ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

Help!

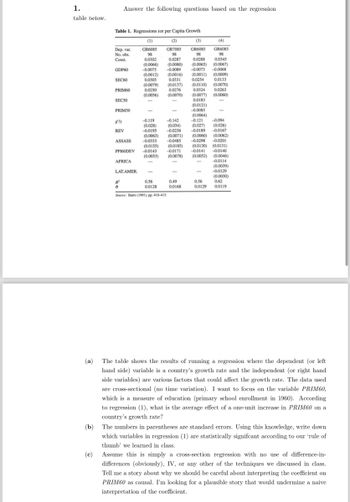

Transcribed Image Text:1.

table below.

Answer the following questions based on the regression

Table 1. Regressions for per Capita Growth

(1)

(2)

(3)

(4)

Dep. var. GR6085

GR7085

GR6085

GR6085

No. obs.

98

98

98

98

Const.

0.0302

0.0287

0.0288

0.0345

(0.0066)

(0.0080)

(0.0065)

(0.0067)

GDP60

-0.0075

-0.0089

-0.0073

-0.0068

(0.0012)

(0.0016)

(0.0011)

(0.0009)

SEC60

PRIM60

0.0305

(0.0079)

0.0250

(0.0056)

0.0331

0.0254

0.0133

(0.0137)

(0.0110) (0.0070)

0.0276

0.0324 0.0263

(0.0070)

(0.0077) (0.0060)

SEC50

0.0183

(0.0121)

PRIM50

-0.0085

(0.0064)

gly

-0.119

-0.142

-0.121

-0.094

(0.028)

(0.034)

(0.027)

(0.026)

REV

-0.0195

-0.0236

-0.0189

-0.0167

(0.0063)

(0.0071)

(0.0060)

(0.0062)

ASSASS

-0.0333

-0.0485

-0.0298

-0.0201

(0.0155)

(0.0185)

(0.0130) (0.0131)

PP160DEV -0.0143

-0.0171

-0.0141

-0.0140

(0.0053)

(0.0078)

(0.0052)

(0.0046)

AFRICA

-0.0114

(0.0039)

LAT.AMER.

-0.0129

(0.0030)

0.56

0.0128

0.49

0.0168

0.56

0.62

0.0129

0.0119

Source: Barro (1991), pp. 410-413.

(a) The table shows the results of running a regression where the dependent (or left

hand side) variable is a country's growth rate and the independent (or right hand

side variables) are various factors that could affect the growth rate. The data used

are cross-sectional (no time variation). I want to focus on the variable PRIM60,

which is a measure of education (primary school enrollment in 1960). According

to regression (1), what is the average effect of a one-unit increase in PRIM60 on a

country's growth rate?

(b) The numbers in parentheses are standard errors. Using this knowledge, write down

which variables in regression (1) are statistically signifcant according to our 'rule of

thumb' we learned in class.

(c)

Assume this is simply a cross-section regression with no use of difference-in-

differences (obviously), IV, or any other of the techniques we discussed in class.

Tell me a story about why we should be careful about interpreting the coefficient on

PRIM60 as causal. I'm looking for a plausible story that would undermine a naive

interpretation of the coefficient.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education