ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

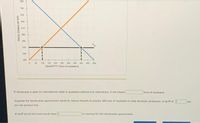

Transcribed Image Text:730

700

670

640

610

s80

550

520

490

460

50

100

150 200 25o

300 350 400

450

500

QUANTITY (Tons of soybeans)

If Venezuela is open to international trade in soybeans without any restrictions, it will import

tons of soybeans.

Suppose the Venezuelan government wants to reduce imports to exactiy 200 tons of soybeans to help domestic producers A tariff of 5

ton will achieve this.

per

A tariff set at this level would raise 5

in revenue for the Venezuelan government.

PRICE (Dollars per ton)

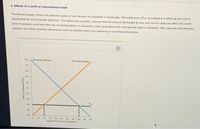

Transcribed Image Text:4. Effects of a tariff on international trade

The following graph shows the domestic supply of and demand for soybeans in Venezuela. The world price (Pw) of soybeans is $520 per ton and is

represented by the horizontal black line. Throughout the question, assume that the amount demanded by any one country does not affect the world

price of soybeans and that there are no transportation or transaction costs associated with international trade in soybeans. Also, assume that domestic

suppliers will satisty domestic demand as much as possible before any exporting or importing takes place.

Domestic Supply

700

Domestic Demand

730

640

10

3D

400

100

IND

200

250

300

300

400

450

s00

QUANTITY (Tons of soybeans)

PRICE (Dotars per ton)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Price Price after trade OA+B+C+E+G OA+B OA+B+C+D+E+F+G ○ C+0 C G A Di B E Supply Imports after tariff Refer to the graph above: Consider the economy depicted in the graph and assume there is international trade if the government imposed a tariff, what would the total surplus be? World Price + tariff World Price Demand Quantityarrow_forwardCalculate the loss in mexico consumer surplus due to the tariff. A) $225 B) $265 C) $285 D) $325arrow_forward9 Assume Australia is an importer of sofas and there are no trade restrictions. Australian consumers buy 1 000 000 sofas per year, of which 450 000 are produced domestically and 550 000 are imported. a Suppose that a technological advance among Swedish sofa manufacturers causes the world price of sofas to fall by $200. Draw a graph to show how this change affects the welfare of Australian consumers and Australian producers, and how it affects total surplus in Australia. b After the fall in price, Australian consumers buy 1 150 000 sofas, of which 300 000 are produced domestically and 850 000 are imported. Calculate the change in consumer surplus, producer surplus and total surplus from the price reduction. c Ifthe government responded by putting a $200 tariff on imported sofas, what would this do? Calculate the revenue that would be raised and the deadweight loss. Would it be a good policy from the standpoint of Australian welfare? Who might support the policy? d Suppose that the fall…arrow_forward

- The following image shows the market for wheat for the country of Palatino. sº is the domestic supply of wheat, and DD is the domestic demand for wheat. Suppose the world price of wheat is $9 per bushel. Suppose a specific tariff of $6 is imposed on each bushel of wheat imported. The net welfare loss from the tariff is represented by the area Figure 19.4 SO Price($) 25 H 15 A E DD 200 300 600 700 Quantity of Wheat (thousands of bushels) a. B and D b. I and H O c. E O d. F e. A and Carrow_forward27. The statement that "if an import tariff raises the relative price of the imported good, the price of the factor used intensively in its production will rise relative to both commodity prices, while the price of the other factor will fall relative to both commodity prices" is called (a) the cancellation axiom (b) the Stolper-Samuelson theorem (c) the law of demand and supply (d) the law of alternatives (e) the principle of comparative advantage oun until on ogui.arrow_forwarda. In the absence of trade, what is the equilibrium price and equilibrium quantity? b. The government opens the wheat market to free trade and U.S enters the Turkish market, pricing wheat at $40 per ton. What will happen to the domestic price of wheat? What will be the new domestic quantity supplied and domestic quantity demanded? How much wheat will be imported from U.S? c. The government imposes a $10 per ton tariff on all imported wheat. What will happen to the domestic price of wheat? What will be the new domestic quantity supplied and domestic quantity demanded? How much wheat will now be imported from U.S? d. How much revenue will the Turkish government receive from the $10 per ton tariff?arrow_forward

- 2. The impact of a tariff Consider a hypothetical example of trade in aluminum between the United States and China. For simplicity, assume that China is the only source of U.S. aluminum imports. The following graph shows the U.S. market for aluminum. Note that in the absence of any trade, the market price for aluminum in the United States is $500 per tonne, and the equilibrium quantity is 250 million tonnes per month. Use the green area (triangle symbol) to show U.S. consumer surplus under free trade with China, and use the purple area (diamond symbol) to show U.S. producer surplus under free trade with China. 1000 Domestic Demand Domestic Supply 900 Consumer Surplus 800 700 Producer Surplus 600 500 400 Free Trade Price 300 200 100 200 250 300 350 400 450 500 50 100 150 QUANTITY OF ALUMINUM (Millions of tonnes per month) PRICE (Dollars per tonne)arrow_forward1. Welfare effects of free trade in an exporting country Consider the New Zealand market for lemons. The following graph shows the domestic demand and domestic supply curves for lemons in New Zealand. Suppose New Zealand's government currently does not allow international trade in lemons. Use the black point (plus symbol) to indicate the equilibrium price of a tonne of lemons and the equilibrium quantity of lemons in New Zealand in the absence of international trade. Then, use the green point (triangle symbol) to shade the area representing consumer surplus in equilibrium. Finally, use the purple point (diamond symbol) to shade the area representing producer surplus in equilibrium. NOTE: for the drop down question. the optionfs for first 2 are (increases or decreases), and the last drop down question is (loss or gain)arrow_forward3. Import quotas Kazakhstan is a grape producer, as well as an importer of grapes. Suppose the following graph shows Kazakhstan's domestic market for grapes, where Sx is the supply curve and Dx is the demand curve. The free trade world price of grapes (Pw) is $800 per ton. Suppose Kazakhstan's government restricts imports of grapes to 120,000 tons. The world price of grapes is not affected by the quota. Analyze the effects of the quota on Kazakhstan's welfare. On the following graph, use the purple line (diamond symbol) to draw the Kazakhstan's supply curve including the quota SK+Q. (Hint: Draw this as a straight line even though this curve should be equivalent to the domestic supply curve below the world price.) Then use the grey line (star symbol) to indicate the new price of grapes with a quota of 120,000 grapes. PRICE (Dollars per ton) 4000 3600 3200 2800 2400 2000 1600 1200 800 400 0 --‒‒‒‒‒‒ 0 40 SK DK Pw 80 120 160 200 240 280 320 360 400 QUANTITY (Thousands of tons) SK+Q Price…arrow_forward

- Assume that the United States, as a steel-importing nation, is large enough so that changes in the quantity of its imports influence the world price of steel. The following table shows the U.S. supply and demand schedules for steel, along with the overall amount of steel supplied to U.S. consumers by domestic and foreign producers. Price (Dollars per ton) 100 200 300 400 PRICE (Dollars per ton) 800 700 600 500 400 300 200 100 500 600 700 0 0 2 Using the data in the table, use the blue points (circle symbol) to plot the demand curve and use the orange points (square symbol) to plot the supply curve (domestic plus imports) on the following graph. Then use the black cross to indicate the equilibrium price and quantity. ? 6 (Domestic) 0 0 1 2 3 5 Quantity Supplied The new equilibrium is (Domestic plus Imports) 0 8 10 12 14 16 18 20 QUANTITY (Tons of steel) With free trade, the equilibrium price of steel is $ 4 8 12 16 20 24 tons are supplied by U.S. producers, and tons are imported.…arrow_forwardKorea’s demand for computers isQK = 2, 000 − PkIts supply isQK = −200 + PkChina’s demand for computers isQC = 1, 000 − Pc Its supply isQC = Pc1. Suppose that Korea imposes a specific tariff of $100 on computerimports. Calculate the price of computers in each country and thequantity of computers supplied and demanded in each country. Alsocalculate the volume of trade.arrow_forwardfast urgent.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education