Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Night

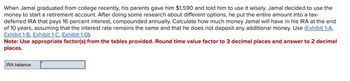

Transcribed Image Text:When Jamal graduated from college recently, his parents gave him $1,590 and told him to use it wisely. Jamal decided to use the

money to start a retirement account. After doing some research about different options, he put the entire amount into a tax-

deferred IRA that pays 16 percent interest, compounded annually. Calculate how much money Jamal will have in his IRA at the end

of 10 years, assuming that the interest rate remains the same and that he does not deposit any additional money. Use (Exhibit 1-A,

Exhibit 1-B, Exhibit 1-C, Exhibit 1-D).

Note: Use appropriate factor(s) from the tables provided. Round time value factor to 3 decimal places and answer to 2 decimal

places.

IRA balance

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- When Jamal graduated from college recently, his parents gave him $1,980 and told him to use it wisely. Jamal decided to use the money to start a retirement account. After doing some research about different options, he put the entire amount into a tax-deferred IRA that pays 14 percent interest, compounded annually. Calculate how much money Jamal will have in his IRA at the end of 10 years, assuming that the interest rate remains the same and that he does not deposit any additional money. Use (Exhibit 1-A, Exhibit 1-B, Exhibit 1-C, Exhibit 1-D). Note: Use appropriate factor(s) from the tables provided. Round time value factor to 3 decimal places and answer to 2 decimal places. IRA balancearrow_forwardDaryl wishes to save money to provide for his retirement. He is now 30 years old and will be retiring at age 64. Beginning one month from now, he will begin depositing a fixed amount into a retirement savings account that will earn 12% compounded monthly. Then one year after making his final deposit, he will withdraw $100,000 annually for 25 years. In addition, and after he passes away (assuming he lives 25 years after retirement) he wishes to leave in the fund a sum worth $1,000,000 to his nephew who is under his charge. The fund will continue to earn 12% compounded monthly. How much should the monthly deposits be for his retirement plan?arrow_forwardJohn is trying to decide whether to contribute to a Roth IRA or a traditional IRA. He plans on making a $5,000 contribution to whichever plan he decides to fund. He currently pays tax at a 32 percent marginal income tax rate, but he believes that his marginal tax rate in the future will be 28 percent. He intends to leave the money in the Roth IRA or traditional IRA for 30 years, and he expects to earn a 6 percent before-tax rate of return on the account. (Use Table 1.) Note: Do not round intermediate calculations. Round your final answers to nearest whole dollar amount. Problem 13-78 Part b (Static) b. How much will John accumulate after taxes if he contributes to a traditional IRA (consider only the funds contributed to the traditional IRA)?arrow_forward

- Daniel knows that he can withdraw up to a maximum of $35,000 from his Registered Retirement Savings Plan (RRSP) under the Home Buyers Plan (HBP). He knows that he has to pay at least 1/15th of the amount that he borrows. Danieľ's RRSP market value is $45,680 on the day that he decides to withdraw $25,700 under the HBP for the down payment on his new home. What is the minimum annual amount that Daniel must repay to his RRSP on the amount he withdraws from the HBP? A $3,045.33 В $2,333.33 $5,000.00 D $1,713.33 E $3,433.33arrow_forwardAnderson just landed his first job and is scheduled to start work on his 20th birthday. His parents have advised him that even though retirement seems like a long way off, it is important to start planning early. He has decided to deposit $4,500 into a retirement fund at the end of his first working year and hopes to increase this amount by 5% each year thereafter. The retirement fund is projected to pay an average rate of interest of 4%. If Danny plans to retire at age 65, and will therefore make 45 payments into the fund, how much is the retirement fund worth to him today?arrow_forwardAs soon as she graduated from college, Kay began planning for her retirement. Her plans were to deposit $500 semiannually into an IRA (a retirement fund) beginning six months after graduation and continuing until the day she retired, which she expected to be 30 years later. Today is the day Kay retires. She just made the last $500 deposit into her retirement fund, and now she wants to know how much she has accumulated for her retirement. The fund earned 10 percent compounded semiannually since it was established. a. Compute the balance of the retirement fund assuming all the payments were made on time. b. Although Kay was able to make all of the $500 deposits she planned, 10 years ago she had to withdraw $10,000 from the fund to pay some medical bills incurred by her mother. Compute the balance in the retirement fund based on this information.arrow_forward

- John recently set up a TDA to save for his retirement. He arranged to have $150 taken out of each of his monthly checks; it will earn 8% interest. He just had his 45 birthday, and his ordinary annuity comes to term when he is 65. Find the future value of the account.arrow_forwardJustin is saving for his retirement 21 years from now by setting up a savings plan. He has set up a savings plan wherein he will deposit $104.00 at the end of every six months for the next 11 years. Interest is 7% compounded semi-annually. (a) How much money will be in his account on the date of his retirement? (b) How much will Justin contribute? (c) How much will be interest?arrow_forwardConsider the case of the following annuities, and the need to compute either their expected rate of return or duration. Ryan inherited an annuity worth $3,280.16 from his uncle. The annuity will pay him five equal payments of $800 at the end of each year. The annuity fund is offering a return of . Ryan’s friend, Sebastian, wants to go to business school. While his father will share some of the expenses, Sebastian still needs to put in the rest on his own. But Sebastian has no money saved for it yet. According to his calculations, it will cost him $30,044 to complete the business program, including tuition, cost of living, and other expenses. He has decided to deposit $4,200 at the end of every year in a mutual fund, from which he expects to earn a fixed 7% rate of return. It will take approximately for Sebastian to save enough money to go to business school.arrow_forward

- The Ali plan to retire and start receiving their Social Security benefits at the same time, when Jimmy is 67 and Lucy is 62 years old. Their monthly Social Security retirement benefits at those ages in today's dollars are estimated to be $3,200 for Jimmy and $2,000 for Lucy. They think their expenses in retirement in today's dollars will be 70% of their total cash outflows now. Other than Social Security, they will rely on their retirement savings in order to meet their retirement expenses. They want to assume they will die in the same year, when Jimmy is 95 and Lucy is 90 years old.Determine what the payments will be in the distribution phase. These will be the withdrawals Jimmy and Lucy will need to take monthly from their accounts, in order to meet their retirement expenses. How much is that monthly amount?Note: this question is asking about the withdrawals they will need, not about the expenses they will be incurring monthly.arrow_forwardssarrow_forwardJohn has decided to start saving for his retirement. Beginning on his twenty-first birthday, John plans to invest $2,000 each birthday into a savings investment earning a 7 percent compound annual rate of interest. He will continue this savings program for a total of 10 years and then stop making payments. But his savings will continue to compound at 7 percent for 35 more years until John retires at age 65. How much will John have at age 35?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education