FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Step by step Solution

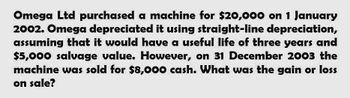

Transcribed Image Text:Omega Ltd purchased a machine for $20,000 on 1 January

2002. Omega depreciated it using straight-line depreciation,

assuming that it would have a useful life of three years and

$5,000 salvage value. However, on 31 December 2003 the

machine was sold for $8,000 cash. What was the gain or loss

on sale?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Awni Company purchased a new machine on May 1, 2010 for €44,000. At the time of acquisition, the machine was estimated to have a useful life of ten years and an estimated salvage value of €2,000. The company has recorded monthly depreciation using the straight-line method. On March 1, 2019, the machine was sold for €6,000. What should be the loss recognized from the sale of the machine?arrow_forwardTavares Ltd. purchased a motor vehicle on 1 January 2014 for £24,000. It had an expected useful life of 5 years and estimated scrap value of £4,000. During the year ended 31 December 2018 the vehicle was sold for £2,700. No depreciation is charged in the year of disposal. What was the profit or loss on disposal?a) Loss of £1,300b) Loss of £5,300c) Loss of £2,700d) Profit of £2,700arrow_forwardJeter Company purchased a new machine on May 1, 1998 for $176,000. At the time of acquisition, the machine was estimated to have a useful life of ten years and an estimated salvage value of $8,000. The company has recorded monthly depreciation using the straight-line method. On March 1, 2007, the machine was sold for $24,000. What should be the loss recognized from the sale of the machine? $-0- O $3,600 $8,000 $11,600arrow_forward

- Jason Co purchased a machinery for £100,000 on 1/1/2018. It had an estimated useful life of ten years and it was depreciated using the reducing balance method at a rate of 20%. On 1/1/20 it was decided to change the depreciation method to the straight line. There was no change to the useful life, and no residual value is anticipated. What are the accumulated depreciation and the net book value of the asset for the year ended 31 December 2021?arrow_forwardOn 1 January 2016 ABC Ltd purchased a machine worth GH¢480,000 with an estimated useful life of 20 years and an estimated zero residual value. Depreciation is on a straight-line basis. The asset had been re-valued on 1 January 2018 to GH¢500,000, but with no change in useful life at that date. On 1 January 2019 an impairment review showed the machine’s recoverable amount to be GH¢200,000 and its remaining useful life to be 10 years. Required Calculate: 1. a. the carrying amount of the machine on 31 December 2017 b. the revaluation surplus arising on 1 January 2018 2. the carrying amount of the machine on 31 December 2017 (immediately before the impairment). 3. a. the impairment loss recognized in the year to 31 December 2019. b. The depreciation charge in the year to 31 December 2019.arrow_forwardOn 1 January 2016 ABC Ltd purchased a machine worth GH¢480,000 with an estimated useful life of 20 years and an estimated zero residual value. Depreciation is on a straight-line basis. The asset had been re-valued on 1 January 2018 to GH¢500,000, but with no change in useful life at that date. On 1 January 2019 an impairment review showed the machine’s recoverable amount to be GH¢200,000 and its remaining useful life to be 10 years. Required Calculate: a) the carrying amount of the machine on 31 December 2017 b) the revaluation surplus arising on 1 January 2018 c) the carrying amount of the machine on 31 December 2017 (immediately before the impairment). d) the impairment loss recognized in the year to 31 December 2019. e) The depreciation charge in the year to 31 December 2019.arrow_forward

- On January 1, 2016, Rexford Company purchased a drilling machine for $11,500. The machines has an estimated useful life of 4 years and a salvage value of $200. Given this information, if Rexford uses double-declining-balance method of depreciation, and sells the machine on December 31, 2017, for $3,000 cash. Then how much will be gain or loss on disposal of this asset? $ 2,750 loss $ 1,800 loss $1,562 gain $ 125 gainarrow_forwardVaughn Manufacturing purchased a new machine on May 1, 2012 for $566400. At the time of acquisition, the machine was estimated to have a useful life of ten years and an estimated salvage value of $20400. The company has recorded monthly depreciation using the straight-line method. On March 1, 2021, the machine was sold for $81600. What should be the loss recognized from the sale of the machine? $2500. $20400. $22900. $0.arrow_forwardOn 1 January 2011, Y Ltd purchased a new machine for $500,000. Please need answer the general accounting questionarrow_forward

- Kpone purchased a machine for GHS30,000 on 1 January 2005 and assigned it a useful life of 12 years. On 31 March 2007 it was revalued to GHS32,000 with no change in useful life. What will be depreciation charge in relation to this machine in the financial statements of Kpone for the year ending of 31 December 2007?arrow_forwardBonita Industries purchased a new machine on May 1, 2012 for $561600. At the time of acquisition, the machine was estimated to have a useful life of ten years and an estimated salvage value of $30000. The company has recorded monthly depreciation using the straight-line method. On March 1, 2021, the machine was sold for $67800. What should be the loss recognized from the sale of the machine?arrow_forwardOn February 1, 2006, Mason Company purchased a building for $359,000. The building was assigned a useful life of forty years and a salvage value of $11,000. XYZ Company uses the straight-line depreciation method to calculate depreciation on its long-term assets. The building was sold for $121,000 cash on August 1, 2029. Calculate the amount of the loss recorded on the sale. Do not enter your answer with a minus sign in front of your number.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education