FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

I understand how they got the answer. In the text book it listed:

Jan 1 2016 Dec 31 2016

Total Owner's Equity 198,300 214,200

I do not see this calcuated in the average assets nor in the solution

I also see:

Jan 1 2016 Dec 31 2016

Notes Payable 34,000 54,000

I do not see this calcuated in the average assets nor in the solution

Do they not include this in the net income or average assets?

Transcribed Image Text:Return on Assets:

The return on assets is a ratio represent the rate of return the business is earning on its average assets

employed. The Average assets employed is taken in to consideration as there may be a movement of assets

during the period and it will serve as a better measure for the rate of return to be computed.

The Return on assets is computed by dividing the net income earned after taxes by the average total assets

earned by the business.

Requirement:

TheReturn on assets for Alec Appliance Service for the year ending Dec31 2016.

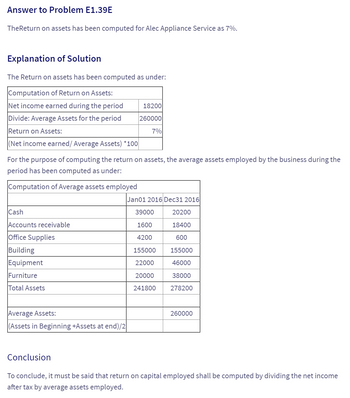

Transcribed Image Text:Answer to Problem E1.39E

TheReturn on assets has been computed for Alec Appliance Service as 7%.

Explanation of Solution

The Return on assets has been computed as under:

Computation of Return on Assets:

Net income earned during the period

Divide: Average Assets for the period

Return on Assets:

(Net income earned/ Average Assets) *100

For the purpose of computing the return on assets, the average assets employed by the business during the

period has been computed as under:

Computation of Average assets employed

Cash

Accounts receivable

Office Supplies

Building

Equipment

Furniture

Total Assets

18200

260000

7%

Average Assets:

(Assets in Beginning +Assets at end)/2

Jan01 2016 Dec31 2016

39000

1600

4200

155000

22000

20000

241800

20200

18400

600

155000

46000

38000

278200

260000

Conclusion

To conclude, it must be said that return on capital employed shall be computed by dividing the net income

after tax by average assets employed.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Concord Today Publishers completed the following investment transactions during 2024 and 2025: i (Click the icon to view the transactions.) Requirements 1. Journalize Concord Today's investment transactions. Explanations are not required. 2. On December 31, 2024, how would the Peaceful stock be classified and at what value would it be reported on the balance sheet? Requirement 1. Journalize Concord's investment transactions. Explanations are not required. (Record debits first, then credits. Exclude explanations from journal entries. If no entry is required, select "No entry required" on the first line of the Accounts column and leave the remaining cells blank.) Dec. 6, 2024: Purchased 1,100 shares of Peaceful stock at a price of $21.00 per share, intending to sell the investment next month. Concord did not have significant influence over Peaceful. Date Credit 2024 Dec. 6 Accounts C Debit More info Dec. 6, 2024 Dec. 23, 2024 Dec. 31, 2024 Jan. 27, 2025 Purchased 1,100 shares of Peaceful…arrow_forwardHartford Today Publishers completed the following investment transactions during 2024 and 2025: i (Click the icon to view the transactions.) Requirements 1. Journalize Hartford Today's investment transactions. Explanations are not required. 2. On December 31, 2024, how would the Golden stock be classified and at what value would it be reported on the balance sheet? Requirement 1. Journalize Hartford's investment transactions. Explanations are not required. (Record debits first, then credits. Exclude explanations from journal entries. If no entry is required, select "No entry required" on the first line of the Accounts column and leave the remaining cells blank.) Dec. 6, 2024: Purchased 950 shares of Golden stock at a price of $35.00 per share, intending to sell the investment next month. Hartford did not have significant influence over Golden. Date Debit Credit 2024 Dec. 6 Accounts More info Dec. 6, 2024 -C Dec. 23, 2024 Dec. 31, 2024 Jan. 27, 2025 Purchased 950 shares of Golden stock…arrow_forwardHello, how do I solve this problem? I attached the bottom part of the question and what it's asking for since it wouldn't fit in the screenshot. Assuming that total assets were $3,112,000 at the beginning of the current fiscal year, determine the following. When required, round to one decimal place. a. Ratio of fixed assets to long-term liabilities b. Ratio of liabilities to stockholders' equity c. Asset turnover d. Return on total assets % e. Return on stockholders’ equity % f. Return on common stockholders' equity %arrow_forward

- Please do not give solution in image format thankuarrow_forwardProblem Solving#1: (Statement of Financial Position) Assume the following balances f Perseverance Company for the y ended December 31, 2016. IL Problem Solving#1: (Statement of Financial Position) Assume the following balances from Persearance Company for the year ended December 31, 2016 Cash Supplies Accounts Receivable Allowance for bad debts Loans Receivable(6maths) Machineries Accumulated depreciation- machineries Buiding Accumulated depreciation- building. Land Accounts Payable Notes Payable (trade) Loans Payable (18moths) Capital 250.000 180.000 100.000 20.000 220.000 190.000 22,000 1.250,000 250.000 1800,000 210,000 50,000 400.000 3.038.000arrow_forwardNeed Answer of this Questionarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education