Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:30.

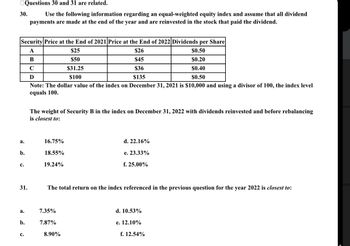

Questions 30 and 31 are related.

Use the following information regarding an equal-weighted equity index and assume that all dividend

payments are made at the end of the year and are reinvested in the stock that paid the dividend.

Security Price at the End of 2021 Price at the End of 2022 Dividends per Share

A

$26

$0.50

B

$45

$0.20

C

$36

$0.40

Ꭰ

$135

$0.50

Note: The dollar value of the index on December 31, 2021 is $10,000 and using a divisor of 100, the index level

equals 100.

a.

b.

C.

31.

a.

b.

C.

The weight of Security B in the index on December 31, 2022 with dividends reinvested and before rebalancing

is closest to:

16.75%

18.55%

19.24%

$25

$50

$31.25

$100

7.35%

7.87%

The total return on the index referenced in the previous question for the year 2022 is closest to:

8.90%

d. 22.16%

e. 23.33%

f. 25.00%

d. 10.53%

e. 12.10%

f. 12.54%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 4 images

Knowledge Booster

Similar questions

- Pls thanks correct steo by steparrow_forwardConsider the following table for different assets for 1926 through 2020. Standard Deviation 19.7% Series Large-company stocks Small-company stocks Long-term corporate bonds Long-term government bonds Intermediate-term government bonds U.S. Treasury bills Inflation Average return 12.2% 16.2 6.5 6.1 5.3 3.3 2.9 Expected range of returns Expected range of returns a. What range of returns would you expect to see 68 percent of the time for large-company stocks? Note: A negative answer should be indicated by a minus sign. Enter your answers from lowest to highest. Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16. b. What about 95 percent of the time? 31.3 8.5 9.8 Note: A negative answer should be indicated by a minus sign. Enter your answers from lowest to highest. Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16. % to % to 5.6 3.1 4.0 % %arrow_forwardProblem 11-6 Risk Premiums (LO1) Assume these are the stock market and Treasury bill returns for a 5-year period: Year Stock Market Return (8) T-Bill Return (%) 2016 13.0 0.2 2017 21.0 0.8 2018 -6.2 1.8 2019 29.8 2.1 2020 20.6 0.4 Check my work Required: a. What was the risk premium on common stock in each year? b. What was the average risk premium? c. What was the standard deviation of the risk premium? (Ignore that the estimation is from a sample of data.) Complete this question by entering your answers in the tabs below. Required A Required B Required C What was the risk premium on common stock in each year? Note: Do not round intermediate calculations. Enter your answers as a percent rounded to 2 decimal places. Negative values should be entered with a negative sign. Year Risk Premium 2016 % 2017 % 2018 % 2019 % 2020 %arrow_forward

- Consider the following information on two stocks: P(State) Stock A Stock B Boom 20% 30% 20% Normal 50% 12% -5% Slow 15% 4% 8% Recession 15% -10% 10% Calculate the covariance(A,B). (Enter percentages as decimals and round to 4 decimals)arrow_forwardReview the following market information: Current Stock Market Return 11.25% Current T-Bill Price $979.43 Historic T-Bill Average Return 2.80% Historic Stock Market Average Return 8.10% Stock Beta 1.23 What is the required return (rounded to two places)?arrow_forwardQ15arrow_forward

- 2-13 Historical Realized Rates of Return You are considering an investment in ei er individual stocks or a portfolio of stocks. The two stocks you are researching, Stock A and Stock B, have the following historical returns: Year 2014 -20.00% -5.00% 2015 42.00 15.00 2016 20.00 -13.00 2017 -8.00 50.00 2018 25.00 12.00 a. Calculate the average rate of return for each stock during the 5-year period. b. Suppose you had held a portfolio consisting of 50% of Stock A and 50% of Stock B. What would have been the realized rate of return on the portfolio in each year? What would have been the average return on the portfolio during this period? C. Calculate the standard deviation of returns for each stock and for the portfolio. d. Suppose you are a risk-averse investor. Assuming Stocks A and B are your only choices, would you prefer to hold Stock A. Stock B, or the portfolio? Why?arrow_forwardSuppose the return of asset A to D, is given as follows: Asset 2018 2019 2020 2021 A 9% 10% -2 % 15% B 7% 10% 5 % 9% C -11% 20% 12% 8% D 10% 16% -5 % -8% Calculate the expected return of: a. One stock at a time b. Portfolio of A, B & D, and, B, D, & A c. Portfolio of A & B, and, D & B d. Portfolio of all the four stocksarrow_forward17. Based on the following table, if you invest $15,000 into AAPL stock at the beginning of the period, what would be the dollar value of your investment at the end of the time period? AAPL Date 2/1/2023 13.33% 3/1/2023 -13.99% 4/1/2023 6.53% 5/1/2023 -3.68% 6/1/2023 9.01% 7/1/2023 1.81% 8/1/2023 7.13% 9/1/2023 0.43% 10/1/2023 -2.66% 11/1/2023 5.33% 12/1/2023 4.77% 1/1/2024 12.89% Average Variance St. Dev. A. $15,512 B. $16,154 C. $19,467 D. $21,725 E. $22,831 3.41% 0.005910 7.69%arrow_forward

- Question 1 The following are the monthly rates of returns for two stocks, Stock A and Stock B over 2022. Month 1 2 3 4 5 6 7 8 9 10 11 12 Stock A 2.52% -3.2% 0.54% 1.32% 2.56% 1.10% 1.85% 0.58% 1.98% 0.05% 1.15% 2.23% Stock B 1.37% Page 3 of 5 1.58% 0.98% -0.78% 0.98% 1.35% -2.04% 0.87% 2.09% -0.07% 1.78% 0.63% (a) What is the average monthly rate of return for each stock? What is the standard deviation of returns for each stock? (b) Calculate the covariance between the rates of return. Calculate the correlation coefficient between the rates of return. ortfolio Analysis (c) Comment on the diversification benefits of constructing a portfolio of these two stocks.arrow_forwardConsider the following information on two stocks: P(State) Stock A Stock B Boom 20% 30% 20% Normal 50% 12% -5% Slow 15% 4% 8% Recession 15% -10% 10% Calculate the correlation (A,B). (Enter percentages as decimals and round to 4 decimals)arrow_forwardView Policies Current Attempt in Progress Calculate the correlation coefficient (PA) for the following situation: (Round intermediate calculations and the final answer to 4 decimal place, e.g. 0.2921.) State of the economy High growth Moderate Recession Probability of Expected return on occurrence stock A in this state 47.0% 26.0% -14.0% 25% 20% 55% Correlation coefficient Expected return on stock B in this state 64.0% 34.0% -24.0%arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education