Cornerstones of Financial Accounting

4th Edition

ISBN: 9781337690881

Author: Jay Rich, Jeff Jones

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Provide this question solution general accounting

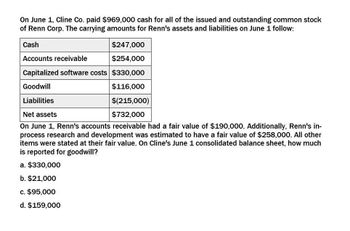

Transcribed Image Text:On June 1, Cline Co. paid $969,000 cash for all of the issued and outstanding common stock

of Renn Corp. The carrying amounts for Renn's assets and liabilities on June 1 follow:

Cash

Accounts receivable

$247,000

$254,000

Capitalized software costs $330,000

Goodwill

$116,000

Liabilities

Net assets

$(215,000)

$732,000

On June 1, Renn's accounts receivable had a fair value of $190,000. Additionally, Renn's in-

process research and development was estimated to have a fair value of $258,000. All other

items were stated at their fair value. On Cline's June 1 consolidated balance sheet, how much

is reported for goodwill?

a. $330,000

b. $21,000

c. $95,000

d. $159,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- On June 1, Cline Co. paid $1,098,500 cash for all of the issued and outstanding common stock of Renn Corp. The carrying amounts for Renn’s assets and liabilities on June 1 follow: Cash $ 223,000 Accounts receivable 232,500 Capitalized software costs 362,000 Goodwill 182,000 Liabilities (137,000 ) Net assets $ 862,500 On June 1, Renn’s accounts receivable had a fair value of $189,000. Additionally, Renn’s in-process research and development was estimated to have a fair value of $288,000. All other items were stated at their fair values. On Cline’s June 1 consolidated balance sheet, how much is reported for goodwill?arrow_forwardPlease need answer the general accounting questionarrow_forwardOn June 1, Cline Co. paid $870,000 cash for all of the issued and outstanding common stock of Renn Corp. The carrying amounts for Renn’s assets and liabilities on June 1 follow: Cash $ 239,000 Accounts receivable 181,000 Capitalized software costs 340,000 Goodwill 103,000 Liabilities (226,000 ) Net assets $ 637,000 On June 1, Renn’s accounts receivable had a fair value of $136,000. Additionally, Renn’s in-process research and development was estimated to have a fair value of $253,000. All other items were stated at their fair values. On Cline’s June 1 consolidated balance sheet, how much is reported for goodwill? Multiple Choice $340,000. $20,000. $128,000. $83,000.arrow_forward

- On June 1, Cline Co. paid $800,000 cash for all of the issued and outstanding common stock of Renn Corp. The carrying amounts for Renn’s assets and liabilities on June 1 follow:Cash . . . . . . . . . . . . . . . . . . $150,000 Accounts receivable . . . . . . . . .180,000Capitalized software costs . . . 320,000Goodwill . . . . . . . . . . . . . . . . . 100,000Liabilities . . . . . . . . . . . . .. . . (130,000)Net assets . . . . . . . . . . . . .. . $620,000 On June 1, Renn’s accounts receivable had a fair value of $140,000. Additionally, Renn’s in-process research and development was estimated to have a fair value of $200,000. All other items were stated at their fair values. On Cline’s June 1 consolidated balance sheet, how much is reported for goodwill?arrow_forwardThe general ledger trial balance of Cullen Corporation includes the following accounts at Dec. 31, 2021: Sales revenue P1,200,000 Interest income 24,000 Proceeds on sale of fixed assets 50,000 Written-down value of assets sold 45,000 Valuation gain on trading investments 20,000 Dividends received 5,000 Cost of sales 840,000 Finance expenses 18,000 Selling and distribution expenses 76,000 Administrative expenses 35,000 Income tax expense 85,000 How much should be reported as profit for the year. ended Dec. 31, 2021? a. P285,000 b. P200,000 c. P195,000 d. P150,000arrow_forwardOn January 1, 2021, the general ledger of Tripley Company included the following account balances: Accounts Debit Credit Cash $ 94,000 Accounts receivable 44,000 Allowance for uncollectible accounts $ 9,400 Inventory 30,400 Building 90,400 Accumulated depreciation 14,000 Land 208,000 Accounts payable 40,000 Notes payable (8%, due in 3 years) 60,000 Common stock 104,000 Retained earnings 239,400 Totals $ 466,800 $ 466,800 The $30,400 beginning balance of inventory consists of 304 units, each costing $100. During January 2021, the company had the following transactions: January 2 Lent $24,000 to an employee by accepting a 6% note due in six months. 5 Purchased 3,700 units of inventory on account for $407,000 ($110 each) with terms 1/10, n/30. 8 Returned 100 defective units of inventory purchased on January 5. 15 Sold…arrow_forward

- The Davidson Corporation's balance sheet and income statement are provided here. Davidson Corporation: Balance Sheet as of December 31, 2021 (millions of dollars) Assets Liabilities and Equity Cash and equivalents $ 20 Accounts payable $ 150 Accounts receivable 610 Accruals 320 Inventories 830 Notes payable 215 Total current assets $ 1,460 Total current liabilities $ 685 Net plant and equipment 2,465 Long-term bonds 1,490 Total liabilities $ 2,175 Common stock (100 million shares) 250 Retained earnings $ 1,500 Common equity $ 1,750 Total assets $ 3,925 Total liabilities and equity $ 3,925 Davidson Corporation: Income Statement for Year Ending December 31, 2021 (millions of dollars) Sales $ 7,250 Operating costs excluding depreciation and amortization 5,430 EBITDA $ 1,820 Depreciation and amortization 410 EBIT $ 1,410 Interest 130 EBT $ 1,280…arrow_forwardConsider the following financial data for Terry Enterprises: Balance Sheet as of December 31, 2018 Cash $ 86,000 Accounts payable $ 15,500 Accts. receivable 91,500 Notes payable 93,500 Inventories 65,500 Accruals 19,500 Total current assets $ 243,000 Total current liabilities $ 128,500 Long-term debt 162,500 Net plant & equip. 419,500 Common equity 371,500 Total assets $ 662,500 Total liab. & equity $ 662,500 Statement of Earnings for 2018 Industry Average Ratios Net sales $ 642,500 Current ratio 2.2× Cost of goods sold 482,000 Quick ratio 1.7× Gross profit $ 160,500 Days sales outstanding 44 days Operating expenses 119,500 Inventory turnover 6.7× EBIT $ 41,000 Total asset turnover 0.6× Interest expense 14,500 Net profit margin 7.2% Pre-tax earnings $ 26,500…arrow_forwardOn January 1, 2021, the general ledger of Tripley Company included the following account balances: Accounts Debit Credit Cash $ 70,000 Accounts receivable 40,000 Allowance for uncollectible accounts $ 5,000 Inventory 30,000 Building 70,000 Accumulated depreciation 10,000 Land 200,000 Accounts payable 20,000 Notes payable (8%, due in 3 years) 36,000 Common stock 100,000 Retained earnings 239,000 Totals $ 410,000 $ 410,000 The $30,000 beginning balance of inventory consists of 300 units, each costing $100. During January 2021, the company had the following transactions: January 2 Lent $20,000 to an employee by accepting a 6% note due in six months. 5 Purchased 3,500 units of inventory on account for $385,000 ($110 each) with terms 1/10, n/30. 8 Returned 100 defective units of inventory purchased on January 5.…arrow_forward

- On January 1, 2021, the general ledger of Tripley Company included the following account balances: Accounts Debit Credit Cash $ 70,000 Accounts receivable 40,000 Allowance for uncollectible accounts $ 5,000 Inventory 30,000 Building 70,000 Accumulated depreciation 10,000 Land 200,000 Accounts payable 20,000 Notes payable (8%, due in 3 years) 36,000 Common stock 100,000 Retained earnings 239,000 Totals $ 410,000 $ 410,000 The $30,000 beginning balance of inventory consists of 300 units, each costing $100. During January 2021, the company had the following transactions: January 2 Lent $20,000 to an employee by accepting a 6% note due in six months. 5 Purchased 3,500 units of inventory on account for $385,000 ($110 each) with terms 1/10, n/30. 8 Returned 100 defective units of inventory purchased on January 5.…arrow_forwardBBP, Inc., with sales of $400,000, has the following balance sheet: BBP, Incorporated Balance Sheet as of 12/31/X0 Assets Liabilities and Equity Cash $ 20,000 Accounts payable $ 16,000 Accounts receivable 52,000 Accruals 20,000 Inventory 72,000 Notes payable 60,000 Current assets 144,000 Current liabilities 96,000 Fixed assets 175,000 Common stock 100,000 Retained earnings 123,000 Total assets $ 319,000 Total liabilities and equity $ 319,000 The firm earns 17 percent on sales and distributes 25 percent of its earnings. Using the percent of sales, determine whether the firm will need external funds and forecast the new balance sheet for sales of $520,000 assuming that cash changes with sales and that the firm is not operating at capacity. Use newly issued short-term debt to cover any needs for additional finance. If the firm has excess funds, add them to cash. Round your answers to the nearest dollar. Enter your…arrow_forwardBBP, Inc., with sales of $600,000, has the following balance sheet: BBP, Incorporated Balance Sheet as of 12/31/X0 Assets Liabilities and Equity Cash $ 30,000 Accounts payable $ 18,000 Accounts receivable 90,000 Accruals 36,000 Inventory 108,000 Notes payable 70,000 Current assets 228,000 Current liabilities 124,000 Fixed assets 180,000 Common stock 120,000 Retained earnings 164,000 Total assets $ 408,000 Total liabilities and equity $ 408,000 The firm earns 15 percent on sales and distributes 25 percent of its earnings. Using the percent of sales, determine whether the firm will need external funds and forecast the new balance sheet for sales of $780,000 assuming that cash changes with sales and that the firm is not operating at capacity. Use newly issued short-term debt to cover any needs for additional finance. If the firm has excess funds, add them to cash. Round your answers to the nearest dollar. Enter your…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning