Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

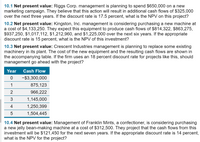

Transcribed Image Text:**10.1 Net present value:** Riggs Corp. management is planning to spend $650,000 on a new marketing campaign. They believe that this action will result in additional cash flows of $325,000 over the next three years. If the discount rate is 17.5 percent, what is the NPV on this project?

**10.2 Net present value:** Kingston, Inc. management is considering purchasing a new machine at a cost of $4,133,250. They expect this equipment to produce cash flows of $814,322, $863,275, $937,250, $1,017,112, $1,212,960, and $1,225,000 over the next six years. If the appropriate discount rate is 15 percent, what is the NPV of this investment?

**10.3 Net present value:** Crescent Industries management is planning to replace some existing machinery in its plant. The cost of the new equipment and the resulting cash flows are shown in the accompanying table. If the firm uses an 18 percent discount rate for projects like this, should management go ahead with the project?

| Year | Cash Flow |

|------|------------|

| 0 | -$3,300,000|

| 1 | 875,123 |

| 2 | 966,222 |

| 3 | 1,145,000 |

| 4 | 1,250,399 |

| 5 | 1,504,445 |

**10.4 Net present value:** Management of Franklin Mints, a confectioner, is considering purchasing a new jelly bean-making machine at a cost of $312,500. They project that the cash flows from this investment will be $121,450 for the next seven years. If the appropriate discount rate is 14 percent, what is the NPV for the project?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Please correct answer thes questionarrow_forwardNet present value. Quark Industries has a project with the following projected cash flows: Initial cost: $280,000 Cash flow year one: $30,000 Cash flow year two: $80,000 Cash flow year three: $153,000 Cash flow year four: $153,000 a. Using a discount rate of 8% for this project and the NPV model, determine whether the company should accept or reject this project. b. Should the company accept or reject it using a discount rate of 15%? c. Should the company accept or reject it using a discount rate of 18%?arrow_forwardCan I get the answers to 10.11 and 10.12.arrow_forward

- 1. What is the profitability index of a project that costs $90,000 and returns $30,000 annually for 8 years if the opportunity cost of capital is 9.6%? a.0.64 b.0.80 c.1.76 d.1.05 e.1.26 2. King Corporation is planning a 15-year project with an initial investment of $2,013,000. The project will have $563,000 cash inflows per year in years 1-2; $166,000 cash inflows in years 3-10, and $57,000 cash inflows in years 11-15. Determine the project's internal rate of return (IRR). Using financial calculator a.6.87% b.5.72% c.4.58% d.10.30% e.8.24%arrow_forwardPlease fully explainarrow_forwardNPV (net present value) Craig is considering several capital investments for the upcoming year. Use the NPV (net present value) method to determine whether the company should investment in the following independent projects: Project 1 costs $28,000 and offers 8 annual cash flows of $8,600. Craig feels this type of investment should require an annual return of 16% on projects like this. Project 2 costs $35,000 and offers 6 annual cash flows of $12,000. Craig feels this type of investment should require an annual return of 12% on projects like this. Requirements 1. Calculate the NPV of both of these projects 2. What is the maximum acceptable price Craig should pay for each of these projects?arrow_forward

- 28. Your restaurant’s new project, creating a gluten-free menu, is expected to have the following cash flows. The company requires a project to have a payback period less than 2 years. The company’s required rate of return is 18%. Year Cash Flows Cumulative cash flows 0 -$850,000 1 $300,000 2 $400,000 3 $500,000 What is the project’s net present value (NPV)? Group of answer choices –$4,173.5 $1,695,826.5 –$10,800.96 $4,173.5arrow_forward24. You are evaluating a project that will cost $534,000, but is expected to produce cash flows of $128,000 per year for 10 years, with the first cash flow in one year. Your cost of capital is 11% and your company's preferred payback period is three years or less. a. What is the payback period of this project? b. Should you take the project if you want to increase the value of the company? a. What is the payback period of this project? The payback period is ____years. b. If you want to increase the value of the company you (will/will not) take the project since the NPV is (negative/positive) **round to two decimal places**arrow_forward11. I need help with finance home work question A company is considering a 7-year project. At the beginning of the project, a cash outflow in the amount of $340,000 would be required. The company expects the project would generate cash inflows in the amount of $70,000 at the end of each of the project's 7 years. Assume the company requires a return of 8%. What NPV does the company expect for this project?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education