Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

F1 paese help......

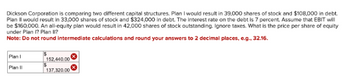

Transcribed Image Text:Dickson Corporation is comparing two different capital structures. Plan I would result in 39,000 shares of stock and $108,000 in debt.

Plan II would result in 33,000 shares of stock and $324,000 in debt. The interest rate on the debt is 7 percent. Assume that EBIT will

be $160,000. An all-equity plan would result in 42,000 shares of stock outstanding. Ignore taxes. What is the price per share of equity

under Plan I? Plan II?

Note: Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.

Plan I

Plan II

$

152,440.00

137,320.00

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- 5 X100 ry https://ng.cengage.com/static/nb/ui/evo/index.html?deploymentld-5829202317504197666520360810&eISBN=97... A S CENGAGE | MINDTAP I Chapter 4 Assignment Maria is a divorce attorney who practices law in San Francisco. She wants to join the American Divorce Lawyers Association (ADLA), a professional organization for divorce attorneys. The membership dues for the ADLA are $500 per year and must be paid at the beginning of each year. For instance, membership dues for the first year are paid today, and dues for the second year are payable one year from today. However, the ADLA also has an option for members to buy a lifetime membership today for $4,500 and never have to pay annual membership dues. Obviously, the lifetime membership isn't a good deal if you only remain a member for a couple of years, but if you remain a member for 40 years, it it's a great deal. Suppose that the appropriate annual interest rate is 8.5%. O 13 years O 15 years What is the minimum number of years that…arrow_forwardⒸ O D O H < UB Unblockit - Proxies to acce X C Solved P11-1A Gão Limited X b Home | bartleby C (4) How to study fo... Dropbox- 1st B.tec... (10) Lil Jaico - Toma Dropbox - 1st B.tec... (10) Lil Would you like to make Opera GX your everyday browser? How do I do that? www.chegg.com/homework-help/questions-and-answers/journalize-transactions-b-post-equity-accounts-use-j5-posting-refrence-c-prepare-share-cap-q90903484 Jaico-Toma (17) Liverpool reacti... (1) How To Study fo... (6) HABITS of SUCC... AMARIA BB - Slow... Type here to search MARM O x + Chegg Books Jan. 10 Mar. 1 Apr. 1 May 1 Aug. 1 Sept. 1 Nov. 1 Study Career Find solutions for your homework business/accounting / accounting questions and answers/p11-1a gão limited was organized on january 1, 2017, it is... Question: P11-1A Gão Limited Was Organized On January 1, 2017. It Is Authorized To Issue 10,000 8%, HK$1,000 Par Value Preference Share... P11-1A Gão Limited was organized on January 1, 2017. It is authorized to issue 10,000…arrow_forwardmyedio.com Question 12 Listen Use the function f(x)=2x-5 • Find the inverse of f(x). . . Graph f(x) and f(x) and state the domain of each function. Prove that f(x) and f¹(x) are inverses, both graphically and algebraically. ATTACHMENTS W Algebra2 U9 UnitTest_Q17 docx 146.32 KBarrow_forward

- On January 1, 2025, Blossom Company has the following defined benefit pension plan balances. Projected benefit obligation $4,454,000 Fair value of plan assets 4,140,000 The interest (settlement) rate applicable to the plan is 10%. On January 1, 2026, the company amends its pension agreement so that prior service costs of $509,000 are created. Other data related to the pension plan are as follows. 2025 2026 Service cost $149,000 $177,000 Prior service cost amortization -0- 92,000 Contributions (funding) to the plan 237,000 283,000 Benefits paid 196,000 274,000 Actual return on plan assets 248,400 260,000 Expected rate of return on assets 6% 8% (a) Prepare a pension worksheet for the pension plan for 2025 and 2026. (Enter all amounts as positive.) BLOSSOM COMPANY Pension Worksheet-2025 and 2026 General Journal Entries OCI-Prior Service Cost OCI-Gain/ Pel Lossarrow_forward1 2 m 4n 07 9. White 9 A Talk S Aint Ia O ENG 10 O Annota S Annota SAnnota M Recibic I Downl ssignment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLocator=&inprogress=false 台☆* + Facebook 6 Student Center Bb Blackboard WhatsApp Ggrammarly unemployment > |国Readi Maps Zoom Mark Turney owns Creative Corners. He does his banking at United Federal Bank (UFB) in Tucson, Arizona. The amounts in his general ledger for payroll taxes and the employee's withholding of Social Security, Medicare, and federal income tax as of April 15 of the current year show the following: Social Security tax payable (employer and employee), $3,020; Medicare tax payable (employer and employee), $734; FUTA tax payable, $84; SSUTA tax payable, $414; and Employees income tax payable, $4,622. Journalize the payment of the Form 941 deposit to UFB and the payment of the SUTA tax to the State of Arizona as of April 15, 20--. If an amount box does not require an entry, leave it blank. Page: POST. DATE DESCRIPTION…arrow_forward5 X100 ry https://ng.cengage.com/static/nb/ui/evo/index.html?deploymentld-5829202317504197666520360810&eISBN=97... A S CENGAGE | MINDTAP I Chapter 4 Assignment Maria is a divorce attorney who practices law in San Francisco. She wants to join the American Divorce Lawyers Association (ADLA), a professional organization for divorce attorneys. The membership dues for the ADLA are $500 per year and must be paid at the beginning of each year. For instance, membership dues for the first year are paid today, and dues for the second year are payable one year from today. However, the ADLA also has an option for members to buy a lifetime membership today for $4,500 and never have to pay annual membership dues. Obviously, the lifetime membership isn't a good deal if you only remain a member for a couple of years, but if you remain a member for 40 years, it it's a great deal. Suppose that the appropriate annual interest rate is 8.5%. O 13 years O 15 years What is the minimum number of years that…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education