Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

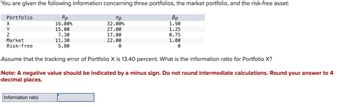

Transcribed Image Text:You are given the following information concerning three portfolios, the market portfolio, and the risk-free asset:

Portfolio

Y

Z

Market

Risk-free

Rp

16.00%

бр

32.00%

15.00

27.00

7.30

17.00

11.30

5.80

22.00

0

Bp

1.90

1.25

0.75

1.00

0

Assume that the tracking error of Portfolio X is 13.40 percent. What is the information ratio for Portfolio X?

Note: A negative value should be indicated by a minus sign. Do not round intermediate calculations. Round your answer to 4

decimal places.

Information ratio

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- 1. Determine the expected return and the variance of the portfolio formed by the two assets S₁, S₂ with weights ₁ = 0.6, x2 = 0.4. The assets returns are described by the following scheme: scenario W1 2لا W3 probability 0.1 0.4 0.5 T1 -20% 0% 20% 12 -10% 20% 40%arrow_forwardPlease advisearrow_forwardD5)arrow_forward

- An investor has a portfolio of two assets A and B. The details are shown in the below table. Portfolio Details Asset Expectedreturn Standarddeviation Covariance (A, B) Expected Portfolio Return A 0.06 0.5 0.12 0.1 B 0.08 0.8 Which one of the following statements is NOT correct? a. The portfolio weight in asset A is -100%. b. The correlation of asset A and B’s returns is 0.3. c. The investor can benefit from a fall in the price of asset A. d. The variance of the portfolio is 2.33. e. The order of short selling is borrowing, buying, selling, and returning.arrow_forwardAsset A has a standard deviation of 0.17, and asset B has a standard deviation of 0.52. Assets A and B have a correlation coefficient of 0.44. What is the standard deviation of a portfolio consisting with a weight of 0.40 in asset A, a weight of 0.24 in asset B, and the remainder invested in a risk-free asset? Give your answer to four decimal places.arrow_forwardCompute the VaR(95%) and ES(95%) of the portfolio managed by Absolute Asset Management if its returns, r, follow the distribution specified below: = 1 10 - |r 100| – 10arrow_forwardIf you plot the relationship between portfolio expected return and portfolio beta, what is the slope of the line that results? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) | Slope of the line %arrow_forwardBaghibenarrow_forwardSuppose that the capital asset pricing model (CAPM) applies. The risk premium of a stock is 3 percent and the risk premium of the market portfolio is 2. The standard deviation of the market portfo- lio is 6. Compute the covariance between the stock and the market portfolio.arrow_forwardPortfolio Suppose rA ~ N (0.05, 0.01), rB ~ N (0.1, 0.04) with pA,B = 0.2 where rA and rB are CCR’s. a) Suppose you construct a portfolio with 50% for A and 50% for B. Find the variance of the portfolio CCR. b) Find the portfolio expected gross return. c) Find the expected portfolio CCR.arrow_forwarde. Calculate the Portfolio Return when you know that its composition is as follows: Asset A: Weight 25%, Return 11% Asset B: Weight 45%, Return 14% Asset C: Weight 30%, Return 16%arrow_forward4arrow_forwardarrow_back_iosSEE MORE QUESTIONSarrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education