Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN: 9781305970663

Author: Don R. Hansen, Maryanne M. Mowen

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

White tiger electronic produces CD players using an automated assembly line process.

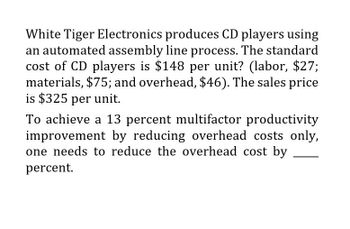

Transcribed Image Text:White Tiger Electronics produces CD players using

an automated assembly line process. The standard

cost of CD players is $148 per unit? (labor, $27;

materials, $75; and overhead, $46). The sales price

is $325 per unit.

To achieve a 13 percent multifactor productivity

improvement by reducing overhead costs only,

one needs to reduce the overhead cost by

percent.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Baxter Company has a relevant range of production between 15,000 and 30,000 units. The following cost data represents average variable costs per unit for 25,000 units of production. Using the costs data from Rose Company, answer the following questions: A. If 15,000 units are produced, what is the variable cost per unit? B. If 28,000 units are produced, what is the variable cost per unit? C. If 21,000 units are produced, what are the total variable costs? D. If 29,000 units are produced, what are the total variable costs? E. If 17,000 units are produced, what are the total manufacturing overhead costs incurred? F. If 23,000 units are produced, what are the total manufacturing overhead costs incurred? G. If 30,000 units are produced, what are the per unit manufacturing overhead costs incurred? H. If 15,000 units are produced, what are the per unit manufacturing overhead costs incurred?arrow_forwardWhat is the manufacturing cost per unit?arrow_forwardDuo Company manufactures two products, Uno and Dos. Contribution margin data follow. Duo company’s production process uses highly skilled labor, which is in short supply. The same employees work on both products and earn the same wage rate. Required: Which of Duo Company’s products is more profitable? Explain.arrow_forward

- Aarrow_forwardMemanarrow_forwardGelb Company currently makes a key part for its main product. Making this part incurs per unit variable costs of $1.40 for direct materials and $0.95 for direct labor. Incremental overhead to make this part is $1.48 per unit. The company can buy the part for $4.02 per unit. (a) Prepare a make or buy analysis of costs for this part. Note: Enter your answers rounded to 2 decimal places. (b) Should Gelb make or buy the part? (a) Make or Buy Analysis Direct materials Direct labor Overhead Cost to buy Cost per unit Cost difference (b) Company should: Make Buyarrow_forward

- Mierlo-Hout manufactures two types of video cameras, RC1 and RC2. The costs for the products are shown herebelow: RC1 RC2 Units sold 800 2,200 Unit sales price $200 $350 variable cost per unit Raw material Labor $60 $45 $90 $66 Total fixed costs = $40,000 Required: Compute the contribution margin per unit for each of RC1 and RC2. Assuming the fixed costs are allocated based on the units produced. Compute the selling price per unit of each type in order to achieve a profit margin of 40%. Assume that Mierlo-Hout has a maximum working labor capacity of 5,000 labor hours. Labour hours are paid at a rate of $30 per hour. Which of the two products RC1 or RC2 is most profitable for the company? Show all your calculationsin in a clear and organized manner.arrow_forwardFogerty Company makes two products-titanium Hubs and Sprockets. Data regarding the two products follow: Direct Labor-Hours per Unit Hubs Sprockets Additional information about the company follows: a. Hubs require $36 in direct materials per unit, and Sprockets require $10. b. The direct labor wage rate is $13 per hour. c. Hubs require special equipment and are more complex to manufacture than Sprockets. d. The ABC system has the following activity cost pools: 0.80 0.40 Annual Production 20,000 units 50,000 units Activity Cost Pool (Activity Measure) Machine setups (number of setups) Special processing (machine-hours) General factory (organization-sustaining) Required 1 Required 2 Required: 1. Compute the activity rate for each activity cost pool. 2. Determine the unit product cost of each product according to the ABC system. Complete this question by entering your answers in the tabs below. Compute the activity rate for each activity cost pool. Activity Cost Pool Machine setups Special…arrow_forwardUse the information below to answer the following two questions: Ginger Company's relevant range of production is 5,000 units to 13,000 units. When it produces and sells 10,000 units, its average costs per unit are as follows: Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Fixed selling expense Fixed administrative expense Sales commissions Variable administrative expense Q. If 12,500 units are produced, what is the manufacturing overhead cost per unit incurred to support this level of production? A. (Click to select) Q. If 12,500 units are produced and sold, the company will incur $60,000 in total period costs. How much is the variable administrative expense per unit? A. (Click to select) per unit Average Cost $4.80 $ 3.50 $1.30 $3.00 $2.50 $1.00 $0.50 ? ✓per unitarrow_forward

- Domesticarrow_forwardYou make component X in-house at a cost of $16 per unit, which consists of $2 direct labor per unit, $7 direct materials per unit, $6 fixed overhead per unit, and $1 variable overhead per unit. You need 1,000 units of X per month. An outside supplier has offered to sell component X to you at $12 per unit. If you outsource the production of X to the supplier, how much will your profit change in the short term? decrease by $4,000 decrease by $2,000 O increase by $2,000 O increase by $12,000 O increase by $4,000arrow_forwardFlounder Corporation produces microwave ovens. The following unit cost information is available: direct materials $33, direct labor $30, variable manufacturing overhead $15, fixed manufacturing overhead $38, variable selling and administrative expenses $12, and fixed selling and administrative expenses $22. Its desired ROI per unit is $25.50. Compute its markup percentage using a total - cost approach.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College