Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

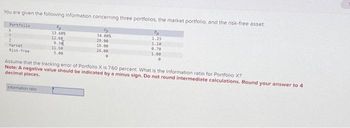

Transcribed Image Text:You are given the following information concerning three portfolios, the market portfolio, and the risk-free asset:

Portfolio

X

Y

2

Market

Risk-free

13.60%

12.60

9.30

11.50

5.00

information ratio

Op

34.00%

29.00

19.09

24.00

e

Op

1.25

1.10

0.70

1.00

0

Assume that the tracking error of Portfolio X is 7.60 percent. What is the information ratio for Portfolio X?

Note: A negative value should be indicated by a minus sign. Do not round intermediate calculations. Round your answer to 4

decimal places.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- son.3arrow_forwardDraw the profit diagram of the portfolio just drawn (and clearly state any assumptions you make). The profit is equal to the difference between the payoff of the portfolio at expiry (maturity) date and the cost of the portfolio. Is the cost of the portfolio positive?arrow_forwardPortfolio Suppose rA ~ N (0.05, 0.01), rB ~ N (0.1, 0.04) with pA,B = 0.2 where rA and rB are CCR’s. a) Suppose you construct a portfolio with 50% for A and 50% for B. Find the variance of the portfolio CCR. b) Find the portfolio expected gross return. c) Find the expected portfolio CCR.arrow_forward

- Suppose you have an investment portfolio with fraction x invested in a market portfolio and (1-x) in a risk- free asset. Increasing fraction x invested in the market portfolio and consequently decreasing (1-x) invested in the risk-free asset shall (select any correct answer, if there are multiple correct answers) Select one or more: O decrease the Sharpe ratio of the resulting portfolio O decrease the expected return of the resulting portfolio increase the Sharpe ratio of the resulting portfolio increase the expected return of the resulting portfolio Dincrease the risk of the resulting portfolioarrow_forwardchoose which one ? 3.Assume CAPM holds. What is the correlation between an efficient portfolio and the market portfolio?a.1b.-1c.0d.Not enough informationarrow_forwardYou are choosing between the following portfolios. Which one do you choose? Select one: a. ASD b. JKL c. Not enough informationarrow_forward

- (Portfolio VaR) Suppose there are two investments A and B. Either investment A or B has a 4.5% chance of a loss of $15 million, a 2% chance of a loss of $2 million, and a 93.5% change of a profit of $2 million. The outcomes of these two investments are independent of each other.arrow_forwardVijayarrow_forwardConsider the following two assets: Asset Expected return Standard deviation of returns 1 18% 30% 2 8% 10% The returns on the two assets are perfectly negatively correlated (i.e. coefficient of -1). Calculate the proportions of assets 1 and 2 that generate a portfolio with a standard deviation of zero. What is the expected return of that portfolio?arrow_forward

- Considering the attached set of securities and portfolio returns: Find the combination of the weights that minimizes CV of the portfolio. How does the CV of the optimal portfolio compare with the CVs of its constituents?arrow_forwardVijayarrow_forwardRefer to the graph below, what is the beta of portfolio X under CAPM? E(r) A 0.14 0.10 0.06 N Beta of portfolio X = place) M X o(r) (to the nearest 1 decimalarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education