Corporate Fin Focused Approach

5th Edition

ISBN: 9781285660516

Author: EHRHARDT

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:14.

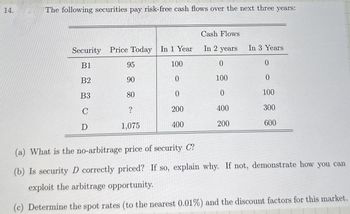

The following securities pay risk-free cash flows over the next three years:

Cash Flows

Security Price Today In 1 Year

In 2 years

In 3 Years

B1

95

100

0

0

B2

B3

80

80

90

0

100

0

0

0

100

C

?

200

400

300

D

1,075

400

200

600

(a) What is the no-arbitrage price of security C?

(b) Is security D correctly priced? If so, explain why. If not, demonstrate how you can

exploit the arbitrage opportunity.

(c) Determine the spot rates (to the nearest 0.01%) and the discount factors for this market.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 6 images

Knowledge Booster

Similar questions

- 17. Consider two securities that pay risk-free cash flows over the next two years and that have the current market prices shown here: Security Price Today ($) Cash Flow in One Year ($) Cash Flow in Two Years ($) B1 94 0 100 0 B2 85 100 a. What is the no-arbitrage price of a security that pays cash flows of $100 in one year and $100 in two years? b. What is the no-arbitrage price of a security that pays cash flows of $100 in one year and $500 in two years? c. Suppose a security with cash flows of $50 in one year and $100 in two years is trading for a price of $130. What arbitrage opportunity is available?arrow_forwardConsider two securities that pay risk-free cash flows over the next two years and that have the current market prices shown here: Security Price Today Cash Flow in One Year Cash Flow in Two Years B1 $192 $200 0 B2 $176 0 $200 What is the no-arbitrage price of a security that pays cash flows of $200 in one year and $200 in two years? What is the no-arbitrage price of a security that pays cash flows of $200 in one year and $1600 in two years? Suppose a security with cash flows of $100 in one year and $200 in two years is trading for a price of $260. What arbitrage opportunity is available?arrow_forwarduestion Consider three securities that will pay risk-free cash flows over the next three years and that have the current market prices shown here: This question: 10p Security Price Today ($) Cash Flow in Cash Flow in Cash Flow in Two Years ($) Three Years ($) Name One Year ($) B1 $92.42 100 B2 $84.32 100 B3 $382.92 500 Calculate the no-arbitrage price, or the price that eliminates any arbitrage opportunities, of a new security, B4, that pays risk-free cash flows of $500 in one year and $1,000 in three years. The current no-arbitrage price of Security B4 is: (round your answer to two decimal places) O Time tv 9 MacBook Air DD DII F10 F9 F8 888 F7 80 F6 F5 F4 F3 esc F2 F1 & * OCarrow_forward

- i need the answer quicklyarrow_forwardThe promised cash flows of three securities are listed below. If the cash flows are risk-free, and the risk-free interest rate is 4.5%, determine the no-arbitrage price of each security before the first cash flow is paid. (Click on the following icon in order to copy its contents into a spreadsheet.) Security A B C Cash Flow Today (S) 700 0 1,400 The no-arbitrage price of security A is S Cash Flow in One Year ($) 700 1,400 0 (Round to the nearest cent.)arrow_forwardConsider two securities that pay risk-free cash flows over the next two years and that have the current market prices shown here: (Click on the following icon in order to copy its contents into a spreadsheet.) Security B1 B2 Price Today $190 $176 Cash Flow in One Year $200 0 Cash Flow in Two Years 0 $200 a. What is the no-arbitrage price of a security that pays cash flows of $200 in one year and $200 in two years? b. What is the no-arbitrage price of a security that pays cash flows of $200 in one year and $1,800 in two years? c. Suppose a security with cash flows of $100 in one year and $200 in two years is trading for a price of $260. What arbitrage opportunity is available? ... a. What is the no-arbitrage price of a security that pays cash flows of $200 in one year and $200 in two years? The no-arbitrage price is $ (Round to the nearest dollar.)arrow_forward

- in order to The table here shows the no-arbitrage prices of securities A and B that we calculated. (Click on the following icon copy its contents into a spreadsheet.) Cash Flow in One Year Security Market Price Today Weak Economy Strong Economy Security A Security B $232 $346 $4 $604 $604 $4 a. What are the payoffs of a portfolio of one share of security A and one share of security B? b. What is the market price of this portfolio? What expected return will you earn from holding this portfolio? a. What are the payoffs of a portfolio of one share of security A and one share of security B? (Select the best choice below.) A. Portfolio A+B pays $578 in both cases (i.e., it is risk free). B. Portfolio A+B pays $608 in both cases (i.e., it is risk free). C. Portfolio A +B pays $4 in both cases (i.e., it is risk free). D. Cannot be determined without the discount rate. b. What is the market price of this portfolio? The market price of this portfolio will be $. (Round to the nearest dollar.)…arrow_forwardNonearrow_forwardAssume investors are indifferent among security maturities. Today, the annualized 2-year interest rate is 2.20 percent, and the 1-year interest rate is 2 percent. What is the forward rate according to the pure expectations theory? Group of answer choices 2.25% 2.20% 2.00% 2.40%arrow_forward

- Suppose you observe the following situation: Security Pete Corporation Repete Company Beta 1.25 .87 Expected Return 1080 .0820 a. Assume these securities are correctly priced. Based on the CAPM, what is the expected return on the market? (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) b. What is the risk-free rate? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) a. Expected return on market using Pete Corporation a. Expected return on market using Repete Company b. Risk-free rate de de % % %arrow_forwardSuppose you observe the following situation: Security Pete Corporation Repete Company Beta 1.70 1.39 a. Expected return on market b. Risk-free rate Expected Return .180 .153 a. Assume these securities are correctly priced. Based on the CAPM, what is the expected return on the market? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) b. What is the risk-free rate? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) % %arrow_forwardSuppose you observe the following situation: Security Beta Expected Return Pete Corp. 1.50 0.160 Repete Co. 1.19 0.133 Assume these securities are correctly priced. Based on the CAPM, what is the expected return on the market? (Do not round intermediate calculations. Round the final answers to 2 decimal places.) Expected Return on Market Pete Corp. % Repete Co. % What is the risk-free rate? (Do not round intermediate calculations. Round the final answer to 3 decimal places.) Risk-free ratearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you