Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN: 9781337115773

Author: Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Help

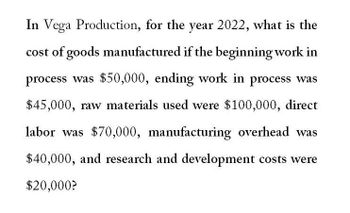

Transcribed Image Text:In Vega Production, for the year 2022, what is the

cost of goods manufactured if the beginning work in

process was $50,000, ending work in process was

$45,000, raw materials used were $100,000, direct

labor was $70,000, manufacturing overhead was

$40,000, and research and development costs were

$20,000?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- A company is spending 70,000 per year for inspecting, 60,000 per year for purchasing, and 56,000 per year for reworking products. What is a good estimate of non-value-added costs? a. 126,000 b. 70,000 c. 56,000 d. 130,000arrow_forwardIn Vega Production, for the year 2022, what is the cost of goods manufactured if the beginning work in process was $50,000, ending work in process was $45,000, raw materials used were $100,000, direct labor was $70,000, manufacturing overhead was $40,000, and research and development costs were $20,000?arrow_forward?arrow_forward

- Capiz Company's 2020 manufacturing costs were as follows: Direct materials P70,000; Direct labor P50,000; Depreciation of manufacturing equipment P85,000; Depreciation of factory building P50,000; Janitor's wages for cleaning factory premises P15,000. How much of these costs should be inventoried using the throughput accounting? a.P 50,000 b.P 70,000 c.P120,000 d.P270,000arrow_forwardIn Apollo Manufacturing, for the year 2023, what is the cost of goods manufactured if the beginning work in process was $40,000, ending work in process was $35,000, raw materials used were $75,000, direct labor was $55,000, manufacturing overhead was $25,000, and administrative expenses were $10,000? Strict Warning: Don't use Alarrow_forwardJessup Company expects to incur manufacturing overhead costs of $20,000 each month during the year ending December 31, 2022 and direct production costs (i.e. direct labor and direct materials) of $126 per unit. Total units produced for the year ending December 31, 2022 are estimated to be 10,000 units. If the company desires to price its product at cost plus 50%, the sales price per unit would be which of the following amounts? $225 $192 $189arrow_forward

- The sales price per unit would be?arrow_forwardFast Track Auto produces and sells an auto part for S65 per unit. In 2020, 125,000 parts were produced and 80,000 units were sold. Other information for the year includes: Direct Materials $20 per unit Direct manufacturing labor $5 per unit Variable manufacturing costs $3 per unit Sales commissions $6 per part Fixed Manufacturing costs $790,000 per year Administrative expenses, all fixed $320,000 per year What is the inventoriable cost per unit using absorption costing? A. $28.00 B. $36.88 C. $34.32 D. $34.00arrow_forwardIf the food cost is $250,000 and the total labor cost is $300,000 and sales are $1,000,000, what is the prime cost in $?arrow_forward

- Provide accurate answer with explanationarrow_forwardDetermine the number of units?arrow_forwardAssume that a manufacturer can purchase a needed component from a supplier at a cost of $9.50 per unit, or it can invest $60,000 in equipment and produce the item at a cost of $7.00 per unit. (a) Determine the quantity for which total costs are equal for the make and buy alternatives. (b) What is the minimum cost alternative if 15,000 units are required? What is the minimum cost? (c) If the number of units required of the component is close to trhe break even quantity, what factors might might influence the final decision to make or buyarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning