ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

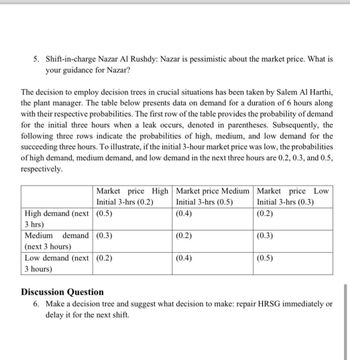

Transcribed Image Text:5. Shift-in-charge Nazar Al Rushdy: Nazar is pessimistic about the market price. What is

your guidance for Nazar?

The decision to employ decision trees in crucial situations has been taken by Salem Al Harthi,

the plant manager. The table below presents data on demand for a duration of 6 hours along

with their respective probabilities. The first row of the table provides the probability of demand

for the initial three hours when a leak occurs, denoted in parentheses. Subsequently, the

following three rows indicate the probabilities of high, medium, and low demand for the

succeeding three hours. To illustrate, if the initial 3-hour market price was low, the probabilities

of high demand, medium demand, and low demand in the next three hours are 0.2, 0.3, and 0.5,

respectively.

Market price High

Market price Medium

Initial 3-hrs (0.2)

Initial 3-hrs (0.5)

Market price Low

Initial 3-hrs (0.3)

High demand (next (0.5)

(0.4)

(0.2)

3 hrs)

Medium

demand (0.3)

(0.2)

(0.3)

(next 3 hours)

Low demand (next (0.2)

(0.4)

(0.5)

3 hours)

Discussion Question

6. Make a decision tree and suggest what decision to make: repair HRSG immediately or

delay it for the next shift.

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- Suppose 1,250 raffle tickets are being sold for $5 each. One ticket will be chosen to receive a cash prize of $2,500, and three tickets will be chosen to recelve cash prizes of $500. Let x be the amount of money won/lost by purchasing one raffle ticket. Find the expected value for . (Round your answer to the nearest penny. Do not include as sign in your answer. Your answer may be positive or negative.)arrow_forwarda and b pleasearrow_forwardConsider the following interaction between a student and a company. The student is either serious or lazy with probabilities 1/3 and 2/3 respectively. The student knows if they are serious or not, but the company does not. Initially, the student decides whether to revise for exams or not. Revising has a cost of 1 for a serious student and 3 for a lazy one. The company observes the student's exam result (that is, whether they have made the effort to revise), and based on this, offers a salary of 3 (for a serious student) or 1 (for a lazy student). The student learns of the proposed salary and can then either accept (and earn the salary) or refuse (and earn O). They also lose the revision effort if they worked. The company's gain is equal to the student's productivity (4 if they are serious, 2 if not) minus the salary if the student accepts the offer, and O otherwise. 1. Represent the game in extensive form. 2. Show that the game has a unique perfect Bayesian Equilibrium, and provide the…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education