ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

What does the value for the coefficient mean in the regression analysis of both the company ?

P-Values - how its related to customer satisfaction in the regression analysis of both the company ?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

Need more explanation by considerinng the data given in snapshots

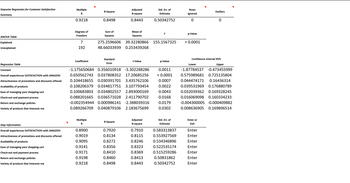

Transcribed Image Text:Stepwise Regression for Customer Satisfaction

Summary

ANOVA Table

Explained

Unexplained

Regression Table

Constant

Overall experiences SATISFACTION with AMAZON

Attractiveness of promotions and discounts offered

Availability of products

Ease of managing your shopping cart

Check-out and payment process

Return and exchange policies

Variety of products that interests me

Step Information

Overall experiences SATISFACTION with AMAZON

Attractiveness of promotions and discounts offered

Availability of products

Ease of managing your shopping cart

Check-out and payment process

Return and exchange policies

Variety of products that interests me

Multiple

R

0.9218

Degrees of

Freedom

7

192

Coefficient

Multiple

R

R-Square

0.8900

0.9019

0.9095

0.9141

0.9171

0.9198

0.9218

0.8498

Sum of

Squares

Standard

Error

Adjusted

R-square

0.8443

R-Square

Mean of

Squares

275.2596606 39.32280866 155.1567325

48.66033939 0.253439268

0.7920

0.8134

0.8272

0.8356

0.8410

0.8460

0.8498

t-Value

-1.175650684 0.356010918 -3.302288286 0.0011

0.650562743 0.037808352 17.20685256 < 0.0001

0.104418655 0.030391701 3.435762106 0.0007

0.108206379 0.034817751 3.107793454 0.0022

0.100683803 0.034802557 2.893000169 0.0043

0.088201665 0.036571028 2.411790702 0.0168

-0.002354944 0.000986141 -2.388039316 0.0179

0.089266709 0.040879106 2.183675699 0.0302

Std. Err. of

Estimate

0.50342752

Adjusted

R-square

F

0.7910

0.8115

0.8246

0.8323

0.8369

0.8413

0.8443

p-Value

Std. Err. of

Estimate

0.583313837

0.553927569

0.534346896

0.522535174

0.515259286

0.50831862

0.50342752

Rows

Ignored

0

p-Value

< 0.0001

Enter or

Exit

Confidence Interval 95%

Lower

Upper

-1.87784537 -0.473455999

0.575989681 0.725135804

0.044474171 0.16436314

0.039531969 0.176880789

0.032039362 0.169328245

0.016069098 0.160334233

-0.004300005 -0.000409882

0.008636905 0.169896514

Enter

Enter

Enter

Outliers

Enter

Enter

Enter

Enter

0

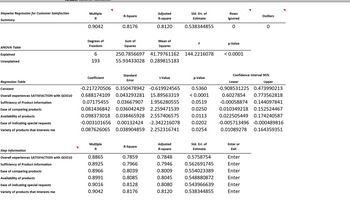

Transcribed Image Text:Stepwise Regression for Customer Satisfaction

Summary

ANOVA Table

Explained

Unexplained

Regression Table

Constant

Overall experiences SATISFACTION with QO010

Sufficiency of Product information

Ease of comparing products

Availability of products

Ease of indicating special requests

Variety of products that interests me

Step Information

Overall experiences SATISFACTION with QO010

Sufficiency of Product information

Ease of comparing products

Availability of products

Ease of indicating special requests

Variety of products that interests me

Multiple

R

0.9042

Degrees of

Freedom

6

193

Coefficient

Multiple

R

R-Square

0.8865

0.8925

0.8966

0.8991

0.9016

0.9042

0.8176

Sum of

Squares

Standard

Error

250.7856697 41.79761162

55.93433028 0.289815183

Adjusted

R-square

0.8120

R-Square

Mean of

Squares

0.7859

0.7966

0.8039

0.8085

0.8128

0.8176

t-Value

-0.217270506 0.350478942 -0.619924565 0.5360

0.688174109 0.043293281 15.89563319 < 0.0001

0.07175455 0.03667907 1.956280555 0.0519

0.081436842 0.036042429 2.259471539 0.0250

0.098373018 0.038465928 2.557406575 0.0113

-0.003101656 0.00132424 -2.342216078 0.0202

0.087626065 0.038904859 2.252316741 0.0254

Adjusted

R-square

Std. Err. of

Estimate

0.7848

0.7946

0.8009

0.8045

0.8080

0.8120

0.538344855

F

144.2216078

p-Value

Std. Err. of

Estimate

0.5758754

0.562691745

0.554023389

0.548880872

0.543966639

0.538344855

Rows

Ignored

0

p-Value

< 0.0001

Outliers

Confidence Interval 95%

Enter or

Exit

0

Lower

Upper

-0.908531225 0.473990213

0.6027854 0.773562818

-0.00058874 0.144097841

0.010349218 0.152524467

0.022505449 0.174240587

-0.005713496 -0.000489816

0.01089278 0.164359351

Enter

Enter

Enter

Enter

Enter

Enter

Solution

by Bartleby Expert

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

Need more explanation by considerinng the data given in snapshots

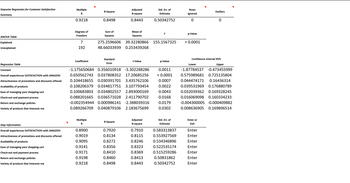

Transcribed Image Text:Stepwise Regression for Customer Satisfaction

Summary

ANOVA Table

Explained

Unexplained

Regression Table

Constant

Overall experiences SATISFACTION with AMAZON

Attractiveness of promotions and discounts offered

Availability of products

Ease of managing your shopping cart

Check-out and payment process

Return and exchange policies

Variety of products that interests me

Step Information

Overall experiences SATISFACTION with AMAZON

Attractiveness of promotions and discounts offered

Availability of products

Ease of managing your shopping cart

Check-out and payment process

Return and exchange policies

Variety of products that interests me

Multiple

R

0.9218

Degrees of

Freedom

7

192

Coefficient

Multiple

R

R-Square

0.8900

0.9019

0.9095

0.9141

0.9171

0.9198

0.9218

0.8498

Sum of

Squares

Standard

Error

Adjusted

R-square

0.8443

R-Square

Mean of

Squares

275.2596606 39.32280866 155.1567325

48.66033939 0.253439268

0.7920

0.8134

0.8272

0.8356

0.8410

0.8460

0.8498

t-Value

-1.175650684 0.356010918 -3.302288286 0.0011

0.650562743 0.037808352 17.20685256 < 0.0001

0.104418655 0.030391701 3.435762106 0.0007

0.108206379 0.034817751 3.107793454 0.0022

0.100683803 0.034802557 2.893000169 0.0043

0.088201665 0.036571028 2.411790702 0.0168

-0.002354944 0.000986141 -2.388039316 0.0179

0.089266709 0.040879106 2.183675699 0.0302

Std. Err. of

Estimate

0.50342752

Adjusted

R-square

F

0.7910

0.8115

0.8246

0.8323

0.8369

0.8413

0.8443

p-Value

Std. Err. of

Estimate

0.583313837

0.553927569

0.534346896

0.522535174

0.515259286

0.50831862

0.50342752

Rows

Ignored

0

p-Value

< 0.0001

Enter or

Exit

Confidence Interval 95%

Lower

Upper

-1.87784537 -0.473455999

0.575989681 0.725135804

0.044474171 0.16436314

0.039531969 0.176880789

0.032039362 0.169328245

0.016069098 0.160334233

-0.004300005 -0.000409882

0.008636905 0.169896514

Enter

Enter

Enter

Outliers

Enter

Enter

Enter

Enter

0

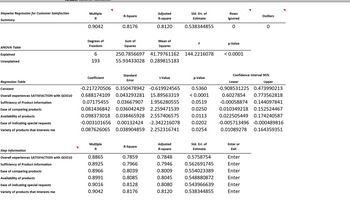

Transcribed Image Text:Stepwise Regression for Customer Satisfaction

Summary

ANOVA Table

Explained

Unexplained

Regression Table

Constant

Overall experiences SATISFACTION with QO010

Sufficiency of Product information

Ease of comparing products

Availability of products

Ease of indicating special requests

Variety of products that interests me

Step Information

Overall experiences SATISFACTION with QO010

Sufficiency of Product information

Ease of comparing products

Availability of products

Ease of indicating special requests

Variety of products that interests me

Multiple

R

0.9042

Degrees of

Freedom

6

193

Coefficient

Multiple

R

R-Square

0.8865

0.8925

0.8966

0.8991

0.9016

0.9042

0.8176

Sum of

Squares

Standard

Error

250.7856697 41.79761162

55.93433028 0.289815183

Adjusted

R-square

0.8120

R-Square

Mean of

Squares

0.7859

0.7966

0.8039

0.8085

0.8128

0.8176

t-Value

-0.217270506 0.350478942 -0.619924565 0.5360

0.688174109 0.043293281 15.89563319 < 0.0001

0.07175455 0.03667907 1.956280555 0.0519

0.081436842 0.036042429 2.259471539 0.0250

0.098373018 0.038465928 2.557406575 0.0113

-0.003101656 0.00132424 -2.342216078 0.0202

0.087626065 0.038904859 2.252316741 0.0254

Adjusted

R-square

Std. Err. of

Estimate

0.7848

0.7946

0.8009

0.8045

0.8080

0.8120

0.538344855

F

144.2216078

p-Value

Std. Err. of

Estimate

0.5758754

0.562691745

0.554023389

0.548880872

0.543966639

0.538344855

Rows

Ignored

0

p-Value

< 0.0001

Outliers

Confidence Interval 95%

Enter or

Exit

0

Lower

Upper

-0.908531225 0.473990213

0.6027854 0.773562818

-0.00058874 0.144097841

0.010349218 0.152524467

0.022505449 0.174240587

-0.005713496 -0.000489816

0.01089278 0.164359351

Enter

Enter

Enter

Enter

Enter

Enter

Solution

by Bartleby Expert

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- I need Explaination based on the answer key answer is D but how. It is econometricsarrow_forwardwages = B1 + B2educ + ßzexper + e where wages denotes hourly wages. We estimate the regression in R and obtain the output ## Coefficients: ## Estimate Std. Error t value Pr(>|t|) ## (Intercept) 2.0 1.0 2 0.0455 * ## educ 0.5 0.5 1 0.3173 ## exper 2.0 0.5 4 6.33e-05 *** ## --- ## Signif. codes: ****' 0. 001 '**' 0.01 **' 0.05 ' 0.1 ' ' 1 Build a 90% confidence interval for B3 using a normal approximation. (Use that if Z ~ N(0, 1) and z1-a satisfies P(Z > z1-a) = a, then zo9 = 1.28, zo95 = 1.64, Z0.975 = 1.96, zo.99 = 2.33, and z0.995 = 2.58). Oa. [2 – 1.64 x (0.5), 2 + 1.64 x (0.5)] O b. [2 – 1.28 × (0.5), 2 + 1.28 x (0.5)] c. [2 – 1.28 x (0.5)², 2 + 1.28 × (0.5)²] O d. [2 – 1.64 × (0.5)², 2 + 1.64 × (0.5)²] O e. [2 – 1.96 × (0.5)², 2 + 1.96 × (0.5)²] O f. [2 – 1.96 × (0.5), 2 + 1.96 × (0.5)]arrow_forwardIn an OLS regression, which value represents the "best" R2 in terms of explained variance in the dependent variable? A. 2.53 B. 16.22 C. .001 D. 0.53arrow_forward

- You estimated a regression with the following output. Source | SS df MS Number of obs = 411 -------------+---------------------------------- F(1, 409) = 4098.54 Model | 22574040.7 1 22574040.7 Prob > F = 0.0000 Residual | 2252702.97 409 5507.83122 R-squared = 0.9093 -------------+---------------------------------- Adj R-squared = 0.9090 Total | 24826743.7 410 60553.0334 Root MSE = 74.215 ------------------------------------------------------------------------------ Y | Coef. Std. Err. t P>|t| [95% Conf. Interval] -------------+---------------------------------------------------------------- X | 6.727341 .1050822 64.02 0.000 6.520772 6.933909 _cons | -.7552724 9.26027 -0.08 0.935 -18.95894 17.44839…arrow_forwardAn analyst working for your firm provided an estimated log-linear demand function based on the natural logarithm of the quantity sold, price, and the average income of consumers. Results are summarized in the following table: SUMMARY OUTPUT Regression Statistics Multiple R R Square Adjusted R Square Standard Error Observations ANOVA Regression Residual Total Intercept LN Price LN Income df 0.968 0.937 0.933 0.003 30 SS MS F 2 0.003637484 0.001818742 202.48598 0.000242516 8.98206E-06 27 29 0.00388 Coefficients Standard Error 0.57 0.00 0.13 0.51 -0.08 0.15 t Stat 0.90 -19.50 1.13 P-value 0.37 0.00 0.27 Significance F 5.55598E-17 Lower 95% -0.65 -0.09 -0.12 How would a 4 percent increase in income impact the demand for your product? Demand would increase by 60 percent. Demand would increase by 0.6 percent. Demand would decrease by 60 percent. Demand would decrease by 0.6 percent. Upper 95% 1.68 -0.07 0.41arrow_forwardQUESTION 10 Answer questions 10 to 16 based on the regression outputs given in Table 1& 2. Table 1 DATA4-1: Data on single family homes in University City community of San Diego, in 1990. price - sale price in thousands of dollars (Range 199. 9 505) sqft - square feet of living area (Range 1065 - 3000) Table 2 Model 1: OLS, using observations 1-14 Dependent variable: price coefficient std. error t-ratio p-value 52. 3509 0.138750 37. 2855 0.0187329 0. 1857 8. 20e-06 *** const sqft 7. 407 Me dependent var Sun squared resid R-squared F(1, 12) Log-likelihood Schwarz criterion 317. 4929 18273. 57 0. 820522 54. 86051 -70. 08421 145. 4465 Hannan-Quinn S.D. dependent var S.E. of regression Adjusted R-squared P-value (F) Akaike criterion 88. 49816 39. 02304 0. 805565 8. 20e-06 144. 1684 144. 0501 There are observations included in this dataset. It is a. data. O 12; cross-sectional 13; time-series data 14; cross-sectional In this regression model, sale price of a single-family house is the. the…arrow_forward

- The dependent variable in the regression in our cost driver analysis is which of the following? Company sales Total overhead cost for the entire period of time Total overhead cost per montharrow_forwardIn the regression equation, what is B0? Group of answer choices the population slope the sample y-intercept the sample slope the population y-interceptarrow_forwardWhen running a ols regression, if my control variables are insignificant via T-test should I keep them in the regression? Are they significant?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education