ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:1.

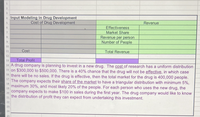

4 Input Modeling in Drug Development

Cost of Drug Development

Revenue

6.

Effectiveness

Market Share

Revenue per person

Number of People

9.

10

Cost

Total Revenue

11

12

13

Total Profit

14 A drug company is planning to invest in a new drug. The cost of research has a uniform distribution

15 on $300,000 to $500,000. There is a 40% chance that the drug will not be effective, in which case

16 there will be no sales. If the drug is effective, then the total market for the drug is 400,000 people.

The company expects their share of the market to have a triangular distribution with minimum 5%,

maximum 30%, and most likely 20% of the people. For each person who uses the new drug, the

20 company expects to make $100 in sales during the first year. The drug company would like to know

the distribution of profit they can expect from undertaking this investment.

17

18

19

21

22

23

24

25

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps with 10 images

Knowledge Booster

Similar questions

- You hold an oral, or English, auction among three bidders. You estimate that each bidder has a value of either $100 or $125 for the item, and you attach probabilities to each value of 50%. The winning bidder must pay a price equal to the second highest bid. The following table lists the eight possible combinations for bidder values. Each combination is equally likely to occur. On the following table, indicate the price paid by the winning bidder. Bidder 1 Value Bidder 2 Value Bidder 3 Value Probability Price ($) ($) ($) $100 $100 $100 0.125 $100$100$1250.125 $100$125$1000.125 $100$125$1250.125 $125$100$1000.125 $125$100$1250.125 $125$125$1000.125 $125$125$1250.125 The expected price paid is . Suppose that bidders 1 and 2 collude and would be willing to bid up to a maximum of their values, but the two bidders would not be willing to bid against each other. The probabilities of the combinations of bidders are still…arrow_forwardAn expected utility maximiser owns a car worth £60000£60000 and has a bank account with £20000£20000. The money in the bank is safe, but there is a 50%50% probability that the car will be stolen. The utility of wealth for the agent is u(y)=ln(y)u(y)=ln(y) and they have no other assets. A risk-neutral insurance company is willing to insure the car at the premium of π=£2/3π=£2/3 for every one pound of coverage. How much insurance coverage will the individual choose to buy? a. £30,000 b.£40,000 c. £80,000 d.£60,000arrow_forwardYou need to hire some new employees to staff your startup venture. You know that potential employees are distributed throughout the population as follows, but you can't distinguish among them: Employee Value Probability $65,000 0.25 $82,000 0.25 $99,000 0.25 $116,000 0.25 The expected value of hiring one employee is . Suppose you set the salary of the position equal to the expected value of an employee. Assume that employees will not work for a salary below their employee value. The expected value of an employee who would apply for the position, at this salary, is . Given this adverse selection, your most reasonable salary offer (that ensures you do not lose money) is .arrow_forward

- A reserve price is a minimum price set by the auctioneer. If no bidder is willing to pay the reserve price, the item is unsold at a profit of $0 for the auctioneer. If only one bidder values the item at or above the reserve price, that bidder pays the reserve price. An auctioneer faces two bidders, each with a value of either $39 or $104, with both values equally probable. Without a reserve price, the second highest bid will be the price paid by the winning bidder. The following table lists the four possible combinations of bidder values. Each combination is equally likely to occur. On the following table, indicate the price paid by the winning bidder with and without the stated reserve price. Bidder 1 Value Bidder 2 Value Probability Price Without Reserve? Price with $104 Reserve Price? ($) ($) ($) $39 $39 0.25 $39 $104 0.25 $104 $39 0.25 $104 $104 0.25 Without a reserve price, the expected price is…arrow_forwardPlease answer correct answer both are questions are answered Don't answer by pen paper please pleasearrow_forwardA reserve price is a minimum price set by the auctioneer. If no bidder is willing to pay the reserve price, the item is unsold at a profit of $0 for the auctioneer. If only one bidder values the item at or above the reserve price, that bidder pays the reserve price. An auctioneer faces two bidders, each with a value of either $60 or $160, with both values equally probable. Without a reserve price, the second highest bid will be the price paid by the winning bidder. The following table lists the four possible combinations of bidder values. Each combination is equally likely to occur. On the following table, indicate the price paid by the winning bidder with and without the stated reserve price. Bidder 1 Value Bidder 2 Value Price Without Reserve ($) ($) ($) $60 $60 $60 $160 $160 $60 $160 $160 Probability 0.25 0.25 0.25 0.25 Without a reserve price, the expected price is $ expected price is larger_ the reserve price. Price with $160 Reserve Price With a reserve price of $160, the…arrow_forward

- Suppose that there is asymmetric information in the market for used cars. Sellers know the quality of the car that they are selling, but buyers do not. Buyers know that there is a 30% chance of getting a "lemon", a low quality used car. A high quality used car is worth $30,000, and a low quality used car is worth $15.000. Based on this probability, the most that a buyer would be willing to pay for a used car is S. (Enter your response rounded to the nearest dollar.)arrow_forwardYour company has a customer list that includes 3000 people. Your market research indicates that 90 of them responded to the coupon. If you send a coupon to ONE customer at random, what’s the probability that he or she will use the coupon? Group of answer choices 3%. 9%. 30%. 90%. None of the above.arrow_forwardAssume that you are working for the Consumer Protection Agency and have recently been getting complaints about the highway gas mileage of the new Dodge Caravans. Chrysler Corporation agrees to allow you to randomly select 40 of its new Dodge Caravans to test the highway mileage. Chrysler claims that the Caravans get 28 mpg on the highway. Your results show a mean of 26.7 and a standard deviation of 4.2. You support Chrysler’s claim. 1. Show whether or not you support Chrysler’s claim by listing the P-value from your output.After more complaints, you decide to test the variability of the miles per gallon on the highway. From further questioning of Chrysler’s quality control engineers, you find they areclaiming a standard deviation of no more than 2.1. Use a one-tailed test.2. Test the claim about the standard deviation.3. Write a short summary of your results and any necessary action that Chrysler must take toremedy customer complaints.4. State your position about the necessity to…arrow_forward

- You need to hire some new employees to staff your startup venture. You know that potential employees are distributed throughout the population as follows, but you can't distinguish among them: Employee Value $30,000 $49,000 $68,000 $87,000 Probability 0.25 0.25 0.25 0.25 The expected value of hiring one employee is $ Suppose you set the salary of the position equal to the expected value of an employee. Assume that employees will not work for a salary below their employee value. The expected value of an employee who would apply for the position, at this salary, is $ Given this adverse selection, your most reasonable salary offer (that ensures you do not lose money) isarrow_forwardYour company must decide whether to introduce a new product. The sales of the product will be either at a high (success) or low (failure) level. The conditional value for this decision is as follows Decision High Low Introduce $4,000,000 -$2,000,000 Do Not Introduce 0 0 Probability 0.3 0.7 You have the option to conduct a market survey to sharpen you market demand estimate. The survey costs $200,000. The survey provides incomplete information about the sales, with three possible outcomes: (1) predicts high sales, (2) predicts low sales, or (3) inconclusive. Such surveys have in the past provided these results Result High Low Predicts High 0.4 0.1 Inconclusive 0.4 0.5 Predicts Low 0.2 0.4 a) Using expected monetary value, what is your decision? b) What is the expected value of perfect information before taking the survey? c) Draw the complete decision tree, including the survey option. d) What is the…arrow_forwardTwo identically able agents are competing for a promotion. The promotion is awarded on the basis of output (whomever has the highest output, gets the promotion). Because there are only two workers competing for one prize, the losing prize=0 and the winning prize =P. The output for each agent is equal to his or her effort level times a productivity parameter (d). (i.e. Q2=dE1 , Q2=dE2). If the distribution of “relative luck” is uniform, the probability of winning the promotion for agent 1 will be a function of his effort (E1) and the effort level of Agent 2 (E2). The formula is given by...Prob(win)=0.5 + α(E1-E2), where α is a parameter that reflects uncertainty and errors in measurement. High measurement errors are associated with small values of α (think about this: if there are high measurement errors, then the level of an agent’s effort will have a smaller effect on his/her chances of winning). Using this information, please answer the following questions. Both workers have a…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education