FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

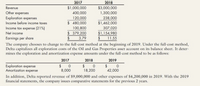

Delta Oil Company uses the successful-efforts method to accout for oil exploration cost. Delta started business in 2017 and prepared the following income statements:

1. Prepare the

Transcribed Image Text:2017

$1,000,000

2018

$3,000,000

Revenue

Other expenses

Exploration expenses

400,000

1,300,000

120,000

238,000

$1,462,000

Income before income taxes

$ 480,000

Income tax expense (21%)

100,800

307,020

$379,200

$1,154,980

11.55

Net income

Earnings per share

3.79

The company chooses to change to the full-cost method at the beginning of 2019. Under the full-cost method,

Delta capitalizes all exploration costs of the Oil and Gas Properties asset account on its balance sheet. It deter-

mines the exploration and amortization expense amounts under the full-cost method to be as follows:

2017

2018

2019

Exploration expense

Amortization expense

$ 0

8,000

$ 0

18,200

$ 0

42,000

In addition, Delta reported revenue of $9,000,000 and other expenses of $4,200,000 in 2019. With the 2019

financial statements, the company issues comparative statements for the previous 2 years.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 1. What is the adjusted net income for 2017? 2. What is the net effect of the errors in the 2018 net income? 3. What is the net effect of the errors in the retained earnings at the end of 2017? 4. What is the net effect of the errors in the retained earnings at the end of 2018?arrow_forwardPlease do not give solution in image format thankuarrow_forwardPrepare an income statement with the information below. Need asap.arrow_forward

- Fill in the dollar changes caused in the Investment account and Dividend Revenue or Investment Revenue account by each of the following transactions, assuming Ayayai Company uses (a) the fair value method and (b) the equity method for accounting for its investments in Sunland Company. (Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45). Do not leave any answer field blank. Enter 0 for amounts.) (a) Fair Value Method (b) Equity Method Transaction Investment Account Dividend Revenue Investment Account Investment Revenue 1. At the beginning of Year 1, Ayayai bought 30% of Sunland's common stock at its book value. Total book value of all Sunland's common stock was $760,000 on this date. 2. (a) During Year 1, Sunland reported $52,000 of net income. (b) During Year 1, Sunland paid $28,500 of dividends. 3. (a) During Year 2, Sunland reported…arrow_forwardPlease do not give solution in image format thankuarrow_forwardPlease do not give solution in image format ? And Fast Answering Please ? And Explain Proper Step by Step.arrow_forward

- Can you provide the statement of profit and loss please Thanks in advancearrow_forwardcan you explain to me how to solve these 3 multiple choice questions based on the first image?arrow_forwardConcord Today Publishers completed the following investment transactions during 2024 and 2025: i (Click the icon to view the transactions.) Requirements 1. Journalize Concord Today's investment transactions. Explanations are not required. 2. On December 31, 2024, how would the Peaceful stock be classified and at what value would it be reported on the balance sheet? Requirement 1. Journalize Concord's investment transactions. Explanations are not required. (Record debits first, then credits. Exclude explanations from journal entries. If no entry is required, select "No entry required" on the first line of the Accounts column and leave the remaining cells blank.) Dec. 6, 2024: Purchased 1,100 shares of Peaceful stock at a price of $21.00 per share, intending to sell the investment next month. Concord did not have significant influence over Peaceful. Date Credit 2024 Dec. 6 Accounts C Debit More info Dec. 6, 2024 Dec. 23, 2024 Dec. 31, 2024 Jan. 27, 2025 Purchased 1,100 shares of Peaceful…arrow_forward

- Hartford Today Publishers completed the following investment transactions during 2024 and 2025: i (Click the icon to view the transactions.) Requirements 1. Journalize Hartford Today's investment transactions. Explanations are not required. 2. On December 31, 2024, how would the Golden stock be classified and at what value would it be reported on the balance sheet? Requirement 1. Journalize Hartford's investment transactions. Explanations are not required. (Record debits first, then credits. Exclude explanations from journal entries. If no entry is required, select "No entry required" on the first line of the Accounts column and leave the remaining cells blank.) Dec. 6, 2024: Purchased 950 shares of Golden stock at a price of $35.00 per share, intending to sell the investment next month. Hartford did not have significant influence over Golden. Date Debit Credit 2024 Dec. 6 Accounts More info Dec. 6, 2024 -C Dec. 23, 2024 Dec. 31, 2024 Jan. 27, 2025 Purchased 950 shares of Golden stock…arrow_forwardPerform a horizontal analysis for Davis Inc. Use 2017 as the base yeararrow_forwardPlease do not give image format and fast answeringarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education