FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

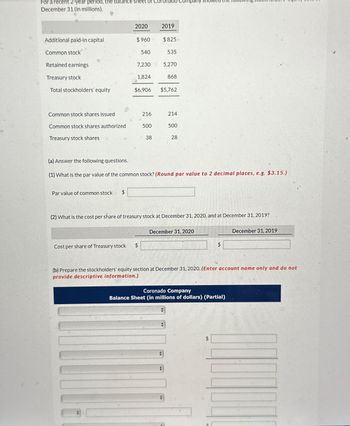

Transcribed Image Text:For a recent 2-year period, the balance sheet of Corona

December 31 (in millions).

Additional paid-in capital

Common stock

Retained earnings

Treasury stock

Total stockholders' equity

Common stock shares issued

Common stock shares authorized

Treasury stock shares

2020

Par value of common stock

$960

540

7,230

1,824

$6,906

216

Cost per share of Treasury stock $

500

38

2019

$825

535

5,270

868

$5,762

214

500

28

(a) Answer the following questions.

(1) What is the par value of the common stock? (Round par value to 2 decimal places, e.g. $3.15.)

mpany

(2) What is the cost per share of treasury stock at December 31, 2020, and at December 31, 2019?

December 31, 2020

December 31, 2019

(b) Prepare the stockholders' equity section at December 31, 2020. (Enter account name only and do not

provide descriptive information.)

Coronado Company

Balance Sheet (in millions of dollars) (Partial)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- 30. Questions 30 and 31 are related. Use the following information regarding an equal-weighted equity index and assume that all dividend payments are made at the end of the year and are reinvested in the stock that paid the dividend. Security Price at the End of 2021 Price at the End of 2022 Dividends per Share A $26 $0.50 B $45 $0.20 C $36 $0.40 Ꭰ $135 $0.50 Note: The dollar value of the index on December 31, 2021 is $10,000 and using a divisor of 100, the index level equals 100. a. b. C. 31. a. b. C. The weight of Security B in the index on December 31, 2022 with dividends reinvested and before rebalancing is closest to: 16.75% 18.55% 19.24% $25 $50 $31.25 $100 7.35% 7.87% The total return on the index referenced in the previous question for the year 2022 is closest to: 8.90% d. 22.16% e. 23.33% f. 25.00% d. 10.53% e. 12.10% f. 12.54%arrow_forwardThere are 2 parts to this question please read and answer carefully using the table provided.arrow_forwardGiven the following price and dividend information, calculate the holding period return. (Enter percentages as decimals and round to 4 decimals) Stock: MSFT Year Price Dividend 2017 $ 64.65 2018 $ 95.01 $ 1.72 2019 $ 104.43 $ 1.89 2020 $ 107.23 $ 2.09 2021 $231.96 $ 2.30 2022 $310.98 $ 2.54 2023 $247.81 $ 3.00arrow_forward

- Please do not give solution in image formatarrow_forwardQuestion-based on, "calculate earnings". I have tried but no answer.arrow_forwardQuestion 1- Texas Instruments (TXN) (please include your Excel spreadsheet file!) Actual data for Texas Instruments common stock! Suppose on December 31, 2011 you purchased TXN stock at $29.11 per share. You hold TXN until December 31, 2021 when you sold it at $188.47 per share. During this holding period, you received the following annual dividends per share. Year Annual DPS Year Annual DPS 2012 $0.72 2017 $2.12 2013 $1.07 2018 $2.63 2014 $1.24 2019 $3.21 2015 $1.40 2020 $3.72 2016 $1.64 2021 $4.21 Using the above TXN stock data and using Excel spreadsheet, determine the average annual return for your TXN investment. Question 2 TXN stock price on December 31, 2020 was $162.70 per share. Calculate the 2021 annual "holding period return" (HPR). Show all work. Question 3 Using the table above, determine the average annual growth rate for TXN dividends per share for the period 2012-2021. Show formula, input, & calculation. Excel is optional.arrow_forward

- Suppose a market consists of four stocks. The number of shares outstanding for each stock as well as the stock prices in two consecutive days are as follows: Stock A Stock B Stock C Stock D Shares outstanding 200 1000 400 3000 I $5 $30 $100 $40 Ро $15 $25 $80 $50 a) Compute the percentage increase in the price-weighted index for this market. b) Compute the percentage increase in the value-weighted index for this market. P₁arrow_forwardPlease Do not Give image formatarrow_forwardConsider a market value-weighted index with only 3 stocks: Stock A, Stock B, and Stock C. The current shares and current prices, as well as the original number of shares and original prices, of the stocks are summarized in the following table: Current Shares Current Price Original Shares Original Price Stock A Stock B Stock C 300 100 200 Assuming the base value is 100, the index level is $48 $69 $91 100 100 100 $28 $79 $51 Round your answer to 4 decimal places.arrow_forward

- Sunland Corporation was organized on January 1, 2021. During its first year, the corporation issued 2,000 shares of $50 par value preferred stock and 100,000 shares of $10 par value common stock. At December 31, the company declared the following cash dividends: 2021, $4,800; 2022, $13,600; and 2023, $29,000. (a) Your answer is correct. Show the allocation of dividends to each class of stock, assuming the preferred stock dividend is 7% and noncumulative. Allocation to preferred stock Allocation to common stock A 2021 4,800 0 LA 2022 7,000 6,600 2023 7,000 22,000arrow_forwardNonearrow_forwardWhen calculating the weighted average shares of common stock outstanding, how should companies adjust for stock dividends? O They should be weighted by the number of days outstanding. O They should be considered outstanding at the beginning of the year. O They should be weighted by the number of months outstanding. O They should be considered outstanding at the mid-point of the year.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education