Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

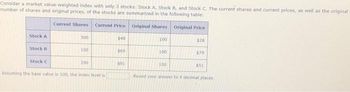

Transcribed Image Text:Consider a market value-weighted index with only 3 stocks: Stock A, Stock B, and Stock C. The current shares and current prices, as well as the original

number of shares and original prices, of the stocks are summarized in the following table:

Current Shares Current Price

Original Shares

Original Price

Stock A

Stock B

Stock C

300

100

200

Assuming the base value is 100, the index level is

$48

$69

$91

100

100

100

$28

$79

$51

Round your answer to 4 decimal places.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- How do you calcuate the bechmark and historical return for the stock ARKK when the last price listed is $123.40 and the current value is $26,531.00.arrow_forward1. Consider the three stocks in the following table. P, represents price at time t, and Q, represents shares outstanding at time t. Calculate the rates of return on the following indexes of the three stocks: A B с Po 90 50 100 a. A market-value-weighted index. b. An equally weighted index. Qo 100 200 200 P₁ 95 45 110 Q₁ 100 200 200arrow_forwardWhat are the portfolio weights for a portfolio that has 125 shares of Stock A that sell for $82 per share and 100 shares of Stock B that sell for $74 per share? (Do not round intermediate calculations and round your answers to 4 decimal places, e.g., .1616.) Stock A: Stock B:arrow_forward

- Three stocks are included in the price-weighted 6ULE stock index. Their current share prices are shown below: Annuity Manufacturing Perpetuity Production, Inc. Additivity Amalgamated Company If the current value of the 6ULE index is 1000, what is the current divisor? 1.00 0.27 0.60 0.90 Current Price $65 $111 $94 0.54arrow_forwardThe following table displays hypothetical stock quotations. Use the information in the table to answer the questions that follow. Listed Stock Quotes Company Ticker High Low Last Price* Net Change** YTD %*** Div. Yield P/E Ratio MarkMin MM 93.06 67.68 84.60 4.56 1.66 0 46 MarlRedBiro MRB 14.00 9.15 10.77 2.01 7.19 6.0 10 TStar TS 341.06 221.69 284.22 2.70 5.02 2.4 26 *Last price for the day **Net change in price from previous day ***Year-to-date percentage change in stock price Of the three stocks listed, a retiree who lives partially off of investment income would be best off holding because of its . You can calculate that MarkMin had per-share earnings for the most recent 12-month period of . If you had purchased 100 shares of TStar stock yesterday at the last price of the day, you would have of if you sold all 100 shares at the last price today.arrow_forwardConsider a market value-weighted index consisting of 3 stocks: A, B, and C. The stocks' prices at time 0 (p0) and time 1 (p1) are given below, along with the number of shares outstanding. Calculate the index levels at time 0. Round your answer to 4 decimal places. For example, if your answer is 3.205%, then please write down 0.0321. stock p0 p1 outstanding shares 43 45 200 69 50 500 11 12 600 A B Carrow_forward

- Use the data table to answer the question that follows. Stock A Stock B Stock C 52W high; 52W low $87.54; $32.21 $9.68; $6.25 $37.11; $35.92 Div 0 $0.05 $0.75 P/E 36 20 7.9 Close $85.43 $6.98 $36.87 An investor's primary concern with adding a new stock to their portfolio is value for the price paid. Which stock should they choose and why? Stock B, because lower-priced stocks are more likely to be good deals in the financial market Stock B, because its P/E ratio means that it is earning more per share than its price Stock C, because its relatively lower P/E ratio indicates the others may be overvalued Stock C, because its relatively higher Div value means it is the best overall dealarrow_forward(5)arrow_forwardConsider the three stocks in the following table. Pt represents price at time t, and Qt represents shares outstanding at time t. Stock C splits two-for-one in the last period. A B с Po 81 41 82 Rate of return 20 100 200 200 Divisor P1₁ 86 36 92 21 100 200 200 Required: a. Calculate the rate of return on a price-weighted index of the three stocks for the first period (t = 0 to t= 1). (Do not round intermediate calculations. Round your answer to 2 decimal places.) % P2 86 36 46 Q2 100 200 400 b. What will be the divisor for the price-weighted index in year 2? (Do not round intermediate calculations. Round your answer to 2 decimal places.)arrow_forward

- pm.3arrow_forwardConsider the three stocks in the following table. Pt represents price at time t, and Qt represents shares outstanding at time t. Stock C splits two-for-one in the last period. A B C Po 82 42 84 Rate of return 00 100 Divisor 200 200 P1 87 37 94 01 100 200 200 % P2 87 Required: a. Calculate the rate of return on a price-weighted index of the three stocks for the first period (t = 0 to t= 1). (Do not round intermediate calculations. Round your answer to 2 decimal places.) 370 47 92 100 200 400 b. What will be the divisor for the price-weighted index in year 2? (Do not round intermediate calculations. Round your answer to 2 decimal places.) c. Calculate the rate of return of the price-weighted index for the second period (t=1 to t=2).arrow_forwardConsider the three stocks in the following table. Pt represents price at time t, and Qt represents shares outstanding at time t. Stock C splits two-for-one in the last period. ABC Po 86 46 92 le 100 200 200 Rate of return P1 91 41 102 Q1 100 1.89 % 200 200 P2 91 41 51 Required: a. Calculate the rate of return on a price-weighted index of the three stocks for the first period (t = 0 to t = 1). (Do not round intermediate calculations. Round your answer to 2 decimal places.) 22 100 200 400arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education