EBK CONTEMPORARY FINANCIAL MANAGEMENT

14th Edition

ISBN: 9781337514835

Author: MOYER

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

Please give me answer

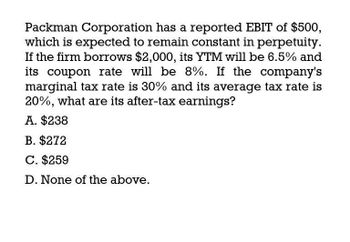

Transcribed Image Text:Packman Corporation has a reported EBIT of $500,

which is expected to remain constant in perpetuity.

If the firm borrows $2,000, its YTM will be 6.5% and

its coupon rate will be 8%. If the company's

marginal tax rate is 30% and its average tax rate is

20%, what are its after-tax earnings?

A. $238

B. $272

C. $259

D. None of the above.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- I need answer of this questionarrow_forward4. Binford Tools has an expected perpetual EBITDA equal to $67k. Its tax rate is 35%. Binford has $139k in debt at a cost of 6.85%. The unlevered capital cost is 10.25%. What is Binford's total value assuming interest is tax deductible?arrow_forwardGet correct answer accountingarrow_forward

- Suppose Tool Corp. is an unleveraged firm. It has an expected EBIT of 67,000 in Perpetuity and a tax rate of 35%. Its cost of equity is 10.25%. What is Tool Corp’s firm value? (SHOW YOUR WORK)arrow_forwardTool Manufacturing has an expected EBIT of $89,000 in perpetuity and a tax rate of 25 percent. The firm has $210,000 in outstanding debt at an interest rate of 8.8 percent, and its unlevered cost of capital is 11 percent. What is the value of the firm according to MM Proposition I with taxes? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Value of the firmarrow_forwardMalbar Gold has taken a loan of two million on which it pays an interest of 4.5 %. If the current tax rate 37.5 %. What is the firm's after tax cost of debt? Select one: a. None of these О Б. 3.44 O c. 4.42 O d. 2.81arrow_forward

- BBA Ltd has just issued $10 million in debt (at par or face value). The firm will pay interest only on this debt. BBA’s marginal tax rate is expected to be 30% for the foreseeable future. a) Suppose BBA pays interest of 6% per year on its debt. What is its annual interest tax shield? b) What is the present value of the interest tax shield, assuming the tax shield’s risk is the same as that of the loan? c) Suppose instead that the interest rate on the debt is 5%. What is the present value of the interest tax shield in this case? Ten years have passed since BBA issued $10 million in perpetual interest-only debt with a 6% annual coupon. Tax rates have remained the same at 30% but interest rates have dropped so BBA’s current cost of debt capital is 4%. d) What is BBA’s annual interest tax shield now? e) What is the present value of the interest tax shield now?arrow_forwardMeyer & Co. expects its EBIT to be $115,000 every year forever. The firm can borrow at 7 percent. The company currently has no debt, and its cost of equity is 13 percent. a. If the tax rate is 24 percent, what is the value of the firm? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) b. What will the value be if the company borrows $255,000 and uses the proceeds to repurchase shares? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.)arrow_forwardMeyer & Co. expects its EBIT to be $78,000 every year forever. The firm can borrow at 7 percent. Meyer currently has no debt, and its cost of equity is 12 percent. If the tax rate is 35 percent, what is the value of the firm? (Do not round intermediate calculations. Round your answer to 2 decimal places, e.g., 32.16.) Value of the firm What will the value be if the company borrows $103,000 and uses the proceeds to repurchase shares? (Do not round intermediate calculations. Round your answer to 2 decimal places, e.g., 32.16.) Value of the firm %24arrow_forward

- Malabar Gold has taken a loan of two million on which it pays an interest of 5.5 % . If the current tax rate 34.5 % . What is the firm's after tax cost of debt ? Select one a . 5.44 b . 3.60 C. 4.42 D. None of thesearrow_forwardYou expect that Tin Roof will generate a perpetual stream of EBIT at $92,000 annually. The firm's cost of debt is about 6.2 percent based on before tax YTMS. The firm's cost of equity is 11.4 percent based on CAPM. What is the value of the firm (in whole dollar) if corporate tax rate is 20 percent and the firm is financed with 40 percent debt and 60 percent equity? $819,623 $856,141 $834,088 $895,941 $861,439arrow_forwardArnell Industries has 5.5 million in permanent debt outstanding. The firm will pay interest only on this debt. Arnell's marginal tax rate is expected to be 40% for the foreseeable future. a. Suppose Arnell pays interest of 9% per year on its debt. What is its annual interest tax shield? b. What is the present value of the interest tax shield, assuming its risk is the same as the loan? c. Suppose instead the interest rate on the debt were 7%. What is the present value of the interest tax shield in this case?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning