FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

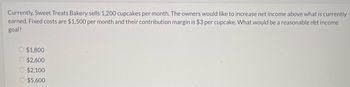

Transcribed Image Text:Currently, Sweet Treats Bakery sells 1,200 cupcakes per month. The owners would like to increase net income above what is currently

earned. Fixed costs are $1,500 per month and their contribution margin is $3 per cupcake. What would be a reasonable net income

goal?

O $1,800

O $2,600

O $2,100

O $5,600

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Similar questions

- A door manufacturer decides to sell each door for $ 479. It has a manufacturing cost ofdoor is $ 237 and fixed costs are $ 4,114 a week.1. How many doors should you produce and sell each week in order to guaranteethe business to break even?2. If you sell 65 doors per month you could guarantee your breakeven point. Explain your answer.arrow_forwardA jeans maker is designing a new line of jeans. These jeans will sell for $410 per unit and cost $328 per unit in variable costs to make. Fixed costs total $120,000. If 5,000 units are produced and sold, what does the income equal?arrow_forwardYou have a business selling and delivering pizzas to businesses for lunch. You pay $4,000 per month in rent, $320 for utilities, and $2,000 a month for salaries. You also have delivery cars that cost $1,000 per month. Your variable costs are $8 per pizza for ingredients and $4 per pizza for delivery costs. You sell the pizzas for $20 each. Round up if necessary What is the number of pizzas you need to sell to break even for the month If you want to make a profit of 2,000 per month, how many pizzas do you need to sell? Round up if necessary Go back to the original numbers If the price of cheese goes up and your variable costs go by $3 what is your new break even in pizzas if you increase your price to $21 Round up if necessary Golden Company has a fleet of delivery trucks and has the following Overhead costs per month with the miles driven Miles Driven Total Costs March 50.000 194.000 Aprill 40.000 170.200 this is the low May 60.000 217.600 June 70.000 241.000 Use the High-Low method to…arrow_forward

- Please help me fastarrow_forwardA company estimates that it can sell 4,000 units each month of its product if it prices each unit at $80. However, its monthly number of sales will increase by 15 units for each $0.15 decrease in price. The company has fixed costs of $500. The cost to make each unit is $4.60, Find the level of production that maximizes the company's profit. They should produce units at a price of $ which will yield a profit of $arrow_forwardKnoll, Inc. currently sells 51,000 units a month for $98 each, has variable costs of $68 per unit, and fixed costs of $108,000. Knoll is considering increasing the price of its units to $108 per unit. If the price is changed, how many units will Knoll need to sell for profit to remain the same as before the price change?arrow_forward

- Lamphere Lawn Care provides lawn and gardening services. The price of the service is fixed at a flat rate for each service, and most costs of providing the service are the same, given the similarity in the lawns and lots. The owner budgets income by estimating two factors that fluctuate with the economy: the contribution margin associated with each service call and the number of customers who will request lawn service. Looking at next year, the owner develops the following estimates of contribution margin (price less variable cost of the service, including labor) and the estimated number of service calls. Although the owner understands that it is not strictly true, the owner assumes that the cost of fuel and the number of customers are independent. Contribution Margin per Service Call (Price - Scenario Excellent Fair Poor Excellent Fair Poor Excellent In addition to the variable costs of service, the owner estimates that other costs are $49,000 plus $8 for each service call in excess…arrow_forward1) Margin at the Kiosk You rent a kiosk in the mall for $300 a month and use it to sell T-shirts with college logos from colleges and universities all over the world. You sell each T-shirt for $25, and your cost for each shirt is $15. You also pay your salesperson a commission of $0.50 per T-shirt sold in addition to a salary of $400 per month. Construct a contribution margin income statement for two different months: in one month, assume 100 T-shirts are sold, and in the other, assume 200 T-shirts are sold.arrow_forwardYou Break It, We Fix-it Repair Shop has a monthly target profit of $18,900. Variable costs are 62% of sales, and monthly fixed costs are $7,500. (Note: 100% of Sales = Variable Costs + Contribution Margin). (Round your answers to two decimal places when needed and use rounded answers for all future calculations). 1. Compute the monthly margin of safety in dollars if the shop achieves its income goal. (Fixed Costs (Fixed Costs + + + + Expected sales - Target Profit) Target Profit) 1 1 Contribution Margin per ratio (%) Contribution Margin ratio (%) = = = = Required Sales in Dollars to Break-even Required Sales in Dollars to meet Target Profit Break-even sales = Margin of safety in dollars 2. Express what You Break It, We Fix-it Repair Shop margin of safety is as a percentage of target ales. Margin of safety in dollars/ Expected sales in dollars = Margin of safety ratio (%)arrow_forward

- A furniture company manufactures desks and chairs. Each desk requires 29 hours to manufacture and contributes $400 to profit, and each chair requires 19 hours to manufacture and contributes $250 to profit. Due to marketing restrictions, a total of 2000 hours are available. Use Solver to maximize the company’s profit. What is the maximum profit? How many desks and chairs should the company manufacture? Of the 2000 available hours, how many hours will be used?arrow_forwardExample: Your company wants to earn $7,000 in after-tax profit selling Frog caps outside the stadium this season. Fixed costs are $6,000 and CMU = $2 per cap. The income tax rate is 30%. 2. How many units do you need to sell to reach the pre-tax profit?arrow_forwardFlora's Flats produces comfortable and portable women's shoes designed to be worn as a second pair of shoes after a formal event. The company has the following financial information: The company's sales price is $20 per unit. The variable costs of producing flats is $6 per unit. The company expects to have fixed costs of $10,000 next year. The company expects to sell 1,000 pairs of flats next year. Assume no taxes. a.) Calculate the breakeven point in units. b.) Calculate the breakeven point in dollars.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education