Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

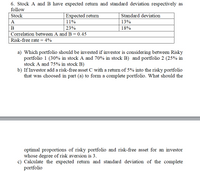

Transcribed Image Text:6. Stock A and B have expected return and standard deviation respectively as

follow

Stock

Expected return

Standard deviation

A

11%

13%

B

23%

18%

Correlation between A and B= 0.45

Risk-free rate = 4%

%3D

a) Which portfolio should be invested if investor is considering between Risky

portfolio 1 (30% in stock A and 70% in stock B) and portfolio 2 (25% in

stock A and 75% in stock B)

b) If Investor add a risk-free asset C with a return of 5% into the risky portfolio

that was choosed in part (a) to form a complete portfolio. What should the

optimal proportions of risky portfolio and risk-free asset for an investor

whose degree of risk aversion is 3.

c) Calculate the expected return and standard deviation of the complete

portfolio

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 9 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Baghibenarrow_forwardYou are given the following information concerning three portfolios, the market portfolio, and the risk-free asset: Portfolio Y Z Market Risk-free Rp 16.00% бр 32.00% 15.00 27.00 7.30 17.00 11.30 5.80 22.00 0 Bp 1.90 1.25 0.75 1.00 0 Assume that the tracking error of Portfolio X is 13.40 percent. What is the information ratio for Portfolio X? Note: A negative value should be indicated by a minus sign. Do not round intermediate calculations. Round your answer to 4 decimal places. Information ratioarrow_forwardAssume CAPM holds. What is the correlation between an efficient portfolio and market portfolio? a. 1 b.-1 c.0 d. Not enough information Assume CAPM holds. The risk-free rate is 1% and the expected return on the portfolio is 5%. What is the expected return of a stock with a beta of 2? 70%arrow_forward

- 2. Consider the following expected returns, volatilities, and correlations: Expected Standard Stock Return Deviation Correlation with Vital Correlation with Mital Correlation with Pital Vital 14% 6% 1.0 -1.0 0.0 Mital 44% 24% -1.0 1.0 0.7 Pital 23% 14% 0.0 0.7 1.0 a. Imagine a portfolio comprising solely of Vital and Mital. What portion of should be allocated to Vital stock to ensure a risk-free investment? your investment b. What is the portfolio's volatility when holding a $10,000 long position in Pital and a $2000 short position in Mital? wwwww c. In a market, there are two securities, Artis and Brotis. Currently, the price of Artis stands at £50. Looking ahead, the price of Artis next year will be £40 during a recession, £55 in normal economic times, and £60 in an expanding economy. The probabilities associated with recession, normal times, and expansion are 0.1, 0.8, and 0.1, respectively. Artis does not pay dividends and has a correlation of 0.8 with the market. On the other…arrow_forwardYou have the following data on three stocks: Stock Standard Deviation Beta A 20% 0.59 B 10% 0.61 C 12% 1.29 If you are a strict risk minimizer, you would choose Stock ____ if it is to be held in isolation and Stock ____ if it is to be held as part of a well-diversified portfolio. Group of answer choices A; A. A; B. C; A. B; A.arrow_forwardVijayarrow_forward

- Vijayarrow_forwardSuppose securities A, B, and C have the following expected return and risk. Stock Expected return Risk A 8% 6% B 7% 9% C 13% 9% What is the coefficient of variation for stock A?arrow_forwardIf an investor that owns a portfolio with 3 stocks increases their portfolio to 30 stocks, which of the following is MOST LIKELY to happen? Select one: a. risk will increase b. risk would decrease c. Systematic risk would increase d. return would increasearrow_forward

- Consider following information on a risky portfolio, risk-free asset and the market index. What is the Sharpe ratio of the market index? Risky portfolio Risk-free asset Market index Average return 8.2% 2% 6% Std. Dev. 26% 20% Residual std. dev. 10% Alpha 1.4% Beta 1.2arrow_forwardConsider following information on a risky portfolio, risk-free asset and the market index. What is the M2 of the risky portfolio? Risky portfolio Risk-free asset Market index Average return 8.2% 2% 6% Std. Dev. 26% 20% Residual std. dev. 10% Alpha 1.4% Betaarrow_forwardGive typing answer with explanation and conclusionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education