ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:44

40

36

32

28

24

20

16

12

8

4

O

SA

tion

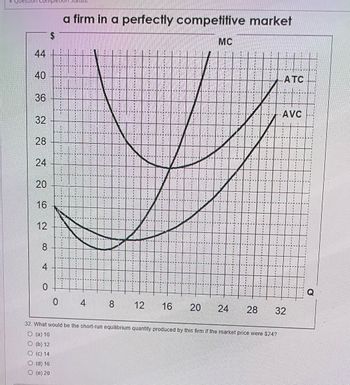

a firm in a perfectly competitive market

0 4 8

MC

12 16 20 24 28

ATC

32. What would be the short-run equilibrium quantity produced by this firm if the market price were $24?

(a) 10

(b) 12

(c) 14

(d) 16

(e) 20

AVC

32

C

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Given your understanding of the various market structures, use the information contained in the diagram below to answer the following questions. Price and cost (dollars per unit) $750 600 475 460 450 400 a) $500, 600 The firm would maximize profit by charging b) $400, 675 Oc) $750: 500 500 d) $400, 500 MR 650 700 725 per unit and producing? ATC MC Quantity per yeararrow_forwardHand written solutions are strictly prohibitedarrow_forward19 Market Representative Firm MC i of A $7 a MR = P АТС b $5 AVC $2 D1 18,000 70 100 115 Quantity (Q) Output (Q) The diagram above shows a Perfectly Competitive market on the left, and a representative firm supplying in that market on the right. If the entry of new firms into the market caused the equilibrium Price to decrease to $5, the representative firm would: Select one: а. earn a positive Economic Profit. b. earn a negative Economic Profit. c. shut down in the short-run. d. earn zero Economic Profit. Price $$$arrow_forward

- 1: 2 (N 2: 4 > 3: sa 4: 5: 6 8 10 ✓ 6: Question 16 Listen Figure 12-2 $60 $45 $40 $30 $10 200 Marginal Cost Average Total Cost 450 800 650 Refer to Figure 12-2. If the market price equals $45, the maximum profit that the firm can earn is: approximately $29,250. approximately $19,500. approximately $9,750. zero dollars. Average Variable Costarrow_forwardI think either 10 or 15 please help ?arrow_forwardSolve all this question......you will not solve all questions then I will give you down?? upvotearrow_forward

- Use the figure below to answer the following questions. Price and cost (dollars per unit) 100 90 85 80 70 55 40 0 MR₂ MC ATC La MR₁ 100 140 200 220 250 Quantity (units per week) Figure 13.2.3 Refer to Figure 13.2.3. Assume this firm faces demand curve D2. If the firm produces the efficient quantity, it makes zero economic profit. makes an economic profit. will face competition from new firms entering the industry. is in a long-run equilibrium. incurs an economic loss.arrow_forward7arrow_forwardWhat's the economic profitarrow_forward

- 2. Suppose that the market for wind chimes is a competitive market. The following graph shows the daily cost curves of a particular firm operating in this PRICE (Dollars per wind chime) 40 b) 36 32 28 24 20 16 2 8 4 0 MC 0 2 4 + 10 12 14 16 18 20 QUANTITY (Thousands of wind chimes per day) 8 market: a) In short run, at a market price of $26 per wind chime how much will firm ATC AVC 6 the market price is $26 in th quantity you obtained in question (a), indicate the area that represents firm's profit or loss in short run on the graph. c) What is this firm's shutdown price, that is the price below which it is optimal for the firm to shut down in short run? d) In the long run, all firms can enter and exit the market, and all entrants have the same costs as above. As this market makes the transition to its long-run equilibrium, will the price rise or fall? Will the quantity demanded rise or fall? Will the quantity supplied by each firm rise or fall? Explain your answers. e) Graph the…arrow_forward1. If a product sells at a price of $16 in a purely competitive market and faces the marginal cost data shown below, what is the profit maximizing/loss minimizing level of output? Output 0 1 2 3 4 5 Marginal Cost $10 9 13 17 21arrow_forwardConsider the following graph: Price and cost (per necklace) 200.00 240.00 220.00- 200.00 180.00 160.00- 140.00 120.00- 100.00 80.00 60.00 40.00- 20.00- 0.00+ -N 2 14 MC What is the maximum profit for the firm? D ATC MR 8 10 12 14 16 18 20 22 24 26 Quantity (diamond necklaces)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education