FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

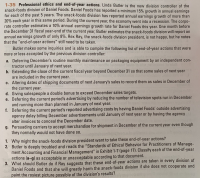

Transcribed Image Text:1-35 Professional ethics and end-of-year actions. Linda Butler is the new division controller of the

snack-foods division of Daniel Foods. Daniel Foods has reported a minimum 15% growth in annual earnings

for each of the past 5 years. The snack-foods division has reported annual earnings growth of more than

20% each year in this same period. During the current year, the economy went into a recession. The corpo-

rate controller estimates a 10% annual earnings growth rate for Daniel Foods this year. One month before

the December 31 fiscal year-end of the current year, Butler estimates the snack-foods division will report an

annual earnings growth of only 8%. Rex Ray, the snack-foods division president, is not happy, but he notes

that the "end-of-year actions" still need to be taken.

Butler makes some inquiries and is able to compile the following list of end-of-year actions that were

more or less accepted by the previous division controller:

a. Deferring December's routine monthly maintenance on packaging equipment by an independent con-

Tds0

b. Extending the close of the current fiscal year beyond December 31 so that some sales of next year

aldianog

tractor until January of next year.

Hofo

included in the current year.

c. Altering dates of shipping documents of next January's sales to record them as sales in December of

the current year.

d. Giving salespeople a double bonus to exceed December sales targets.

Deferring the current period's advertising by reducing the number of television spots run in December

and running more than planned in January of next year.

f. Deferring the current period's reported advertising costs by having Daniel Foods' outside advertising

agency delay billing December advertisements until January of next year or by having the agency

alter invoices to conceal the December date.

g. Persuading carriers to accept merchandise for shipment in December of the current year even though

they normally would not have done so.

1. Why might the snack-foods division president want to take these end-of-year actions?

2. Butler is deeply troubled and reads the "Standards of Ethical Behavior for Practitioners of Manage-

ment Accounting and Financial Management" in Exhibit 1-7 (page 17). Classify each of the end-of-year

o1actions (a-g) as acceptable or unacceptable according to that document.

3. What should Butler do if Ray suggests that these end-of-year actions are taken in every division of

Daniel Foods and that she will greatly harm the snack-foods division if she does not cooperate and

paint the rosiest picture possible of the division's results?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Similar questions

- Q4. Mark Johns is the new division controller of the Frozen-Foods Division of Lindel Foods. Lindel Foods has reported a minimum 15% growth in annual earnings for each of the past 5 years. The Frozen-Foods Division has reported annual earnings growth of more than 20% each year in this same period. During the current year, the economy went into recession. The corporate controller estimates a 10% annual earnings growth rate for Lindel Foods this year. One month before the December 31 fiscal year-end of the current year, Johns estimates the Frozen-Foods Division will report an annual earnings growth of only 8%. Linda Kay, the Frozen-foods Division president, is not happy, but she notes that the "end-of-year actions" still need to be taken.Johns makes some inquiries and is able to compile a list of end-of-year actions that were more or less accepted by the previous division controller. Which one of the following proposed actions would clearly present an ethical dilemma to the company and…arrow_forwardGeneral Manager of Marketing, has recently completed a sales forecast. She believes the company’s sales during the first quarter of 20x1 will increase by 10 percent each month over the previous month’s sales. Then Wilcox expects sales to remain constant for several months. Intercoastal’s projected balance sheet as of December 31, 20x0, is as follows: Cash$55,000 Accounts receivable 324,000 Marketable securities 15,000 Inventory 211,200 Buildings and equipment (net of accumulated depreciation) 634,000 Total assets$1,239,200 Accounts payable$241,920 Bond interest payable 6,250 Property taxes payable 6,000 Bonds payable (5%; due in 20x6) 300,000 Common stock 500,000 Retained earnings 185,030 Total liabilities and stockholders’ equity$1,239,200 Jack Hanson, the assistant controller, is now preparing a monthly budget for the first quarter of 20x1. In the process, the following information has been accumulated:Projected sales for December of 20x0 are $480,000. Credit sales typically are 75…arrow_forwardCharle's Furniture Store has been In business for several years. The firm's owners have described the store as a "high-price, high- service" operatlon that provides lots of assistance to Its customers. Margin has averaged a relatively high 29% per year for several years, but turnover has been a relatively low 0.6 based on average total assets of $800,000. A discount furniture Store is about to open in the area served by Charlie's, and management Is considering lowering prices to compete effectively. Required: a. Calculate current sales and ROI for Charlie's Furniture Store. b. Assuming that the new strategy would reduce margin to 20%, and assuming that average total assets would stay the same, calculate the sales that would be required to have the same ROl as Charlie's currently earns. c. Suppose you presented the results of your analysis in parts a and b of this problem to Charle, and he replied, "What are you telling me? If I reduce my prices as planned, then I have to Increase my…arrow_forward

- You are trying to prepare financial statements for Bartlett Pickle Company, but seem to be missing its balance sheet. You have Bartlett's income statement, which shows sales last year were $300 million with a gross profit margin of 30 percent. You also know that credit sales equaled three-quarters of Bartlett's total revenues last year. In adlon, Bartlett had a collection period of 40 days, a payables period of 30 days, and an inventory turnover of 7 times based on cost of oods sold. Calculate Bartlett's year-ending balance for accounts receivable, inventory, and accounts payable. Note: Round your answers to 1 decimal place. Bartlett's year-ending balance (million) Accounts receivable Inventory Accounts payable BV3arrow_forward[The following information applies to the questions displayed below.] Mears and Company has been operating for five years as an electronics component manufacturer specializing in cellular phone components. During this period, it has experienced rapid growth in sales revenue and in inventory. Mr. Mears and his associates have hired you as Mears's first corporate controller. You have put into place new purchasing and manufacturing procedures that are expected to reduce inventories by approximately one-third by year-end. You have gathered the following data related to the changes: Inventory (dollars in thousands) Beginning of Year $585,700 End of Year (projected) $392,310 Current Year Cost of goods sold P7-7 Part 1 (projected) $7,018,984 Required: 1. Compute the inventory turnover ratio based on two different assumptions: Note: Round your answers to 1 decimal place. a. Those presented in the above table (a decrease in the balance in inventory). b. No change from the beginning-of-the-year…arrow_forwardLast year company A introduced a new product and sold 25,900 units at $97.00 per unit. The product variable expense $67.00 per unit with a fixed price expense of $835,500 per year. a. What is the product's net income or loss last year? b. What is the product break-even point in unit sales and dollar sales? c. Assume the company has conducted a market study that estimates it can increase sales by 5,000 units for each $2.00 reduction in its selling price. If the company would only consider increments of $2.00(e.g. $68,$66, etc) What is the maximum annual profit that can be earned on this product? What sales volume and selling price per unit generate the maximum profit? d. What would be the break-even point in unit sales and dollar sales using the selling price that was determined in the required letter c above? Thank you,arrow_forward

- The Frozen North Construction Company would like to forecast its minimum volume of work (turnover) in order to “break even” (i.e., cover its corporate overheads) for the coming year. The company’s previous year’s corporate overheads were $900,000. The company anticipates 22% inflation and 6% growth in the firm for the coming year. It also expects to achieve a gross margin of 13% on its projects, based on old experience. The company defines gross margin as a percentage of revenue (i.e., selling price). Determine the minimum volume of work, which will allow the Frozen North Company to break even at the end of the coming year.arrow_forwardQ5. Mark Johns is the new division controller of the Frozen-Foods Division of Lindel Foods. Lindel Foods has reported a minimum 15% growth in annual earnings for each of the past 5 years. The Frozen-Foods Division has reported annual earnings growth of more than 20% each year in this same period. During the current year, the economy went into recession. The corporate controller estimates a 10% annual earnings growth rate for Lindel Foods this year. One month before the December 31 fiscal year-end of the current year, Johns estimates the Frozen-Foods Division will report an annual earnings growth of only 8%. Linda Kay, the frozen-foods division president, is not happy, but she notes that the "end-of-year actions" still need to be taken. Johns makes some inquiries and is able to compile a list of end-of-year actions that were more or less accepted by the previous division controller. Which one of the following proposed actions would clearly not present an ethical dilemma to the company…arrow_forwardReady Electronics is facing stiff competition from imported goods. Its operating income margin has been declining steadily for the past several years. The company has been forced to lower prices so that it can maintain its market share. The operating results for the past 3 years are as follows: Year 1 Year 2 Year 3 Sales 14,500,000 9,500,000 9,000,000 Operating income 1,200,000 1,145,000 945,000 Average assets 15,000,000 15,000,000 16,750,000 For the coming year, Ready's president plans to install a JIT purchasing and manufacturing system. She estimates that inventories will be reduced by 70% during the first year of operations, producing a 20% reduction in the average operating assets of the company, which would remain unchanged without the JIT system. She also estimates that sales and operating income will be restored to Year 1 levels because of simultaneous reductions in operating expenses and selling prices. Lower selling prices will allow Ready to expand its market share. 1.…arrow_forward

- 9 Rundle Pointers Corporation expects to begin operations on January 1, year 1; it will operate as a specialty sales company that sells laser pointers over the Internet. Rundle expects sales in January year 1 to total $370,000 and to increase 10 percent per month in February and March. All sales are on account. Rundle expects to collect 70 percent of accounts receivable in the month of sale, 21 percent in the month following the sale, and 9 percent in the second month following the sale. Required a. Prepare a sales budget for the first quarter of year 1. b. Determine the amount of sales revenue Rundle will report on the year 1 first quarterly pro forma income statement. c. Prepare a cash receipts schedule for the first quarter of year 1. d. Determine the amount of accounts receivable as of March 31, year 1. Complete this question by entering your answers in the tabs below. Required Required Required A B Required D с Prepare a sales budget for the first quarter of year 1. Sales Budget…arrow_forwardba.1arrow_forwardReturn on investment, Margin, Turnover Ready Electronics is facing stiff competition from imported goods. Its operating income margin has been declining steadily for the past several years. The company has been forced to lower prices so that it can maintain its market share. The operating results for the past 3 years are as follows. For the coming year, Ready's president plans to install a JIT purchasing and manufacturing system. She estimates that inventories will be reduced by 70 % during the first year of operations, producing a 20% reduction in the average operating assets of the company, which would remain unchanged without the JIT system.She also estimates that sales and operating income will be restored to Year 1 levels because of simultaneous reductions in operating expenses and selling prices. Lower selling prices will allow Ready to expand its market share.(Note : Round all numbers to two decimal places.) Required : 1. Compute the ROI, margin, and turnover for Years 1, 2…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education