Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Please solve this problem

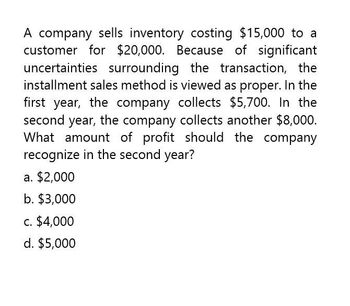

Transcribed Image Text:A company sells inventory costing $15,000 to a

customer for $20,000. Because of significant

uncertainties surrounding the transaction, the

installment sales method is viewed as proper. In the

first year, the company collects $5,700. In the

second year, the company collects another $8,000.

What amount of profit should the company

recognize in the second year?

a. $2,000

b. $3,000

c. $4,000

d. $5,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- An entity was offering premium as a sales promotion scheme and that during the year it purchased 10,000 premiums for P20 each. Customers need to remit 10 boxes and P5 to redeem one premium. Assume there were no redemptions during the first year of the promotion, which of the following statements would be correct if it uses the revenue approach? a. The entity will report an inventory of premiums at the net cost of P15. Tb. he entity will report an estimated liability equal to the premium expense. c. None of the other choices are correct. Td. he entity will not report any expense since there were no redemption. e. No accounting liability shall be recognized since there were no redemptions.arrow_forwardNational Co. has just ended the calendar year making a sale in the amount of P250,000 of merchandise purchased during the year at a total cost of P150,000. Although the firm paid in full for the merchandise during the year, it only collected 10,000 at year end from the customer. The net profit and cash flow from this sale for the year are A. P50,000 and P250,000, respectively. B. P50,000 and -P150,000, respectively. C. P250,000 and -P20,000, respectively. D. 50,000 and -P140,000, respectively.arrow_forwardAt the beginning of the year, Bennett Supply has inventory of $3,500. During the year, the company purchases an additional $12,000 of inventory. An inventory count at the end of the year reveals remaining inventory of $4,000. What amount will Bennett report for cost of goods sold? a. $11,000.b. $11,500.c. $12,000.d. $12,500.arrow_forward

- Traylor Corporation began the year with three items in beginning inventory, each costing $5. During the year Traylor purchased five more items at a cost of $6 each and then two more items at a cost of $7 each. Traylor sold eight items for $10 each. If Traylor uses a periodic LIFO system, what would be Traylor’s gross profit for this year? 45 $45 $80 $80 $51 $51 $36arrow_forwardVikrambahiarrow_forwardZane Corporation has an inventory conversion period of 64 days,an average collection period of 28 days, and a payables deferral period of 41 days.a. What is the length of the cash conversion cycle?b. If Zane’s annual sales are $2,578,235 and all sales are on credit, what is the investmentin accounts receivable?c. How many times per year does Zane turn over its inventory? Assume that the cost ofgoods sold is 75% of sales. Use sales in the numerator to calculate the turnover ratio.arrow_forward

- What was Profit? Answerarrow_forwardIn the current year, Borden Corporation had sales of $2,000,000 and cost of goods sold of $1,200,000. Borden expects returns in the following year to equal 8% of sales. The unadjusted balance in Inventory Returns Estimated is a debit of $6,000, and the unadjusted balance in Sales Refund Payable is a credit of $10,000. The adjusting entry or entries to record the expected sales returns is (are): (A) Accounts Receivable 2,000,000 Sales 2,000,000 (B) Sales returns and allowances 150,000 Sales 150,000 Cost of Goods Sold 90,000 Inventory Returns Estimated 90,000 (C) Sales 2,000,000 Sales Refund Payable 160,000 Accounts receivable 1,840,000 Sales Refund Payable 150,0000 Accounts receivable 150,000 (D) Sales Returns and Allowances 150,000 Sales Refund Payable 150,000 Inventory Returns Estimated 90,000 Cost of goods sold 90,000arrow_forwardIn the current year, Laker Corporation had sales of $2,020,000 and cost of goods sold of $1,210,000. Laker expects returns in the following year to equal 6% of sales and 6% of cost of goods sold. The unadjusted balance in Inventory Returns Estimated is a debit of $8,000, and the unadjusted balance in Sales Refund Payable is a credit of $12,000. The adjusting entry or entries to record the expected sales returns is (are):arrow_forward

- AB Ltd.'s gross purchases were $8,000, net purchases account for an average 10% discount on all items purchased and 5% of items were returned due to wrong specifications during the year. Also during the year the net sales were $7,805. Required 1: If beginning and ending inventory are zero (Just in time), AB's cost of good solf for the period must have been: $ Required 2: AB's Purchase Return and Allowances for the period must have been: $ Required 3: AB's Purchase Discounts for the period must have been: $ Required 4: AB's Net Puchases for the period must have been: $ Required 5: AB's Gross Profit on Sales in dollars for the period must have been: $arrow_forwardAn entity reported operating expenses other than interest expense for the year at 40% of cost of goods sold butonly 20% of sales. Interest expense is 5% of sales. The amount purchased is 120% of cost of goods sold. Endinginventory is twice as much as the beginning inventory. The net income for the year is P2,100,000. The incometax is 30%.Question 1: What is the amount of sales for the year?a. 10,000,000 c. 18,000,000b. 15,000,000 d. 12,000,000Question 2: What is the amount of purchases?a. 6,000,000 c. 3,000,000b. 7,200,000 d.3,600,000arrow_forward. Purchases for the year ended December 31, 2020 should amount to: *A. 4,500,000B. 4,527,000C. 4,631,000D. 5,727,000arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning