Century 21 Accounting General Journal

11th Edition

ISBN: 9781337680059

Author: Gilbertson

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:Home Page - JagApp

Week 13 - Homework #8 (100 points) i

4

10

points

Skipped

eBook

Print

References

Mc

Graw

Hill

ווח

ezto.mheducation.com

M Question 4 - Week 13 - Homework #8 (100 points) - Connect

b My Questions | bartleby

Saved

Help

Save & Exit

Submit

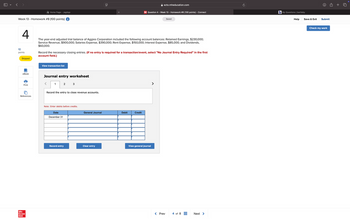

The year-end adjusted trial balance of Aggies Corporation included the following account balances: Retained Earnings, $230,000;

Service Revenue, $900,000; Salaries Expense, $390,000; Rent Expense, $150,000; Interest Expense, $85,000; and Dividends,

$60,000.

Record the necessary closing entries. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first

account field.)

View transaction list

Journal entry worksheet

1

2 3

Record the entry to close revenue accounts.

Note: Enter debits before credits.

Date

December 31

General Journal

Debit

Credit

Record entry

Clear entry

View general journal

< Prev

4 of 8

Next >

Check my work

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Guardian Carpets Incorporated provided the following accounts related to beginning balances in its accounts receivable and allowance accounts for the current year: Accounts Receivable Beginning Balance 6,000,000 Allowance for Uncollectible Accounts 2,000,000 Beginning Balance Question content area top right Part 1 Requirement Prepare the journal entries to record the following transactions that occurred during the current year. Prepare a schedule for both accounts receivable and the allowance for uncollectible accounts that shows the beginning balances, the various items that change the beginning balance, and the ending balance. Question content area bottom Part 1 Prepare the journal entries to record the following transactions that occurred during the current year. (Record debits first, then credits. Exclude explanations from any journal…arrow_forwardd 1 5 rint GLO401 (Algo) - Based on Problem 4-1A LO P1, P2 erences Prepare journal entries to record the following merchandising transactions of Turner's, which uses the perpetual inventory system and the gross method. (Hint: It will help to identify each receivable and payable; for example, record the purchase on July 1 in Accounts Payable-Griffin.) Graw July 1 Purchased merchandise from Griffin Company for $10,400 under credit terms of 1/15, n/30, FOB shipping point, invoice dated July 1. July 2 Sold merchandise to Wilson Company for $3,100 under credit terms of 2/10, n/60, FOB shipping point, invoice dated July 2. The merchandise had cost $1,860. July 3 Paid $1,005 cash for freight charges on the purchase of July 1. July 8 Sold merchandise that had cost $3,700 for $6,100 cash. July 9 Purchased merchandise from Lee Company for $4,400 under credit terms of 2/15, n/60, FOB destination, invoice dated July 9. July 11 Returned $900 of merchandise purchased on July 9 from Lee Company and…arrow_forwardRefer to the following selected financial information from Weekend Getaways Incorporated Compute the company's days' sales uncollected for Year 2. (Use 365 days a year.) Accounts receivable, net Net sales Multiple Choice O O 39.9. 43.8. 45.5. 38.4. 42.7. Year 2 98,760 823,000 Year 1 86,600 793,000arrow_forward

- 1. COMPPRO.03.01.PART.1 Comprehensive Problem 3 Part 1: Selected transactions completed by Kornett Company during its first fiscal year ended December 31, 20Y5, were as follows: 1. Journalize the selected transactions. Assume 360 days per year. If no entry is required, select "No entry required" from the dropdown and leave the amount boxes blank. If an amount box does not require an entry, leave it blank. Jan. 3: Issued a check to establish a petty cash fund of $4,500. Date Description Debit Credit Jan. 3 Feb. 26: Replenished the petty cash fund, based on the following summary of petty cash receipts: office supplies, $1,680; miscellaneous selling expense, $570; miscellaneous administrative expense, $880. Date Description Debit Credit Feb. 26 Apr. 14: Purchased $31,300 of merchandise on account, terms n/30. The perpetual inventory system is used to account for inventory. Date Description Debit Credit Apr. 14arrow_forwardWrite out the journal entries for these transacstions, Thank you!!!arrow_forwardWhat is the Balance for December 31?arrow_forward

- Saved e Quiz: Accounting for Current Liabi... A Required information Knowledge Check 01 The records of Pippins, Incorporated, included the following information: Net sales 475,000 Gross margin Interest expense Income tax expense Net income 000'0 000'0 Compute the times interest earned ratio, rounded to the nearest decimal. O 4.8 O 6.4 O7.4 O 20.0 *********** II F3 F5 F6 F8 F4 #3arrow_forwardThe following information was taken from the accounts receivable records of Monty Corporation as at December 31, 2020: OutstandingBalance Percentage Estimatedto be Uncollectible 0 – 30 days outstanding $156,000 0.5% 31 – 60 days outstanding 65,400 2.5% 61 – 90 days outstanding 40,000 4.0% 91 – 120 days outstanding 20,800 6.5% Over 120 days outstanding 5,100 10.0% (a) Prepare the year-end adjusting entry for bad debt expense, assuming allowance for doubtful accounts had a credit balance of $1,280 prior to the adjustment. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Account Titles and Explanation Debit Credit (b) Prepare the year-end adjusting entry for bad debt expense, assuming allowance for doubtful accounts had a debit balance of $4,010 prior to the…arrow_forwardUS Kiumel, finamclal Accounting, Se Hele I Syotem Aenouncements CALLAT Briel Exercise 8-11 he 20117 financial staternents of 3M Company report net sales of $25.3 billion. Accounts receivable (net) are $3.00 billion at the beginning of the year and $3.24 billion at the cde Compute 3M Company's receivable turnover. (Round answer to 1 decimal place, e.g. 12.5.) Accounts receivable turnover ratio times SHOW LIST OF ACCOUNTS LINK TO TEXT INTERACTIVE TUTORIAL Compute 3M Company's average collection period for accounts receivable in days. (Round answer to 1 decimal place, e.g. 12.5. Use 365 days for calculation.) Average collection period days Click if you would like to Show Work for this question: Open Show Work SHOW LIST OF ACCOUNTS LINK TO TEXT INTERACTIVE TUTORIAL Question Attempts: 0 of 3 usecarrow_forward

- A. More Review Show (MRS) prepares quarterly statements. Thebookkeeper presented to you the records and you found out the following account balancesbefore adjustments for the quarter ended March 31, 200B:1. The notes receivable balance of P180,000 as of March 31, 200B consisted of a 60-day 12% note for P120,000 dated February 14, 200B and a 30-day 6% note for P60,000 dated March 16, 200B2. The balance of the prepaid insurance account of P22,000 represents a one-year policycontracted last November 1, 200A for P10,000 and a two-year policy contracted last July 1, 200A for P12,0003. The balance of the prepaid rent account of P50,000 pertains to advance rent paid lastDecember 1, 200A six months effective on the same date.4. The rate per day for each of the four shop workers is P350. MRS pays the weekly salaries of its workers every Monday of the following week ( a week consisting of five days from Monday to Friday). March 31, 200B falls on Thursday.5. Mortgage notes payable had a credit…arrow_forward10:04 Assignment Details ATG-110-20A01: Financial Accounting (Session II Summer 2021) 7474 unread replies.7575 replies. Please read and respond to TIF 12-2 on page 623. Review the rubric to ensure you receive full points for this discussion. Discussion Rubric- 25 points(1)_(3).docx *After you have posted your answers, please reply to three other students' posts. This discussion board was set up so that you will not be able to see others replies until you post your own. Search entries or author Filter replies by unreadUnread Collapse replies TIF 12-2 Issuing Stock 1. ETHICS Lou Hoskins and Shirley Crothers are organizing Red Lodge Metals Unlimited Inc. to undertake a high-risk gold mining venture in Canada. Lou and Shirley tentatively plan to request authorization for 400,000,000 shares of common stock to be sold to the general public. Lou and Shirley have decided to establish par of $0.03 per share in order to appeal to a wide variety of potential investors. Lou and Shirley believe…arrow_forwardLTI Post Attend cengage lo * CengageNO M Reset your E Homework com/ilm/takeAssignment/takeAssignmentMain.do?invoker-&takeAssignmentSessionLocator=&inpr.. Chart of Accounts General Journal Instructions Delmarva Company, during its first year of operations in 2020, reported taxable income of $170,000 and pretax financial income of $100,000. The differenc between taxable income and pretax financial income was caused by two timing differences: excess depreciation on tax return, $70,000; and warranty expenses in excess of warranty payments, $40,000. These two timing differences will reverse in the next three years as follows: Year Depreciation Warranty Expenses 2021 $10,000 $20,000 2022 20,000 16,000 2023 40,000 4,000 Enacted tax rates are 30% for 2020, 35% for 2021 and 2022, and 40% for 2023. Required:arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning  College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...

Accounting

ISBN:9781305666160

Author:James A. Heintz, Robert W. Parry

Publisher:Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning