ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

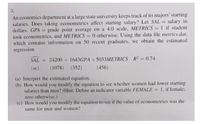

Transcribed Image Text:3.

An economics department at a large state university keeps track of its majors' starting

salaries. Does taking econometrics affect starting salary? Let SAL

dollars, GPA = grade point average on a 4.0 scale, METRICS = 1 if student

took econometrics, and METRICS = 0 otherwise. Using the data file metrics.dat,

which contains information on 50 recent graduates, we obtain the estimated

regression

salary in

%3D

%3D

%3D

%3D

SAL = 24200 + 1643GPA + 5033METRICS R = 0.74

%3D

(se)

(1078) (352)

(456)

(a) Interpret the estimated equation.

(b) How would you modify the equation to see whether women had lower starting

salaries than men? (Hint: Define an indicator variable FEMALE = 1, if female:

%3D

zero otherwise.)

(c) How would you modify the equation to see if the value of econometrics was the

same for men and women?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Imagine you are an economist working for the Government of Econville. You are tasked with developing a model to predict the GDP of the country based on various factors such as interest rates, inflation, unemployment rate, and population growth. You collect quarterly data for the past 20 years and start building your model. After running your initial regression, you notice some peculiar patterns in the residuals: (1) residuals do not have identical variances across different levels of the independent variables; (2) two or more independent variables in a regression model are highly correlated with each other; (3) the correlation of a variable with its own past values. You suspect that your model might be suffering from 3 potential issues in the regression analysis that can affect reliability and validity. what are the implications of Heteroscedasticity if this potential issue in your model?arrow_forwardExplain carefully why running the regression above might suffer from endogeneity concerns: are their any unobservable variables that might confound the results? Should we be worried about reverse causality? What empirical methods could we use to address these concerns?arrow_forwardq9-arrow_forward

- Imagine you are an economist working for the Government of Econville. You are tasked with developing a model to predict the GDP of the country based on various factors such as interest rates, inflation, unemployment rate, and population growth. You collect quarterly data for the past 20 years and start building your model. After running your initial regression, you notice some peculiar patterns in the residuals: (1) residuals do not have identical variances across different levels of the independent variables; (2) two or more independent variables in a regression model are highly correlated with each other; (3) the correlation of a variable with its own past values. You suspect that your model might be suffering from 3 potential issues in the regression analysis that can affect reliability and validity. List 2 factors in your model that might be causing the Heteroscedasticity and give a reasonarrow_forwardImagine you are an economist working for the Government of Econville. You are tasked with developing a model to predict the GDP of the country based on various factors such as interest rates, inflation, unemployment rate, and population growth. You collect quarterly data for the past 20 years and start building your model. After running your initial regression, you notice some peculiar patterns in the residuals: (1) residuals do not have identical variances across different levels of the independent variables; (2) two or more independent variables in a regression model are highly correlated with each other; (3) the correlation of a variable with its own past values. You suspect that your model might be suffering from 3 potential issues in the regression analysis that can affect reliability and validity. Based on Addressing Heteroscedasticity list one test you would employ to test this potential issue?arrow_forward7. The Stata data set "college_gpa" has data on students' college GPAS, high school GPAS, ACT scores, lectures skipped during the academic year, and other characteristics. We wish to examine the predictors of college GPAS. You must submit your do-file (commands). a) Regress college GPA on high school GPA and write the estimated regression line. b) Interpret the intercept of your regression in a sentence. Does this coefficient make sense?n Explain c) Interpret the coefficient on high school GPA in a sentence. Does this coefficient make sense? Explain. reg colGPA hsGPA Source df MS Number of obs 141 %3D F(1, 139) 33.80 Model 5.58478164 1 5.58478164 Prob > F e.0000 Residual 22.9668501 139 .165229138 R-squared Adj R-squared 0.1956 %3D 0.1898 %3D Total 28.5516318 140 .203940227 Root MSE .40648 colGPA Coef. Std. Err. t P>|t| [95% Conf. Interval] hsGPA .6242948 .1073816 5.81 0.000 .4119822 .8366073 _cons 890254 3669263 2.43 0.017 647755arrow_forward

- Please answer all three sub-sections of this questionarrow_forward4- The manager of Collins Import Autos believes the number of cars sold in a day(Q) depends on two factors: (1) the number of hours the dealership is open (H) and (2) the number of salespersons working that day (S ). After collecting data for two months (53 days), the manager estimates the following log-linear model: Q = aHbSc ----- a. Explain how to transform this log-linear model into a linear form that can be estimated using multiple regression analysis. b. How do you interpret coefficients b and c? If the dealership increases the number of salespersons by 20 percent, what will be the percentage increase in daily sales? c. Test the overall model for statistical significance at the 5 percent significance level.arrow_forward1. Suppose output (Q) is related to labor (L) and capital (K) in the following nonlinear way: Q = albKc When taking log to this equation, it is transformed into a linear LnQ = Ina + b In(L) + c Ln (K) One hundred twenty-three observations are used to obtain the following regression results: Dependant Variable: Observations: Variable Intercept L K Q 123 5.5215 Parameter Standard Estimate error 0.650 R-square 0.350 0.7547 0.9750 0.2950 0.1450 F-ratio 184.56 t-ratio 5.66 2.20 2.41 p-value on F 0.00001 p-value 0.0001 0.0295 0.0173 a. Write the regression equation based on the output either in the transformed linear form or the original non-linear form.arrow_forward

- 5. Confounding variables and multiple regressions Suppose you are interested in studying the effect of square footage on the price of houses. You propose the following regression of housing prices on square footage: price - Bo + P sqft + u where price the price of the house. sqft = the square footage of the house residual Failing to account for the number of bathrooms in a house, which may influence housing prices and may be positively correlated with square footage, could lead to estimate of the effect . This issue of confounding variables would likely bias the estimate ofarrow_forwardnumber 1 pleasearrow_forward9. The (incomplete) table below shows the x and y values for three data points. It also shows the estimated coefficients, predicted y values and residuals for two potential regression lines (A and B). Fill in the missing values in the table below. obs 1 W23 2 3 100 90 80 70 60 50 40 30 20 10 0 y 60 20 0 1 X 3 2 8 Using the values you just calculated, plot the three data points and the two estimated regression equations in the graph below. Be sure to label everything clearly VA 40 50 3 aA A BA Regression A UA 4 -30 -15 5 10 YB 6 40 60 B Regression B A Вв 7 UB 25 -20 15 8 20 9 10arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education