FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

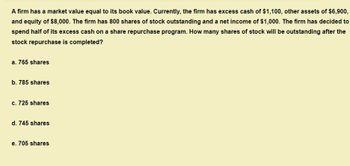

Transcribed Image Text:A firm has a market value equal to its book value. Currently, the firm has excess cash of $1,100, other assets of $6,900,

and equity of $8,000. The firm has 800 shares of stock outstanding and a net income of $1,000. The firm has decided to

spend half of its excess cash on a share repurchase program. How many shares of stock will be outstanding after the

stock repurchase is completed?

a. 765 shares

b. 785 shares

c. 725 shares

d. 745 shares

e. 705 shares

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Suppose Beta Industries and Delta Technology have identical assets that generate identical cash flows. Beta Industries is an all-equity firm, with 13 million shares outstanding that trade for a price of $19.00 per share. Delta Technology has 23 million shares outstanding, as well as debt of $74.10 million. Suppose Delta Technology stock currently trades for $11.25 per share. What arbitrage opportunity is available? What assumptions are necessary to exploit this opportunity? If Delta Technology stock currently trades for $11.25 per share, an example of an arbitrage opportunity that exists today which requires no future cash flow obligations would be: Sell----million shares of-----at the current price of $------and buy-----million shares of---at the current price of $---and borrow $---million.(Round to two decimal places.arrow_forwardBased on a discounted free cash flow method, you have estimated the value of a company to be $720 million. The company has $145 million of long-term debt outstanding (common equity comprises the rest). There are 11.0 million shares of common stock outstanding. What is the firm's estimated value per share of common stock? 13.18 52.27 65.00 65.45 O 78.64arrow_forwardAssume that you have just purchased some shares in an investment company reporting $575 million in assets, $35 million in liabilities, and 25 million shares outstanding. What is the net asset value (NAV) of these shares?arrow_forward

- ETA is an all-equity firm with 50 million shares outstanding. It has $200 million in cash and expects future free cash flows of $80 million per year (with the next cash flow occurring in exactly one year's time). The Board of ETA can either use all excess cash to repurchase shares or for expansion. Suppose that ETA is able to invest the $200 million excess cash into a project that will increase the future free cash flows by 30% in year 1 (and cash flows stay constant at that level after year 1). This investment will not alter the risk of the business. ETA's cost of capital is 10% and assume that capital markets are perfect. If you were advising the board, what course of action would you recommend? Should ETA use the $200 million to expand or repurchase shares? Required: (a) Firm value with expansion is $ million. Note: Please provide your answer as an integer in million in the format of xxxx (for example, if the answer is $1,234.5 million, type in 1235). (b) If the board decides to…arrow_forwardK Zoom Enterprises expects that one year from now it will pay a total dividend of $4.8 million and repurchase $4.8 million worth of shares. It plans to spend $9.6 million on dividends and repurchases every year after that forever, although it may not always be an even split between dividends and repurchases. If Zoom's equity cost of capital is 13.2% and it has 4.7 million shares outstanding, what is its share price today? The price per share is $ (Round to the nearest cent.)arrow_forwardBQ, Incorporated, is considering making an offer to purchase iReport Publications. The vice president of finance has collected the following information: BQ iReport Price-earnings ratio 12.2 8.8 Shares outstanding 1,500,000 165,000 Earnings $ 4,600,000 $ 680,000 Dividends $ 960,000 $ 410,000 BQ also knows that securities analysts expect the earnings and dividends of iReport to grow at a constant rate of 4 percent each year. BQ management believes that the acquisition of iReport will provide the firm with some economies of scale that will increase this growth rate to 6 percent per year. a. What is the value of iReport to BQ? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) b. What would BQ’s gain be from this acquisition? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) c. If BQ were to offer $36 in cash for each share of iReport, what would the…arrow_forward

- Maynard Steel plans to pay a dividend of $2.82 this year. The company has an expected earnings growth rate of 3.9% per year and an equity cost of capital of 9.5%. a. Assuming that Maynard's dividend payout rate and expected growth rate remain constant, and that the firm does not issue or repurchase shares, estimate Maynard's share price. b. Suppose Maynard decides to pay a dividend of $0.95 this year and use the remaining $1.87 per share to repurchase shares. If Maynard's total payout rate remains constant, estimate Maynard's share price. a. Assuming that Maynard's dividend payout rate and expected growth rate remain constant, and that the firm does not issue or repurchase shares, estimate Maynard's share price. Maynard's share price will be $ (Round to the nearest cent.)arrow_forwardTJ's has a market value equal to its book value. Currently, the firm has excess cash of $218,500, other assets of $897,309, and equity of $547,200. The firm has 40,000 shares of stock outstanding and net income of $59,800. Management has decided to spend 15 percent of the excess cash on a share repurchase program. How many shares of stock will be outstanding after the stock repurchase is completed?arrow_forwardCSH has EBITDA of $5 million. You feel that an appropriate EV/EBITDA ratio for CSH is 7. CSH has $6 million in debt, $3 million in cash, and 750,000 shares outstanding. What is your estimate of CSH's stock price? The estimate of CSH's stock price is (Round to the nearest cent.)arrow_forward

- An all-equity firm has expected earnings of $14,200 and a market value of $82,271. The firm is planning to issue $15,000 of debt at 6.3 percent interest and use the proceeds to repurchase shares at their current market value. Ignore taxes. What will be the cost of equity after the repurchase?arrow_forwardSuppose Beta Industries and Delta Technology have identical assets that generate identical cash flows. Beta Industries is an all-equity firm, with 7 million shares outstanding that trade for a price of $16.00 per share. Delta Technology has 22 million shares outstanding, as well as debt of $33.60 million. a. According to MM Proposition I, what is the stock price for Delta Technology? b. Suppose Delta Technology stock currently trades for $8.27 per share. What arbitrage opportunity is available? What assumptions are necessary to exploit this opportunity? a. According to MM Proposition I, what is the stock price for Delta Technology? According to MM Proposition I, the stock price per share for Delta Technology is $ (Round to the nearest cent.)arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education