ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

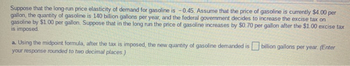

Transcribed Image Text:Suppose that the long-run price elasticity of demand for gasoline is -0.45. Assume that the price of gasoline is currently $4.00 per

gallon, the quantity of gasoline is 140 billion gallons per year, and the federal government decides to increase the excise tax on

gasoline by $1.00 per gallon. Suppose that in the long run the price of gasoline increases by $0.70 per gallon after the $1.00 excise tax

is imposed.

a. Using the midpoint formula, after the tax is imposed, the new quantity of gasoline demanded is billion gallons per year. (Enter

your response rounded to two decimal places.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- The elasticity of demand for home computers is -2.5, the elasticity of demand for business computers is -.90, and the elasticity of supply for computers for both purposes is 1. a. A per-unit tax of $200 is imposed on the suppliers of computers. How much does the gross price increase in each market? [Hint: first find the tax incidence/shares.] b. Suppose the untaxed market equilibrium price and quantity in the home computer market are $850 and 10 million, respectively. In the business market, the untaxed market equilibrium price and quantity are $1200 and 15 million, respectively. What is the deadweight loss of the $200 tax? Answer part B please! Hand written asaparrow_forwardGive short explanations of why each of the following statements is true (assume for your answer that they all are true). (Hint: your explanation should be related to elasticity). a) Computers and monitors have a cross elasticity of demand of -1. b) The government would rather put excise taxes on beer than on designer clothes. c) Cars have an income elasticity of demand of 1 while bus passes have an income elasticity of demand of -1. d) Apple MacBooks have more elastic demand than laptops as a whole do. Essay Toolbar navigation В I A a) computers and monitors have a cross elasticity of demand of -1 because there is an increase in price and decrease in elasticity demand. b)| 1arrow_forwardA local government is seeking to impose a specific tax on hotel rooms. The price elasticity of supply of hotel rooms is 3.5, and the price elasticity of demand is 0.3. If the new tax is imposed, who will bear the greater burden-hotel suppliers or hotel consumers? The hotel consumers pay percent and hotel suppliers pay percent of the tax. (Enter your responses rounded one decimal place.)arrow_forward

- Suppose supply is P= 4 + (1/4)Qs and demand is P= 58 ―(1/2)Qs. At a glance, can you tell whether supply or demand is more price elastic in equilibrium? How? What does this tell you about who will pay more of a tax on this product?arrow_forwardWhen tolls on the Dulles Airport Greenway were reduced from $1.25 to $1.05, traffic increased from 15,000 to 20,000 trips a day. Assuming all changes in quantity were due to the change in price, what is the price elasticity of demand for the Dulles Airport Greenway?arrow_forward1. Suppose the demand for towels and supply of towels are given by the below: QD = 100 - 4P QS = P a. Find the equilibrium price and quantity using demand and supply functions above. b. Plot demand and supply curve on the same graph and point out the equilibrium quantity and price. You should draw each graph precisely with intercepts and slopes. c. Solve for the price elasticities of demand and supply at the equilibrium point. Which is more elastic: demand or supply? Simply explain why. d. Suppose there was a demand shock so that at each price 20 more towels are demanded since consumers want more. Plot the new demand curve on the graph that you derive in part (a). Find the new equilibrium price and quantity. (Hint: You may derive a new demand function by adding a constant to find a new equilibrium price and quantity.)arrow_forward

- The supply of wigits is pefectly elastic and the demand for wigits has a price elasticity of 2 and an income elasticity of 1 (a) If income increases by 25 percent then the equilibrium quantity will_____(increase, decrease, not change) by_____percent and the equilibrium price will ____ (increase, decrease, not change) (b) If a 25 percent tax is imposed on wigits then the quantity consumed will_____(increase, decrease, not change) by____percent and the equilibrium price, inclusive of the tax, will increase by____ percent.arrow_forwardUse the concept of Price Elasticity of Demand to explain why the public policy recommendation of raising taxes on cigarettes causes State revenues to rise while also effectively deterring smoking among young people. Be sure to consider availability of substitutes and the effect of the percentage spent of each buyer’s budget when formulating a response. Who bears the brunt of the tax – the consumer or the producer? Are there any potential negative side effects of increasing taxes on cigarettes?arrow_forward4-3 In each of the following instances, determine whether demand is elastic, inelastic, or unit-elastic. If price increases by 10 percent and quantity demanded decreases by 10 percent, demand is _______. If price decreases by 10 percent and quantity demanded increases by 5 percent, demand is _______.arrow_forward

- Consider the following excerpt: "Steve Cannon, CEO of the AMB Group, Blank's holding company, told ESPN that although food and beverage prices ere 50 percent lower in its new Mercedes-Benz Stadium than the prices in the Georgia Dome the previous year, fans spent 16 percent more." If there has been no change in the demand for concessions at football games, which of the following is true? Oa. Demand for concessions is always elastic b. At the initial prices, demand was inelastic. Oc. The demand curve for concessions slopes upwards Od. Concessions are an inferior goodarrow_forwardINFO: Yesterday, the price of envelopes was $3 a box, and Julie was willing to buy 10 boxes. Today, the price has gone up to $3.75 a box, and Julie is now willing to buy 8 boxes. What is Julie’s elasticity of demand? _____ (Hint: only a number goes here) Is Julie's demand for envelopes elastic or inelastic? Explain your answer in a complete sentence(s) here:arrow_forward1. As a transit planner for the city of Miami, you must predict how many people ride the Miami Metrorail and how much money is generated from train fares. According to a recent study, the short-run elasticity of demand for Metrorail is 0.62 and the long- run elasticity is 1.59. The current ridership is 50,000 people per day. Suppose the city commission decides to increase fares by 10%. Predict the changes in train ridership over a one-month period and a five-year period. ANS: b. Over the one-month period, will total revenue increase or decrease? What will happen in the five-year period? ANSarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education