Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

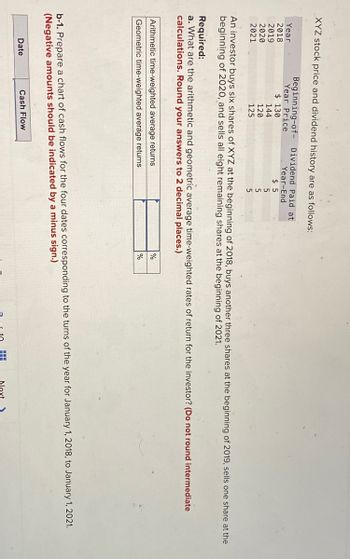

Transcribed Image Text:XYZ stock price and dividend history are as follows:

Dividend Paid at

Year-End

$5

Year

2018

2019

2020

2021

Beginning-of-

Year Price

$ 130

144

120

125

An investor buys six shares of XYZ at the beginning of 2018, buys another three shares at the beginning of 2019, sells one share at the

beginning of 2020, and sells all eight remaining shares at the beginning of 2021.

Required:

a. What are the arithmetic and geometric average time-weighted rates of return for the investor? (Do not round intermediate

calculations. Round your answers to 2 decimal places.)

Arithmetic time-weighted average returns

Geometric time-weighted average returns

5

5

5

Date

b-1. Prepare a chart of cash flows for the four dates corresponding to the turns of the year for January 1, 2018, to January 1, 2021.

(Negative amounts should be indicated by a minus sign.)

Cash Flow

%

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Am. 405.arrow_forwardRaghubhaiarrow_forward7. XYZ stock price and dividend history are as follows: Year 2018 2019 2020 2021 Beginning-of-Year Price $100 110 90 95 Dividend Paid at Year-End $4 4 4 4 An investor buys three shares of XYZ at the beginning of 2018, buys another two shares at the beginning of 2019, sells one share at the beginning of 2020, and sells all four remaining shares at the beginning of 2021. (LO 5-1) a. What are the arithmetic and geometric average time-weighted rates of return for the investor? b. What is the dollar-weighted rate of return? (Hint: Carefully prepare a chart of cash flows for the four dates corresponding to the turns of the year for January 1, 2018, to January 1, 2021. If your calculator cannot calculate internal rate of return, you will have to use a spreadsheet or trial and error.)arrow_forward

- Nonearrow_forwardXYZ's stock price and dividend history are as follows: Beginning-of-Year Price Year 2019 $ 110 2020 120 2021 100 2022 110 -1.34% -3.64% -2.58% -5.47% -0.37% Dividend Paid at Year- End $4 4 44 An investor buys three shares of XYZ at the beginning of 2019, buys another two shares at the beginning of 2020, sells one share at the beginning of 2021, and sells all four remaining shares at the beginning of 2022. What is the dollar-weighted rate of return? (Hint: Carefully prepare a chart of cash flows for the four dates corresponding to the turns of the year for January 1, 2019, to January 1, 2022.arrow_forwardXYZ stock price and dividend history are as follows: Beginning-of- $ 104 Year 2018 Year Price 2019 2020 2021 115 90 105 Dividend Paid at Year-End $ 2 2 2 2 An investor buys three shares of XYZ at the beginning of 2018, buys another one shares at the beginning of 2019, sells one share at the beginning of 2020, and sells all three remaining shares at the beginning of 2021. Required: a. What are the arithmetic and geometric average time-weighted rates of return for the investor? (Do not round intermediate calculations. Round your answers to 2 decimal places.) Arithmetic time-weighted average returns Geometric time-weighted average returns % % b-1. Prepare a chart of cash flows for the four dates corresponding to the turns of the year for January 1, 2018, to January 1, 2021. (Negative amounts should be indicated by a minus sign.) Date Cash Flow 01/01/2018 01/01/2019 01/01/2020 01/01/2021arrow_forward

- XYZ's stock price and dividend history are as follows: Beginning-of-Year Dividend paid at Price $ 102 122 92 102 Year 2018 2019 2020 2021 Year-End $4 Arithmetic average rate of return Geometric average rate of return 4 An investor buys three shares of XYZ at the beginning of 2018, buys another two shares at the beginning of 2019, sells one share at the beginning of 2020, and sells all four remaining shares at the beginning of 2021. 4 4 a. What are the arithmetic and geometric average time-weighted rates of return for the investor? (Round your year-by-year rates of return and final answers to 2 decimal places. Do not round other calculations.) Dollar-weighted rate of return b. What is the dollar-weighted rate of return? (Hint: Carefully prepare a chart of cash flows for the four dates corresponding to the turns of the year for January 1, 2018, to January 1, 2021. If your calculator cannot calculate internal rate of return, you will have to use trial i and error.) (Round your answer to 4…arrow_forwardYou have been provided with the following information for the year ended 30 June 2022 for ABCLtd:RNet profit for the year -R1 800 000Weighted average number of shares (WANOS) outstanding during the year-R 120 000Average fair value per share -R30.00Weighted average number of shares (WANOS) under option during the year -R25 000Exercise price for shares under option during the year -R28.00REQUIRED:Q.2.1 Explain the purpose and objective of disclosing diluted earnings per share.arrow_forwardProblem 1. Gene Company has a portfolio of trading securities as of December 31, 2020 as follows: Cost Fair Value 15,000 ordinary shares of Terry Co. P 477,000 P 417,000 30,000 ordinary shares of Gina Co. 546,000 570,000 P1,023,000 P 987,000 All of the above securities were purchased in 2020. The following transactions related to the securities occurred in 2021: Mar 1. Sold 15,000 shares of Terry Co. at P31 less brokerage commission of P4,500. Apr 1. Bought 1,800 shares of Wendy Co. at P45 plus commission, taxes, and other transaction costs of P1,650. On December 31, 2021, the Company’s investment portfolio appears as follows: Cost Fair Value 30,000 ordinary shares of Gina Co. P 546,000 P 580,000 1,800 ordinary shares of Wendy Co. 82,650 75,000 P 628,650 P 655,000 The fair values excludes the estimated transaction costs that would be incurred on the…arrow_forward

- During 2020, Empresas ABC issued 4,000 preferred shares with a par value of $ 10 to $ 11 each. Each preferred share can be exchanged at the option of the holder (investor) for three common shares of ABC with a par value of $ 1. In August 2021, all preferred shares were exchanged. At that time the market value of the common stock was $ 5 per share. What amount must ABC credit to the Capital account contributed in excess of the value for common shares? a. $32,000 b. $48,000 c. 0 d. $44,000arrow_forwardAn investor is considering purchasing shares in Unicorn plc & has asked for your advice. On April 1st, 2020 the share price was 662p. In the June 2020 an interim dividend of 12p was paid and in January 2021, a final dividend of 32p was paid. On March 31st, 2021 the share price was 724p. What was the TSR for the year for Unicorn Ordinary shares?arrow_forwardPreference sharesOn 1 March 2020, NOL issued 3 million 4% redeemable preference shares of $1 each at par andaccounted for as an equity. NOL will redeem the preference shares on 1 March 2025 at $4,408,000.The effective interest rate associated with the preference shares is 8%. On 28 February 2021, NOLpaid stated rate preference share dividend for the year to its shareholders. Discuss how each of the above events should account for in the financial statement of NOL for theyear ended 28 February 2021 with reference to relevant HKFRSsarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education