FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

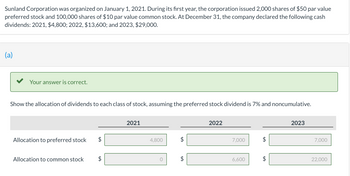

Transcribed Image Text:Sunland Corporation was organized on January 1, 2021. During its first year, the corporation issued 2,000 shares of $50 par value

preferred stock and 100,000 shares of $10 par value common stock. At December 31, the company declared the following cash

dividends: 2021, $4,800; 2022, $13,600; and 2023, $29,000.

(a)

Your answer is correct.

Show the allocation of dividends to each class of stock, assuming the preferred stock dividend is 7% and noncumulative.

Allocation to preferred stock

Allocation to common stock

A

2021

4,800

0

LA

2022

7,000

6,600

2023

7,000

22,000

Transcribed Image Text:Show the allocation of dividends to each class of stock, assuming the preferred stock dividend is 8% and cumulative.

Allocation to preferred

stock

Allocation to common

stock

A

2021

p

A

LA

2022

2023

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- sarrow_forward-/1 Question 12 of 17 View Policies Current Attempt in Progress On September 1, 2020, Coronado Industris reacquired 29200 shares of its $10 par value common stock for $15 per share. Coronado uses the cost method to account for treasury stock. The journal entry to record the reacquisition of the stock should debit O Treasury Stock for $438000. O Common Stock for $292000. O Common Stock for $292000 and Paid-in Capital in Excess of Par for $146000. O Treasury Stock for $29200O. Save for Later Attempts: 0 of 1 used Submit Answer MacBook IIarrow_forwardExercise 19-2O (Algo) EPS; shares issued; stock options [LO19-6, 19-7, 19-8, 19-9] Stanley Department Stores reported net income of $776,000 for the year ended December 31, 2021. Additional Information: Common shares outstanding Incentive stock options (vested in 2020) outstanding throughout 2021 (Each option is exercisable for one common share at an exercise price of $23.00) During the year, the market price of Stanley's common stock averaged $27.60 per share. On Aug. 30, Stanley sold 15,000 common shares. Stanley's only debt consisted of $36, 000 of 10% short-term bank notes. The company's income tax rate is 25%. Jan. 1, 2021 90,000 24,000 Required: Compute Stanley's basic and diluted earnings per share for the year ended December 31, 2021. (Enter your answers in thousands. Do not round intermediate calculations) Numerator Denominator Earnings per Share Basic %3D Diluted %3Darrow_forward

- question 7 is attached below thanks for help aprpecaited itph2 5h 25phoarrow_forwardProblem 24-6 (Algo) XYZ's stock price and dividend history are as follows: Beginning of Year Price $ 110 Year 2020 2021 2022 2023 120 100 110 Dividend Paid at Year-End $4 An investor buys three shares of XYZ at the beginning of 2020, buys another two shares at the beginning of 2021, sells one share at the beginning of 2022, and sells all four remaining shares at the beginning of 2023. Required: a. What are the arithmetic and geometric average time weighted rates of return for the investor? Note: Round your year-by-year rates of return and final answers to 2 decimal places. Do not round other calculations. b. What is the dollar-weighted rate of return? (Hint Carefully prepare a chart of cash flows for the four dates corresponding to the turns of the year for January 1, 2020, to January 1, 2023. If your calculator cannot calculate internal rate of return, you will have to use trial and error.) Note: Round your answer to 4 decimal places. Negative amount should be indicated by a minus…arrow_forwardrmn.3arrow_forward

- Question Content Area Ulmer Company is considering the following alternative financing plans: Plan 1 Plan 2 Issue 8% bonds at face value $2,000,000 $1,000,000 Issue preferred stock, $15 par — 1,500,000 Issue common stock, $10 par 2,000,000 1,500,000 Income tax is estimated at 35% of income. Dividends of $1 per share were declared and paid on the preferred stock. Determine the earnings per share of common stock, assuming income before bond interest and income tax is $600,000. Round your answers to two decimal places. Earnings per Shareon Common Stock Plan 1 $fill in the blank 1 Plan 2 $fill in the blank 2arrow_forwardPlease do not give solution in image format thankuarrow_forwardF1arrow_forward

- Subject: acountingarrow_forwardQuestion 16 Superb Manufactutring inc attached in ss below thanks for help aprpeciated irwgwrgwarrow_forwardQuestion 3 On 6 July 2021, Falta Limited paid $300 to purchase a put option on Zebra Limited when the market price per ordinary shares was $120. The option gives Falta Limited to sell 500 shares at an exercise price of $120 and the option expires on 1 February 2022. Market price per share $ Time value of put Option $ Date 30 September 2021 31 December 2021 123 180 115 100 1 February 2022 112 30 Required: Prepare the journal entries for Falta for the following dates: (a) On 6 July 2021 to record the investment in the put option. (b) On 30 September 2021 when Falta Limited prepared the financial statements. (c) On 31 December 2021 when Falta Limited prepared the financial statements. (d) On 1 February 2022 when Falta Limited settled the call option.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education