Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN: 9781305970663

Author: Don R. Hansen, Maryanne M. Mowen

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

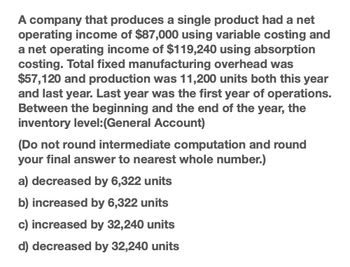

Transcribed Image Text:A company that produces a single product had a net

operating income of $87,000 using variable costing and

a net operating income of $119,240 using absorption

costing. Total fixed manufacturing overhead was

$57,120 and production was 11,200 units both this year

and last year. Last year was the first year of operations.

Between the beginning and the end of the year, the

inventory level:(General Account)

(Do not round intermediate computation and round

your final answer to nearest whole number.)

a) decreased by 6,322 units

b) increased by 6,322 units

c) increased by 32,240 units

d) decreased by 32,240 units

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Using the information in the previous exercises about Marleys Manufacturing, determine the operating income for department B, assuming department A sold department B 1,000 units during the month and department A reduces the selling price to the market price.arrow_forwardEllerson Company provided the following information for the last calendar year: During the year, direct materials purchases amounted to 278,000, direct labor cost was 189,000, and overhead cost was 523,000. During the year, 100,000 units were completed. Required: 1. Calculate the total cost of direct materials used in production. 2. Calculate the cost of goods manufactured. Calculate the unit manufacturing cost. 3. Of the unit manufacturing cost calculated in Requirement 2, 2.70 is direct materials and 5.30 is overhead. What is the prime cost per unit? Conversion cost per unit?arrow_forwardPlease give me answer Accountingarrow_forward

- AJ Manufacturing Company Incurred $55,500 of fixed product cost and $44,400 of variable product cost during its first year of operation. Also during its first year, AJ incurred $17.650 of fixed and $14.100 of variable selling and administrative costs. The company sold all of the units it produced for $182.000. Required a. Prepare an income statement using the format required by generally accepted accounting Principles (GAAP) b. Prepare an income statement using the contribution margin approach. Complete this question by entering your answers in the tabs below. Required A Required B Prepare an income statement using the format required by generally accepted accounting Principles (GAAP). AJ MANUFACTURING COMPANY Income Statementarrow_forwardAt the end of the year, overhead applied was $42,000,000. Actual overhead was $40,300,000. Closing over/underapplied overhead into Cost of Goods Sold would cause net income to increase or decase and by how much?arrow_forwardMitvhel corporation manufactures...Accountingarrow_forward

- Flatcher, inc. dispose of under or overapplied give me answerarrow_forwardAJ Manufacturing Company incurred $50,500 of fixed product cost and $40.400 of variable product cost during its first year of operation. Also during its first year, AJ incurred $16,150 of fixed and $13,100 of variable selling and administrative costs. The company sold all of the units it produced for $162,000. Required a. Prepare an income statement using the format required by generally accepted accounting Principles (GAAP). b. Prepare an income statement using the contribution margin approach. Complete this question by entering your answers in the tabs below. Required A Required B Prepare an income statement using the format required by generally accepted accounting Principles (GAAP). AJ MANUFACTURING COMPANY Income Statement Required B > Mc Graw Hillarrow_forwardAJ Manufacturing Company incurred $50,500 of fixed product cost and $40,400 of variable product cost during its first year of operation. Also during its first year, AJ incurred $16,150 of fixed and $13,100 of variable selling and administrative costs. The company sold all of the units it produced for $162,000. Required a. Prepare an income statement using the format required by generally accepted accounting Principles (GAAP). b. Prepare an income statement using the contribution margin approach. Complete this question by entering your answers in the tabs below. Required A Required B Prepare an income statement using the format required by generally accepted accounting Principles (GAAP). AJ MANUFACTURING COMPANY Income Statementarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College