ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

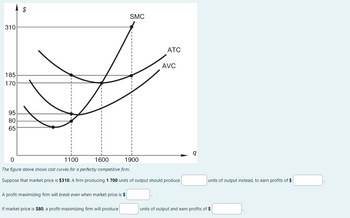

Transcribed Image Text:310

185

170

95

80

65

$

A profit-maximizing firm will break even when market price is $

SMC

If market price is $80, a profit-maximizing firm will produce

ATC

0

1100

1600

1900

The figure above shows cost curves for a perfectly competitive firm.

Suppose that market price is $310. A firm producing 1 700 units of output should produce

AVC

9

units of output instead, to earn profits of $

units of output and earn profits of $

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 8 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Nonearrow_forwardSolve all questions compulsory..arrow_forward3. Profit maximization using total cost and total revenue curves Suppose Jayden operates a handicraft pop-up retail shop that sells cardigans. Assume a perfectly competitive market structure for cardigans with a market price equal to $25 per cardigan. The following graph shows Jayden's total cost curve. Use the blue points (circle symbol) to plot total revenue and the green points (triangle symbol) to plot profit for cardigans for quantities zero through seven (including zero and seven) that Jayden produces. TOTAL COST AND REVENUE (Dollars) 200 175 150 125 100 75 50 19 Fo O D 2 0 4 QUANTITY (Cardigans) 6 Total Cost Total Revenue Profit ? Calculate Jayden's marginal revenue and marginal cost for the first seven cardigans they produce, and plot them on the following graph. Use the blue points (circle symbol) to plot marginal revenue and the orange points (square symbol) to plot marginal cost at each quantity.arrow_forward

- K The marginal revenue and marginal cost functions of a food importer are given by 6e0.05Q MR=400-0.5Q and MC = If the firm makes a profit of 3500 when Q=8, calculate the profit when Q=12. Give your answer to two decimal places. The firm makes a profit of CamScannarrow_forwardSuppose solar panel manufacturing is an industry subject to significant economies of scale, and there are currently three solar panel manufacturers all with identical costs. If the demand for solar panels is 5 times the quantity produced at the bottom of the long-run average cost curve, which of the following is most likely to happen to the solar panel manufacturing industry in the long run? O The number of solar panel manufacturers will increase O The price of solar panels will increase O The fixed costs of manufacturing solar panels will increase The quantity supplied of solar panels will decreasearrow_forwardAmos McCoy is currently raising corn on his 100-acre farm and earning an accounting profit of $100 per acre. However, if he raised soybeans, he could earned an accounting profit of $200 per acre. Is he currently earning an economic profit?arrow_forward

- 53 ces Suppose an industry consists of 150 firms with identical cost structures (represented by the "typical individual firm" in the figure below). The price is $18. Price/Cost $60 $50 $40 $30 $20 $10 0 10 20 30 MC Quantity 40 ATC AVC 50 60 Instructions: Enter your answers as a whole number. a. The firm output quantity at the equilibrium price is: b. The market output quantity at the equilibrium price is: units. units. Save & Exit Submitarrow_forwardConsider a perfectly competitive market for wheat in Toronto. There are 90 firms in the industry, each of which has the cost curves shown on the following graph:arrow_forwardThe information below applies to a competitive firm that sells its output for $44.00 per unit. . When the firm produces and sells 100 units of output, its average total cost is $24.50. . When the firm produces and sells 101 units of output, its average total cost is $24.75. Suppose the firm is currently producing and selling 100 units of output. Should the firm increase its output to 101 units? Yes. This is because the marginal revenue exceeds the marginal cost. Yes. This is because the marginal revenue exceeds the average total cos No. This is because the marginal cost exceeds the marginal revenue. No. This is because the average total cost exceeds the marginal revenue.arrow_forward

- Only typed solutionarrow_forwardImagine that you are a price-taking firm with the following total cost schedule. Q 1 2 3 4 5 6 7 8 9 TC 12 20 24 28 34 42 52 64 78 Assume that if this firm produces zero they have a total cost of zero. (That is in italics because it's important..... Notice that this is a problem we have done before except for a little twist. Can you notice what it is?) Another way of saying that is that there is no fixed cost. Fill in the following supply schedule. (Enter only integers.) (If you don't know what I'm talking about, pleeeeeease go back and figure out what supply means before you try to answer!) P QS 4 ? 6 ? 8 ? 10 ? 12 ? 14 ?arrow_forwardAll firms in a perfectly competitive industry have a cost function given by: 10Q^2+200Q+2250. What is the profit maximizing quantity of each firm if the current market price is $500? What does each firms profit equal? Give typing answer with explanation and conclusionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education