Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

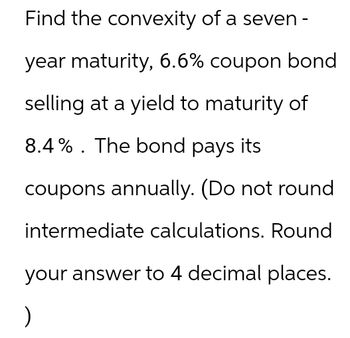

Transcribed Image Text:Find the convexity of a seven-

year maturity, 6.6% coupon bond

selling at a yield to maturity of

8.4% The bond pays its

coupons annually. (Do not round

intermediate calculations. Round

your answer to 4 decimal places.

)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Find the convexity of a seven-year maturity, 6.5% coupon bond selling at a yield to maturity of 8.8%. The bond pays its coupons annually. (Do not round intermediate calculations. Round your answer to 4 decimal places.)arrow_forwardRequired: Find the convexity of a seven-year maturity, 6.0% coupon bond selling at a yield to maturity of 7.2%. The bond pays its coupons annually. (Do not round intermediate calculations. Round your answer to 4 decimal places.) Convexityarrow_forwardH3. Show proper step by step calculationarrow_forward

- Nonearrow_forward, a. Find the duration of a 7% coupon bond making annual coupon payments if it has three years until maturity and a yield to maturity of 7.6%. (Do not round intermediate calculations. Round your answers to 4 decimal places.) b. What is the duration if the yield to maturity is 11.6%? (Do not round intermediate calculations. Round your answers to 4 decimal places.) 7.6% YTM __ Years 11.6% YTM __ Yearsarrow_forwardA newly issued bond pays its coupons once a year. Its coupon rate is 4.7%, its maturity is 15 years, and its yield to maturity is 7.7%. a. Find the holding-period return for a one-year investment period if the bond is selling at a yield to maturity of 6.7% by the end of the year. (Do not round intermediate calculations. Round your answer to 2 decimal places.) Holding-period return % b. If you sell the bond after one year when its yield is 6.7%, what taxes will you owe if the tax rate on interest income is 40% and the tax rate on capital gains income is 30%? The bond is subject to original-issue discount (OID) tax treatment. (Do not round intermediate calculations. Round your answers to 2 decimal places.) Tax on interest income $ Tax on capital gain $ Total taxes $ c. What is the after-tax holding-period return on the bond? (Do not round intermediate calculations. Round your answer to 2 decimal places.)…arrow_forward

- The following table shows some data for three bonds. In each case, the bond has a coupon of zero. The face value of each bond is $1,000. Bond Price Maturity (Years) Yield to Maturity A $ 230 20 B с 230 17 10% 9 What is the yield to maturity of bond A? Note: Do not round intermediate calculations. Enter your answer as a percent rounded to 3 decimal places. Assume annual compounding. What is the maturity of B? Note: Do not round intermediate calculations. Round your answer to 2 decimal places. Assume annual compounding. What is the price of C? Note: Do not round intermediate calculations. Round your answer to 2 decimal places. Assume annual compounding.arrow_forwardFind the duration of a 6% coupon bond making annual coupon payments if it has three years until maturity and a yield to maturity of 7.5%. Note: Do not round intermediate calculations. Round your answers to 4 decimal places. What is the duration if the yield to maturity is 11.5%? Note: Do not round intermediate calculations. Round your answers to 4 decimal places. YTM Duration 7.5% YTM 11.5% YTMarrow_forwardA bond sells for $894.17 and has a coupon rate of 6.20 percent. If the bond has 13 years until maturity, what is the yield to maturity of the bond? Assume semiannual compounding. (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.)arrow_forward

- Find the duration of a bond with a settlement date of May 27, 2023, and maturity date November 15, 2034. The coupon rate of the bond is 8.5%, and the bond pays coupons semiannually. The bond is selling at a bond-equivalent yield to maturity of 10.0%. Use Spreadsheet 16.2. (Do not round intermediate calculations. Round your answers to 4 decimal places.) Macaulay duration Modified durationarrow_forwardRaghu bhaiarrow_forwardBhaarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education