Managerial Accounting

15th Edition

ISBN: 9781337912020

Author: Carl Warren, Ph.d. Cma William B. Tayler

Publisher: South-Western College Pub

expand_more

expand_more

format_list_bulleted

Question

Total material cost?

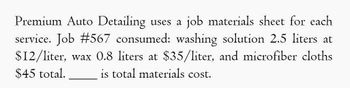

Transcribed Image Text:Premium Auto Detailing uses a job materials sheet for each

service. Job #567 consumed: washing solution 2.5 liters at

$12/liter, wax 0.8 liters at $35/liter, and microfiber cloths

is total materials cost.

$45 total.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- eBook Show Me How Predetermined Factory Overhead Rate Turbo Shop uses job order costing to determine the cost of performing engine repair work. Estimated costs and expenses for the coming period are as follows: Engine parts $678,200 Shop direct labor 495,000 Shop and repair equipment depreciation 41,000 Shop supervisor salaries 113,900 Shop property taxes 20,700 Shop supplies 15,800 13,600 58,300 7,500 $1,444,000 Advertising expense Administrative office salaries Administrative office depreciation expense Total costs and expenses The average shop direct labor rate is $15.00 per hour. Determine the predetermined shop overhead rate per direct labor hour. Round the answer to nearest whole cent. per direct labor hour.arrow_forwardPreparing job order costing journal entries Journalize the following transactions for Marge’s Sofas. Explanations are not required. Incurred and paid Web site expenses, $2,000. incurred manufacturing wages of $15,000, 75% of which was direct labor and 25% of which was indirect labor. Purchased raw materials on account, $24,000. Used in production: direct materials, $7,500; indirect materials, $5,000. Recorded manufacturing overhead: depreciation on plant, $18,000; plant insurance (previously paid), $1,500; plant property tax, $3,900 (credit Property Tax Payable). Allocated manufacturing overhead to jobs, 200% of direct labor costs. Completed production on jobs with costs of $40,000. Sold inventory on account, $22,000; the cost of goods sold, $18,000. Adjusted for overallocated or under-allocated overhead.arrow_forwardPreparing job order costing journal entries Journalize the following transactions for Marge’s Sofas. Explanations are not required. a. Incurred and paid Web site expenses, $2,000. b. incurred manufacturing wages of $15,000, 75% of which was direct labor and 25% of which was indirect labor. c. Purchased raw materials on account, $24,000. d. Used in production: direct materials, $7,500; indirect materials, $5,000. e. Recorded manufacturing overhead: depreciation on plant, $18,000; plant insurance (previously paid), $1,500; plant property tax, $3,900 (credit Property Tax Payable). f. Allocated manufacturing overhead to jobs, 200% of direct labor costs. g. Completed production on jobs with costs of $40,000. h. Sold inventory on account, $22,000; cost of goods sold, $18,000. i. Adjusted for overallocated or underallocated overhead.arrow_forward

- Subject: Financial Accountingarrow_forwardTik Tok Company manufactures customized coffee tables. The following relates to Job No.X10, an order for 150 coffee tables:Direct materials used $22 800Direct labour hours worked 600Direct labour rate per hour $16.00Machine hours used 400Applied factory overhead rate per machine hour $30.00Required:a) What is the total manufacturing cost for Job No. X10? b) Calculate the cost per coffee table for Job No. X10? c) List two uses of this unit cost information to the managers at Tik Tok Company. please provide the proper expalnation because i have to many difficulty in this problemarrow_forwardSolution step by steparrow_forward

- eBook Show Me How E Print Item Rex Industries has identified three different activities as cost drivers: machine setups, machine hours, and inspections. The overhead and estimated usage are: Compute the overhead rate for each activity. Round your answers to two decimal places. Overhead Overhead Annual Rate per Activity per Activity Usage Activity Machine Setups $162,750 4,200 Machine Hours 381,051 14,113 Inspections 110,550 3,300arrow_forwardProvide Answerarrow_forwardssume estimated overhead cost is $4,500,000, estimated direct labor costs is $3,000,000. Overhead is based on direct labor cost. If Job 265 incurs direct material costs of $963, direct labor of $1,750, and is sold for $7,200. **Use the following format for the journal entries: Dr. Raw Materials Inventory 500 Cr. Accounts Payable 500**** 1. What is the overhead rate? % 2. What is the journal entry to apply overhead to Job 5265? 3. What is total cost of Job? $ 4. What is gross profit? $ 5. At the end of the period it was determined that actual overhead incurred was $4,468,000. What is the adjusting entry to record the over/under applied OH?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub