Financial Accounting

14th Edition

ISBN: 9781305088436

Author: Carl Warren, Jim Reeve, Jonathan Duchac

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

ni.3

answer must be in table format or i will give down vote

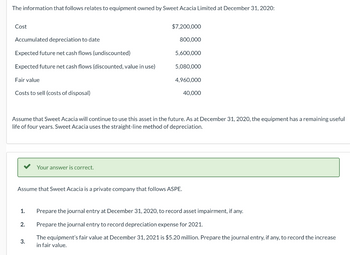

Transcribed Image Text:The information that follows relates to equipment owned by Sweet Acacia Limited at December 31, 2020:

Cost

Accumulated depreciation to date

$7,200,000

800,000

Expected future net cash flows (undiscounted)

5,600,000

Expected future net cash flows (discounted, value in use)

5,080,000

Fair value

4,960,000

Costs to sell (costs of disposal)

40,000

Assume that Sweet Acacia will continue to use this asset in the future. As at December 31, 2020, the equipment has a remaining useful

life of four years. Sweet Acacia uses the straight-line method of depreciation.

Your answer is correct.

Assume that Sweet Acacia is a private company that follows ASPE.

1.

Prepare the journal entry at December 31, 2020, to record asset impairment, if any.

2.

Prepare the journal entry to record depreciation expense for 2021.

3.

The equipment's fair value at December 31, 2021 is $5.20 million. Prepare the journal entry, if any, to record the increase

in fair value.

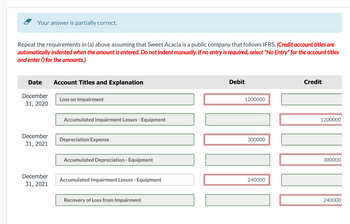

Transcribed Image Text:Your answer is partially correct.

Repeat the requirements in (a) above assuming that Sweet Acacia is a public company that follows IFRS. (Credit account titles are

automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles

and enter O for the amounts.)

Date

Account Titles and Explanation

December

31, 2020

Loss on Impairment

Accumulated Impairment Losses - Equipment

December

31, 2021

Depreciation Expense

December

Accumulated Depreciation - Equipment

Debit

1200000

300000

31, 2021

Accumulated Impairment Losses - Equipment

240000

Recovery of Loss from Impairment

Credit

1200000

300000

240000

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- Nonearrow_forward14, please answer the following questionarrow_forwardRequired: (a) What is the total estimated uncollectible amount of accounts receivable? (b) Prepare journal entries to record impairment loss of receivable in 2021 using Statement of Financial Position approach. (c) Prepare a partial statement of financial position as at 31 December 2021 on the accounts receivable. (d) Prepare journal entries to record impairment loss of receivable in 2021 assuming the balance of the Allowance for Impairment account is $7.300 (Cr.) prior to adjustment.arrow_forward

- Which following statement is a correct statement about the direct write-off method for calculating credit loss expense? A. It is in accordance with GAAP. B. It uses an allowance for credit losses account. C. It tends to understate accounts receivable on the balance sheet. D. It recognizes credit loss expense when a specific account is determined to be uncollectible.arrow_forwarda) Explain the credit term n/40; 1.8/26; 3/10? b) Differentiate between unlisted company and private company? (Any two points) c) Distinguish between current and non-current liabilities. Also give one example for each d) Explain the term “aging of accounts"? Explain with one example. e) What is meant by SMC and MMC? Tell the main difference between them.arrow_forward(b) Assuming that the exchange of Assets A and B lacks commercial substance, record the exchange for both Tamarisk, Inc. and Vaughn, Inc. in accordance with generally accepted accounting principles. (Do not round intermediate calculations. Round final answer to O decimal places e.g. 58,971. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Account Titles and Explanation Tamarisk, Inc.'s Books Debit Credit Vaughn, Inc.'s Books eTextbook and Mediaarrow_forward

- Prepare the adjusting journal entries to record the credit losses for the following independent situations. Required: (Explanation for the journal entry is NOT required.) a. The Allowance for Impairment has a S1,500 credit balance prior to adjustment. Net credit sales during the year are $425,000 and 4% are estimated to be uncollectible. Assume the income statement approach is used. b. The Allowance for Impairment has a $300 debit balance prior to adjustment. Based on an aging schedule of accounts receivable prepared on December 31, $18,100 of accounts receivable are estimated to be uncollectible. Assume the statement of financial position approach is used. c. Explain how the transaction in (b) affects the accounting equation.arrow_forwardUNICHITAchpugi 33 Bridgeport Corp. is a medium-sized corporation specializing in quarrying stone for building construction. The company has long dominated the market, at one time achieving a 70% market penetration. During prosperous years, the company's profits, coupled with a conservative dividend policy, resulted in funds available for outside investment. Over the years, Bridgeport has had a policy of investing idle cash in equity securities. In particular, Bridgeport has made periodic investments in the company's principal vendor of mining equipment, Norton Industries. Although the firm currently owns 12% of the outstanding common stock of Norton Industries, Bridgeport does not have significant influence over the operations of Norton Industries. Cheryl Thomas has recently joined Bridgeport as assistant controller, and her first assignment is to prepare the December 31, 2025 year-end adjusting entries for the accounts that are valued by the "fair value" rule for financial reporting…arrow_forward08:24 C uie Instructions. On 28 February 2019, the debtors control account in the General Ledger of Lesego Fashions showed a debit balance of R8 735, while the debtors list in the Debtors ledger showed a total of R5 584. The errors and omissions described below were found on 28 February 2019. Required: Indicate in the table provided below, how the errors and omissions should be corrected in order to reconcile the control account balance with debtor's list total. No. General Ledger Debtors ledger Debtors list Debtors control Dr (+) Cr (-) Dr (+) Cr (-) 3. The balance on the account of a debtor, R150, was brought down incorrectly as R15. 4. The amount on an invoice issued to A Shokane was miscalculated. The account should be R62 and not R72. 5. Payments to creditors as per the Cash Payment Journal were debited to debtors control account, R3 960. 6. The debtors' journal was undercast and posted accordingly. The total should have been R4 710, and not R4 170. 7. A credit note for R51 was…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning