Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

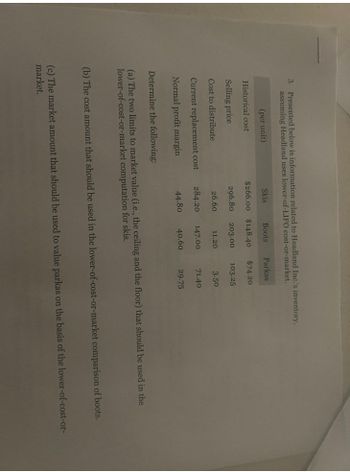

Transcribed Image Text:3. Presented below is information related to Headland Inc.'s inventory,

assuming Headland uses lower-of-LIFO cost-or-market.

(per unit)

Skis

Boots Parkas

Historical cost

$266.00 $148.40

$74.20

Selling price

296.80

203.00

103.25

Cost to distribute

26.60

11.20

3.50

Current replacement cost

284.20

147.00

71.40

Normal profit margin

44.80

40.60

29.75

Determine the following:

(a) The two limits to market value (i.e., the ceiling and the floor) that should be used in the

lower-of-cost-or-market computation for skis.

(b) The cost amount that should be used in the lower-of-cost-or-market comparison of boots.

(c) The market amount that should be used to value parkas on the basis of the lower-of-cost-or-

market.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Calculate the Lower-of-Cost-or-Market using the table below for Samson Goods, Inc. springs inventory. (1) Complete the table. Part # Cost Replacement Cost Net Realizable Value Normal Profit NRV less Normal Profit LCM SP17G $181,000 $ 152,000 $151,000 $15,000 SP23X 254,000 249,800 262,500 25,800 SP78A 205,400 214,000 206,000 10,200 Total (2) Prepare the journal entry to record the Allowance to Reduce Inventory to Market using the "Loss Method". $ $ (Record the adjustment to inventory due to decline in value)arrow_forwardPresented below is information related to Sheffield Inc's inventory, assuming Sheffield uses lower-of-LIFO cost-or-market. Historical cost Selling price Cost to distribute Current replacement cost Normal profit margin (per unit) Floor $ Skis $254.60 $ $ 284.08 25.46 272.02 42.88 Boots $142.04 194.30 10.72 140.70 Parkas $71.02 98.83 Determine the following: (a) The two limits to market value (i.e., the ceiling and the floor) that should be used in the lower-of-cost-or-market computation for skis. (Round answers to 2 decimal places, e.g. 52.75.) Ceiling $ 3.35 68.34 38.86 28.48 (b) The cost amount that should be used in the lower-of-cost-or-market comparison of boots. (Round answer to 2 decimal places, e.g. 52.75.) (c) The market amount that should be used to value parkas on the basis of the lower-of-cost-or-market. (Round answer to 2 decimal places, e.g. 52.75.)arrow_forwardPresented below is information related to Rembrandt Inc.’s inventory, assuming Rembrandt uses lower-of-LIFO cost-or-market. 000000(per unit)000000 0 Skis0 0Boots0 Parkas Historical cost $190.00 $106.00 $53.00 Selling price 212.00 145.00 73.75 Cost to distribute 19.00 8.00 2.50 Current replacement cost 203.00 105.00 51.00 Normal profit margin 32.00 29.00 21.25 Determine the following: (a) the two limits to market value (i.e., the ceiling and the floor) that should be used in the lower-of-cost-or-market computation for skis, (b) the cost amount that should be used in the lower-of-cost-or-market comparison of boots, and (c) the market amount that should be used to value parkas on the basis of the lower-of-cost-or-market.arrow_forward

- Smmons. Inc. uses the lower-of-cont-ormarket method to value s inventory that is accounted for using the FIFO method. Data regarding an tam in its inventory ls as follows Cost $26 Replacement cost 20 Selling price 30 Cost of completion and disposal 2 Normal profit margin 7. What is the lower-of-cost-or-mariket for this item?arrow_forwardsanarrow_forwardFrom the information above, determine the amount of Bolton Company inventory.arrow_forward

- Presented below is information related to Waterway Inc's inventory, assuming Waterway uses lower-of-LIFO cost-or-market. (per unit) Skis Boots Parkas Historical cost $262.20 $146.28 $73.14 Selling price 292.56 200.10 101.78 Cost to distribute 26.22 11.04 3.45 Current replacement cost 280.14 144.90 70.38 Normal profit margin 44.16 40.02 29.33 Determine the following: (a) The two limits to market value (i.e., the ceiling and the floor) that should be used in the lower-of-cost-or-market computation for skis. (Round answers to 2 decimal places, e.g. 52.75.) Ceiling $ Floor $arrow_forwardPlease Provide Explanation And Don`t Give Image Formatarrow_forward3arrow_forward

- The following information is available for the Century Trading: Product A B C D Cost $102 $45 $24 $9 Estimated sales price 120 60 30 15 Estimated disposal costs 15 18 8 5 Number of units 4,000 6,000 5,500 7,200 REQUIRED: Using the lower of cost and net realizable value, determine the total inventory value to be presented in Centurys Trading's statement of financial position.arrow_forwardPresented below is information related to Nash Inc.’s inventory, assuming Nash uses lower-of-LIFO cost-or-market. (c) The amount that should be used to value parkas on the basis of the lower-of-cost-or-market. (Round answers to 2 decimal places, e.g. 52.75.) (per unit) Skis Boots Parkas Historical cost $197.60 $110.24 $55.12 Selling price 220.48 150.80 76.70 Cost to distribute 19.76 8.32 2.60 Current replacement cost 211.12 109.20 53.04 Normal profit margin 33.28 30.16 22.10arrow_forwardSplish Brothers, Inc. values its inventory at the lower-of-LIFO-cost-or-market. The following information is available from the company’s inventory records as of December 31, 2020. Item Quantity UnitCost ReplacementCost/Unit Estimated SellingPrice/Unit Completion & DisposalCost/Unit Normal ProfitMargin/Unit X490 8,976 $11.00 $10.52 $12.32 $2.64 $2.99 X512 4,356 6.16 6.60 7.83 0.22 1.58 X682 15,840 16.72 16.37 27.76 2.86 7.92 Z195 11,000 12.54 12.32 17.42 1.23 5.06 Z846 7,568 10.56 11.22 12.28 1.85 0.97 (a) Correct answer icon Your answer is correct. Calculate the lower-of-cost-or-market using the individual-item approach. (Round answers to 2 decimal places, e.g. 52.75.) (b) Partially correct answer icon Your answer is partially correct. Show the journal entries Splish Brothers, Inc. will…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Corporate Financial AccountingAccountingISBN:9781305653535Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Corporate Financial AccountingAccountingISBN:9781305653535Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Corporate Financial AccountingAccountingISBN:9781337398169Author:Carl Warren, Jeff JonesPublisher:Cengage Learning

Corporate Financial AccountingAccountingISBN:9781337398169Author:Carl Warren, Jeff JonesPublisher:Cengage Learning Financial & Managerial AccountingAccountingISBN:9781337119207Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial & Managerial AccountingAccountingISBN:9781337119207Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial & Managerial AccountingAccountingISBN:9781285866307Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial & Managerial AccountingAccountingISBN:9781285866307Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:9781337398169

Author:Carl Warren, Jeff Jones

Publisher:Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:9781337119207

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:9781285866307

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning