FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

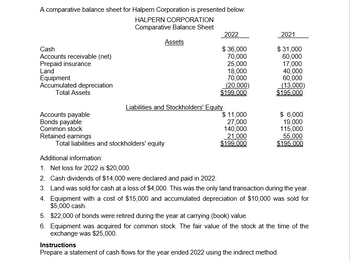

Transcribed Image Text:A comparative balance sheet for Halpern Corporation is presented below:

HALPERN CORPORATION

Comparative Balance Sheet

Cash

Accounts receivable (net)

Prepaid insurance

Land

Equipment

Accumulated depreciation

Total Assets

Accounts payable

Bonds payable

Common stock

Retained earnings

Assets

Total liabilities and stockholders' equity

2022

$ 36,000

70,000

25,000

Liabilities and Stockholders' Equity

18,000

70,000

(20,000)

$199.000

$ 11,000

27,000

140,000

21,000

$199,000

2021

$ 31,000

60,000

17,000

40,000

60,000

(13,000)

$195.000

$ 6,000

19,000

115,000

55,000

$195.000

Additional information:

1. Net loss for 2022 is $20,000.

2. Cash dividends of $14,000 were declared and paid in 2022.

3. Land was sold for cash at a loss of $4,000. This was the only land transaction during the year.

4. Equipment with a cost of $15,000 and accumulated depreciation of $10,000 was sold for

$5,000 cash.

5. $22,000 of bonds were retired during the year at carrying (book) value.

6. Equipment was acquired for common stock. The fair value of the stock at the time of the

exchange was $25,000.

Instructions

Prepare a statement of cash flows for the year ended 2022 using the indirect method.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Selected financial info for Strand Corp is below: Cash Accounts receivable (net) Inventory Land Equipment Accumulated depreciation TOTAL Accounts payable Notes payable- current Notes payable- non-current Common stock Retained earnings TOTAL 2022 2021 $63,000 $42,000 $151,200 $84,000 $201,600 $168,000 $21,000 $58,800 $789,600 $504,000 ($115,600) ($84,000) $1,110,800 $772,800 $86,000 $50,400 $29,400 $67,200 $302,400 $168,000 $487,200 $420,000 $205,800 $67,200 $1,110,800 $772,800 Additional info for 2022: 1) Net Income was $235,200 2) Depreciation expense was recorded 3) Land was sold at its original cost. No other assets were sold 4) Cash dividends were paid 5) Equipment was purchased for cash REQUIRED: A) Prepare a formal Statement of Cash Flows for 2022 B) Prepare a calculation for Free Cash Flowarrow_forwardRequired: 1. Calculate the following risk ratios for 2024: 2. When we compare two companies, can one have a higher current ratio while the other has a higher acid-test ratio? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Calculate the following risk ratios for 2024: (Round your answers to 1 decimal place.) Risk Ratios a. Receivables turnover ratio b. Inventory turnover ratio c. Current ratio d. Acid-test ratio e. Debt to equity ratio times times % Required 1 Required 2 >arrow_forwardThe comparative statement of financial position of Concord Corporation as at December 31, 2023, follows: Assets Cash Accounts receivable Equipment CONCORD CORPORATION Statement of Financial Position December 31 Less: Accumulated depreciation Total Liabilities and Shareholders' Equity Accounts payable 2023 December 31 $53,000 90,000 26,300 (9,300) $160,000 $20,000 2022 $1,400 88,700 21,600 (11,300) $100,400 $10,000arrow_forward

- The balance sheets for Dual Monitors Corporation and additional information are provided below. DUAL MONITORS CORPORATION Balance Sheets December 31, 2024 and 2023 Assets. Current assets: Cash Accounts receivable Inventory Investments Long-term assets: Land Equipment Less: Accumulated depreciation Total assets Liabilities and Stockholders' Equity Current liabilities: Accounts payable Interest payable. Income tax payable Long-term liabilities: Notes payable Stockholders' equity: Common stock Retained earnings Total liabilities and stockholders' equity Additional information for 2024: 1. Net income is $91,560. 2. Sales on account are $1,416,800. (All sales are credit sales.) 3. Cost of goods sold is $1,098,500. 2024 $149,560 72,000 92,000 3,700 450,000 760,000 2023 450,000 640,000 (398,000) (238,000) $1,129,260 $1,136,700 $95,400 6,000 8,000 $117,000 89,000 77,000 1,700 $82,000 11,700 4,700 220,000 670,000 148,300 110,000 670,000 239,860 $1,129,260 $1,136,700 Required: 1. Calculate the…arrow_forwardCalculate the dividend payout ratio.arrow_forwardSubject: acountingarrow_forward

- What does the vertical analysis reveal on ABC Corporation in terms of Statement of Financial Positionarrow_forwardArlington Corporation's financial statements (dollars and shares are in millions) are provided here. Balance Sheets as of December 31 Assets Cash and equivalents Accounts receivable Inventories Total current assets Net plant and equipment Total assets Liabilities and Equity Accounts payable Accruals Notes payable Total current liabilities Long-term bonds Total liabilities Common stock (4,000 shares) Retained earnings Common equity Total llabilities and equity Sales Operating costs excluding depreciation and amortization EBITDA Depreciation & amortization EBIT Interest EBT Taxes (25%) Net Income Dividends pald Income Statement for Year Ending December 31, 2021 2021 Balances, 12/31/20 2021 Net Income Cash Dividends Addition to retained earnings Balances, 12/31/21 $ 15,000 35,000 34,190 $ 84,190 48,000 $132,190 $ 10,100 7,300 6,200 $ 23,600 15,000 $ 38,600 60,000 33,590 $ 93,590 $132,190 c. Construct Arlington's 2021 statement of stockholders' equity. Shares $ 2020 $ 13,000 30,000 28,000…arrow_forward1arrow_forward

- Some recent financial statements for Smolira Golf Corporation follow. Assets Current assets Cash Accounts receivable Inventory Total Fixed assets Net plant and equipment Total assets Sales Cost of goods sold Depreciation Taxable income Taxes (22%) Earnings before interest and taxes Interest paid Net income Dividends Retained earnings 2020 $35,585 $38,940 28,846 43,112 18,401 3,970 SMOLIRA GOLF CORPORATION 2021 Income Statement a. Price-earnings ratio b. Dividends per share c. Market-to-book ratio d. PEG ratio SMOLIRA GOLF CORPORATION 2020 and 2021 Balance Sheets 2021 Liabilities and Owners' Equity Current liabilities $57,956 $110,898 $ 465,585 $ 27,000 37,022 Accounts payable Notes payable Other $ 521,433 Total $ 523,541 $ 632,331 Total liabilities and owners' equity Long-term debt times Owners' equity Common stock and paid-in surplus Accumulated retained earnings times times Total $ 512,454 363,528 45,963 $102,963 20,883 $ 82,080 18,058 $ 64,022 Smolira Golf Corporation has 52,000…arrow_forwardThe information on the following page was obtained from the records of Breanna Incorporated: $ 10, 200 50,800 128,000 9,500 64,500 Accounts receivable Accumulated depreciation Cost of goods sold Income tax expense Cash Net sales Equipment Selling, general, and administrative expenses Common stock (8,200 shares) Accounts payable Retained earnings, 1/1/22 Interest expense Merchandise inventory Long-term debt Dividends declared and paid during 2022 Except as otherwise indicated, assume that all balance sheet items reflect account balances at December 31, 2022, and that all income statement items reflect activities that occurred during the year ended December 31, 2022. There were no changes in paid-in capital during the year. Required: a. Prepare an income statement and statement of changes in stockholders' equity for the year ended December 31, 2022, and a balance sheet at December 31, 2022, for Breanna Incorporated. Based on the financial statements that you have prepared for part a,…arrow_forwardCondensed financial data of Granger Inc. follow. Assets Cash Accounts receivable Inventory Prepaid expenses Long-term investments Plant assets GRANGER INC. Comparative Balance Sheets December 31 Accumulated depreciation Total Liabilities and Stockholders' Equity Accounts payable Accrued expenses payable Bonds payable Common stock Retained earnings Total 2022 $80,800 87,800 112,500 28,400 138,000 285,000 (50,000) $682,500 $102,000 16,500 110,000 220,000 234,000 $682,500 2021 $48,400 38,000 102,850 26,000 109,000 242,500 (52,000) $514,750 $67,300 21,000 146,000 175,000 105,450 $514,750arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education