepare Mueller Company's statement of cash flows.arrow_forwardSolpoder Corporation has the following comparative financial statements: Dividends of 17,100 were paid. No equipment was purchased or retired during the current year. Required: Prepare a statement of cash flows using the direct method.arrow_forwardPartial Statement of Cash Flows Service Company had net income during the current year of $65,800. The following information was obtained from Services balance sheet: Accounts receivable $26,540 increase Inventory 32,180 increase Accounts payable 9,300 decrease Interest payable 2,120 increase Accumulated depreciation (Building) 14,590 increase Accumulated depreciation (Equipment) 32,350 increase Additional Information: 1. Equipment with accumulated depreciation of $18,000 was sold during the year. 2. Cash dividends of $29,625 were paid during the year. Required: 1. Prepare the net cash flows from operating activities using the indirect method. 2. CONCEPTUAL CONNECTION How would the cash proceeds from the sale of equipment he reported on the statement of cash flows? 3. CONCEPTUAL CONNECTION How would the cash dividends be reported on the statement of cash flows? 4. CONCEPTUAL CONNECTION What could the difference between net income and cash flow from operating activities signal to financial statement users?arrow_forward

- Selected information from Brook Corporations accounting records and financial statements for 2019 follows: On the statement of cash flows for the year ended December 31, 2019, Brook should disclose a net increase in cash in the amount of: a. 1,700,000 b. 2,400,000 c. 3,700,000 d. 4,200,000arrow_forwardReporting changes in equipment on statement of cash flows An analysis of the general ledger accounts indicates that office equipment, which cost 245,000 and on which accumulated depreciation totaled 112,500 on the date of sale, was sold for 105,900 during the year. Using this information, indicate the items to be reported on the statement of cash flows.arrow_forwardOrearrow_forward

- Sheridan Company reported net income of $0.50 million in 2022. Depreciation for the year was $80,000, accounts receivable decreased $175,000, and accounts payable decreased $140,000. Compute net cash provided by operating activities using the indirect approach. (Show amounts that decrease cash flow with either a - sign e.g. -15,000 or in parenthesis e.g. (15,000).) Sheridan Company Statement of Cash Flows-Indirect Approacharrow_forwardSwifty Ltd. had the following 2023 income statement data: Revenues Expenses 1/1/23 Revenues $113,000 In 2023, Swifty had the following activity in selected accounts: 12/31/23 49,200 $63,800 Accounts Receivable 19,100 113,000 34,780 1,320 Write-offs 96,000 Collections Allowance for Expected Credit Losses Write-offs 1.320 Swifty Ltd. Statement of Cash Flows (Indirect Method) 1,300 1.540 1.520 1/1/23 Loss on impairment 12/31/23 Prepare Swifty's cash flows from operating activities section of the statement of cash flows using the indirect method. (Show amounts that decrease cash flow with either a negative sign e.g. -10,000 or in parenthesis eg. (10,000).arrow_forwardVaughn, Inc. reported net income of $2.45 million in 2022. Depreciation for the year was $156,800, accounts receivable decreased $343,000, and accounts payable decreased $274,400. Compute net cash provided by operating activities using the indirect method. (Show amounts that decrease cash flow with either a - sign e.g.-15,000 or in parenthesis e.g. (15,000).) Cash Flows from Operating Activities Net Income Vaughn, Inc. Statement of Cash Flows-Indirect Approach For the Year Ended December 31, 2022 Adjustments to reconcile net income to Net Cash Provided by Operating Activities Depreciation Expense Accounts Receivable Decrease V Accounts Payable Decrease Net Cash Provided by Operating Activities $ 156,800 343,000 -274,400 $ $ 225,400arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning