FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Please do not give solution in image format thanku

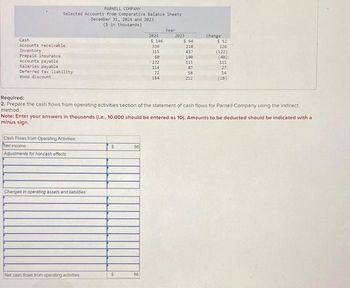

Transcribed Image Text:PARNELL COMPANY

Selected Accounts from Comparative Balance Sheets

Cash

Accounts receivable.

Inventory

Prepaid insurance

Accounts payable

Salaries payable

Deferred tax liability

Bond discount

Cash Flows from Operating Activities:

Net income

Adjustments for noncash effects

Changes in operating assets and liabilities:

December 31, 2024 and 2023

($ in thousands)

Net cash flows from operating activities

$

$

86

2024

86

$146

336

315

60

222

114

72

184

Year

Required:

2. Prepare the cash flows from operating activities section of the statement of cash flows for Parnell Company using the indirect

method.

Note: Enter your answers in thousands (i.e., 10,000 should be entered as 10). Amounts to be deducted should be indicated with a

minus sign.

2023

$94

210

437

100

111

87

58

212

Change

$ 52

126

(122)

(40)

111

27

14

(28)

![Required information

[The following information applies to the questions displayed below]

Portions of the financial statements for Parnell Company are provided below.

Revenues and gains:

Sales

Gain on sale of building

Expenses and loss:

For the Year Ended December 31, 2024

($ in thousands)

Cost of goods sold

Salaries

Insurance

Depreciation

Interest expense

Loss on sale of equipment

Income before tax

Income tax expense

Net income

PARNELL COMPANY

Income Statement

Cash

Accounts receivable

Inventory

Prepaid insurance:

Accounts payable

Salaries payable

Deferred tax liability

Bond discount

$860

11

PARNELL COMPANY

Selected Accounts from Comparative Balance Sheets

December 31, 2024 and 2023

($ in thousands)

$ 330

126

46

129

56

12

2024

$ 146

336

315

60

222

114

72

184

Year

$ 871

2023

699

172

86

$ 86

$ 94

210

437

100

111

87

58

212

Change

$ 52

126

(122)

(40)

111

27

14

(28)

Required:

2. Prepare the cash flows from operating activities section of the statement of cash flows for Parnell Company using the indirect

method

Note: Enter your answers in thousands (i.e., 10,000 should be entered as 10). Amounts to be deducted should be indicated with a

minus sign.](https://content.bartleby.com/qna-images/question/ecb3ccf8-64a3-4f42-90b5-c9c7edf16923/caae156e-01c3-4958-b463-ca977ac8bf84/lp4sb2f_thumbnail.jpeg)

Transcribed Image Text:Required information

[The following information applies to the questions displayed below]

Portions of the financial statements for Parnell Company are provided below.

Revenues and gains:

Sales

Gain on sale of building

Expenses and loss:

For the Year Ended December 31, 2024

($ in thousands)

Cost of goods sold

Salaries

Insurance

Depreciation

Interest expense

Loss on sale of equipment

Income before tax

Income tax expense

Net income

PARNELL COMPANY

Income Statement

Cash

Accounts receivable

Inventory

Prepaid insurance:

Accounts payable

Salaries payable

Deferred tax liability

Bond discount

$860

11

PARNELL COMPANY

Selected Accounts from Comparative Balance Sheets

December 31, 2024 and 2023

($ in thousands)

$ 330

126

46

129

56

12

2024

$ 146

336

315

60

222

114

72

184

Year

$ 871

2023

699

172

86

$ 86

$ 94

210

437

100

111

87

58

212

Change

$ 52

126

(122)

(40)

111

27

14

(28)

Required:

2. Prepare the cash flows from operating activities section of the statement of cash flows for Parnell Company using the indirect

method

Note: Enter your answers in thousands (i.e., 10,000 should be entered as 10). Amounts to be deducted should be indicated with a

minus sign.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- What is meant by Authorized and issued captial?arrow_forwardPlease do not give solution in image format thankuarrow_forwardAI - E H E AutoSave Normal Document1 - Word Search badiya aldujaili ff BА EN File Home Insert Draw Design Layout References Mailings Review View Help A Share O Comments X Cut Calibri (Body) 11 - A A Aav A E E AaBbCcDc AaBbCcDc AaBbC AABBCCC AaB AAB6CCC AaBbCcDa O Find - A Copy Paste S Replace В IUvab х, х* А I Normal 1 No Spac. Heading 1 Heading 2 Title Subtitle Subtle Em.. A Select v Dictate Editor Format Painter Clipboard Font Paragraph Styles Editing Voice Editor 1. 2 4 7 Use the following information to answer the next 3 questions Kite Corp. manufactures custom cabinets and uses a job-order costing system. The company had two jobs in process at the beginning of October: Job No. 64 with a total beginning cost of $56,700 and Job No. 65 with a total beginning cost of $83,300. The company applies manufacturing overhead on the basis of machine hours. Budgeted overhead and machine activity for the year were anticipated to be $3,021,000 and 57,000 machine hours. The company worked on four…arrow_forward

- Zarrow_forwardO PowerPoint O from Towards a O Mail - Edjouline X E Content - ACG: X * CengageNOWv. x D (58) YouTube v2 cengagenow.com/ilm/takeAssignment/takeAssignmentMain.do?invoker=assignments&takeAssignmentSessionLocator=assignment-take&inpro. Q < * * C WouTube O Maps ANKSHEET Entries for Notes Receivable Spring Designs & Decorators issued a 120-day, 4% note for $60,000, dated April 13 to Jaffe Furniture Company on account. Assume a 360-day year when calculating LANKSHEET interest. LGO a. Determine the due date of the note. LGO b. Determine the maturity value of the note. cl. Journalize the entry to record the receipt of the note by Jaffe Furniture. c2. Journalize the entry to record the receipt of payment of the note at maturity. If an amount box does not require an entry, leave it blank. 24 068 s: 912 items Previous Next 回习 9 O 11:49arrow_forwardPlease avoid answers in image format thank youarrow_forward

- help please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forwardPlease don't provide handwrittin solution....arrow_forwardWhich of the following is true of the correcting entry method? a.It cannot be used to correct a manual entry. b.It cannot be used to correct computerized entry. c.It can be used only to correct an error before posting has taken place. d.It can be used to correct both manual and computerized entries.arrow_forward

- Can you explain what I might be missing throughly please? I have it correct but it claims that it's not complete. What am I missing?arrow_forwardhelp please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forwardI need this in text not imagesarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education