ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

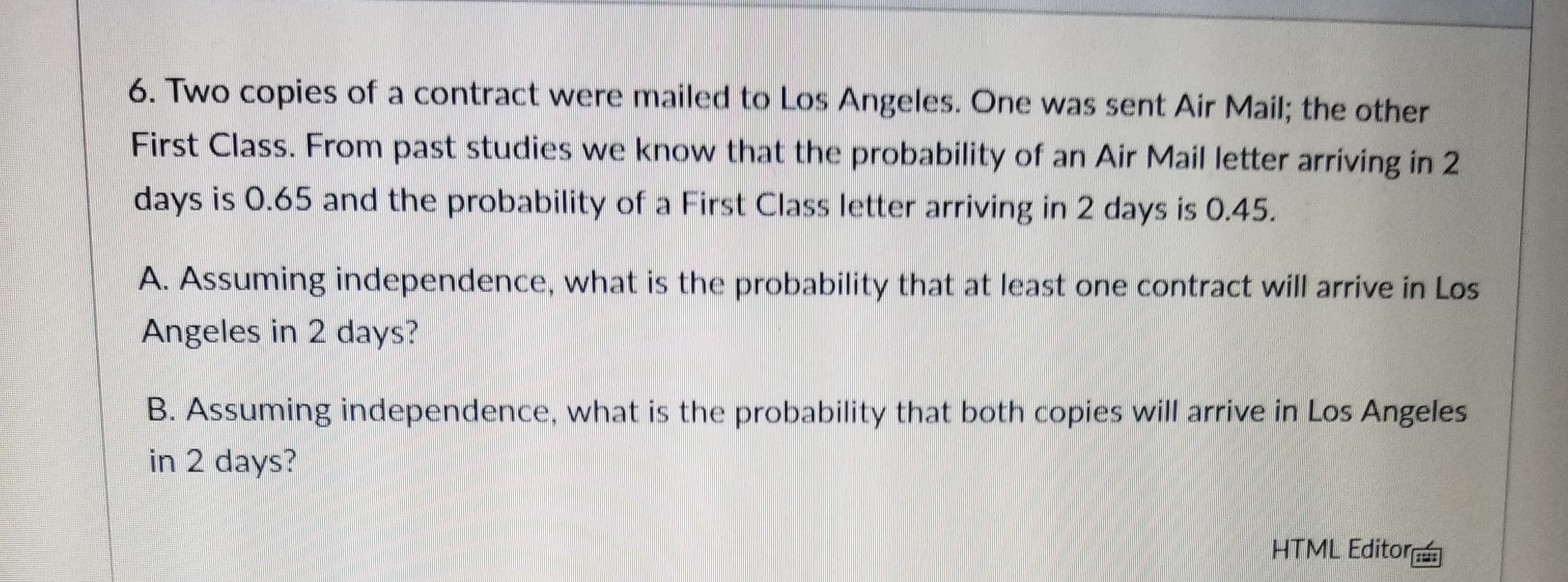

Transcribed Image Text:6. Two copies of a contract were mailed to Los Angeles. One was sent Air Mail; the other

First Class. From past studies we know that the probability of an Air Mail letter arriving in 2

days is 0.65 and the probability of a First Class letter arriving in 2 days is 0.45.

A. Assuming independence, what is the probability that at least one contract will arrive in Los

Angeles in 2 days?

B. Assuming independence, what is the probability that both copies will arrive in Los Angeles

in 2 days?

HTML Editor

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- At races, your horse, White Rum, has a probability of 1/20 of coming 1st, 1/10 of coming 2nd and a probability of 1⁄4 in coming 3rd. First place pays $5,000 to the winner, second place $4,000 and third place $1,350.Hence, is it worth entering the race if it costs $1050? Your company plans to invest in a particular project. There is a 40% chance you will lose $3,000, a 45% chance you will break even, and a 15% chance you will make $5,500. Based solely on this information, what should you do? On 1st Jan 2006, a business had inventory of $19,000. During the month, sales totalled $32,500 and purchases $24,000. On 31st Jan 2006 a fire destroyed some of the inventory. The undamaged goods in inventory were valued at $11,000. The business operates with a standard gross profit margin of 30%. Based on this information, what is the cost of the inventory destroyed in the fire?arrow_forwardIf the farmer uses pesticides he expects a crop of 60,000 bushels; if he does not use pesticides he expects a crop of 50,000 bushels. The cost of pesticides is $30,000 and the other costs associated with planting and harvesting the crop total $450,000. The price of corn at harvest time will either be $9.00 with probability of 0.50 or it will be $11.00 with probability 0.50, so if the farmer decides to sell the crop at harvest, the expected price per bushel that he will receive is $10.00. If the farmer decides to sell the crop at harvest, then: a. He should not use pesticides because not using pesticides ensures greater expected profit. b. He should not use pesticides because not using pesticides ensures lower expected profit. c. He should use pesticides because using pesticides ensures greater expected profit. d. He should use pesticides because using pesticides ensures lower expected profit.arrow_forwardOnline sale Suppose a student is considering selling their used smartphone online. They can sell it now for $p or wait and sell it next month for a different price. If they wait, they will receive a random offer with an equal probability of being either $300 or $100. The student can only receive one offer and cannot sell the phone after the second month. 1. Calculate the expected price in the next month. 2. Suppose that the current price p is equal to 200. (a) Give a reason why selling today could be a good idea. (b) Give a reason why selling next month could be a good idea.arrow_forward

- In a large casino, the house wins on its blackjack tables with a probability of 50.9%. All bets at blackjack are 1 to 1, which means that if you win, you gain the amount you bet, and if you lose, you lose the amount you bet. a. If you bet $1 on each hand, what is the expected value to you of a single game? What is the house edge? b. If you played 150 games of blackjack in an evening, betting $1 on each hand, how much should you expect to win or lose? c. If you played 150 games of blackjack in an evening, betting $3 on each hand, how much should you expect to win or lose? d. If patrons bet $7,000,000 on blackjack in one evening, how much should the casino expect to earn? a. The expected value to you of a single game is $ (Type an integer or a decimal.)arrow_forwardIf the farmer uses pesticides he expects a crop of 60,000 bushels; if he does not use pesticides he expects a crop of 55,000 bushels. The cost of pesticides is $20,000 and the other costs associated with planting and harvesting the crop total $450,000. The price of corn at harvest time will either be $10.00 with probability of 0.50 or it will be $12.00 with probability 0.50, so if the farmer decides to sell the crop at harvest, the expected price per bushel that he will receive is $11.00. If the farmer does not use pesticides and decides to sell the crop at harvest, what is his expected revenue? a. $550,000.00 b. $660,000.00 c. $600,000.00 d. $605,000.00arrow_forwardA wheel of fortune in a gambling casino has 54 different slots in which the wheel pointer can stop. Four of the 54 slots contain the number 9. For a 1 dollar bet on hitting a 9, if he or she succeeds, the gambler wins 10 dollars plus the return of the 1 dollar bet. What is the expected value of this gambling game? What is the meaning of the expected value result?arrow_forward

- Given the following data with 25 % probability Bidder 1 bids 100 and Bidder 2 bids 80. What is the winning bid? Select the correct response 80 45 100 25arrow_forward‘Lottery A’ refers to a lottery ticket that pays $2,000 with a probability of 0.3, $8,000 with a probability of 0.4, $12,000 with a probability of 0.2, and $18,000 with a probability of 0.1.What is the expected value of Lottery A?A) $7200B) $8000C) $9000D) $7900E) None of the abovearrow_forwardConsider the following interaction between a student and a company. The student is either serious or lazy with probabilities 1/3 and 2/3 respectively. The student knows if they are serious or not, but the company does not. Initially, the student decides whether to revise for exams or not. Revising has a cost of 1 for a serious student and 3 for a lazy one. The company observes the student's exam result (that is, whether they have made the effort to revise), and based on this, offers a salary of 3 (for a serious student) or 1 (for a lazy student). The student learns of the proposed salary and can then either accept (and earn the salary) or refuse (and earn O). They also lose the revision effort if they worked. The company's gain is equal to the student's productivity (4 if they are serious, 2 if not) minus the salary if the student accepts the offer, and O otherwise. 1. Represent the game in extensive form. 2. Show that the game has a unique perfect Bayesian Equilibrium, and provide the…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education