Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

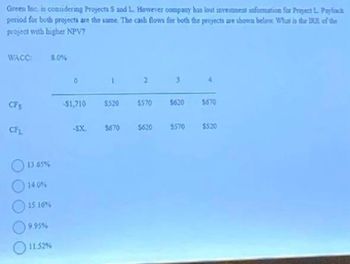

Transcribed Image Text:Green Inc. is considering Projects S and L. However company has lost investment information for Project L. Payback

period for both projects are the same. The cash flows for both the projects are shown below What is the IRR of the

project with higher NPV?

WACC

CFS

CFL

13.65%

14.0%

15.16%

8.0%

9.95%

11.52%

0

1

$1,710 $520 $570 $620

-SX.

$670 $620 $570

$670

$520

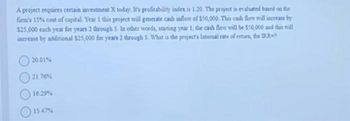

Transcribed Image Text:A project requires certain investment X today. It's profitability index is 1.20. The project is evaluated based on the

firm's 15% cost of capital. Year 1 this project will generate cash inflow of $50,000. This cash flow will increase by

$25,000 each year for years 2 through 5. In other words, starting year 1, the cash flow will be $50,000 and this will

increase by additional $25,000 for years 2 through 5. What is the project's Internal rate of return, the IRR

20.01%

21.76 %

16.29%

15.47%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- 3 https://pwcollege.brightspace.com/d21/le/content/6894/viewContent/7549/View?ou=6894 T 01 2 Cost Pay Back and NPV A company is considering investing in a project to expand the facilities for customers. There are two different ways of doing this and they have each been costed. Projected net cash flow into the company has also been estimated. Project 2 £115,000.00 Year Expected Contributions 1 3 4 Automatic Zoom 5 Project 1 £120,000.00 6 £50,000.00 £40,000.00 £50,000.00 £45,000.00 £50,000.00 £50,000,00 £40,000.00 £40,000.00 £45,000.00 £30,000.00 a. If the company used the payback method, when does each project pay for itself? b. If the company were to employ a discount rate of 12%, what would be the NPV of each project? CIRR to > A view as TexT DOWI £50,000.00 £30,000.00arrow_forwardA company is analyzing two mutually exclusive projects, S and L, with the following cash flows: 1 2 3 4 Project S -$1,000 $870.95 $260 $5 $10 Project L -$1,000 $5 $260 $400 $803.94 The company's WACC is 8.0%. What is the IRR of the better project? (Hint: The better project may or may not be the one with the higher IRR.) Round your answer to two decimal places. %arrow_forwardCalculate IRR of projects S and L, IRRS & IRRL IRRS IRRL UF Company is considering Projects S and L, whose cash flows are shown below. These projects are mutually exclusive, equally risky, and are not repeatable. WACC: 7.75% Year 0 1 2 3 4 CFS ($1,050) $700 $625 CFL ($1,050) $370 $370 $360 $360arrow_forward

- Find the crossover rate. UF Company is considering Projects S and L, whose cash flows are shown below. These projects are mutually exclusive, equally risky, and are not repeatable. WACC: 7.75% Year 0 1 2 3 4 CFS ($1,050) $700 $625 CFL ($1,050) $370 $370 $360 $360arrow_forwardNonearrow_forwardNonearrow_forward

- UF Company is considering Projects S and L, whose cash flows are shown below. These projects are mutually exclusive, equally risky, and are not repeatable. WACC 7.5% Year 0 1 2 3 4 CFS ($1,050) $700 $625 CFL ($1,050) $370 $370 $360 $360 Question: Calculate IRR of projects S and L, IRRS & IRRL (show in excel format with spreadsheet inputs)arrow_forwardDo not give image formatarrow_forwardNonearrow_forward

- 17arrow_forwardNonearrow_forwardNet Cash Flows and NPVs for different discount rate for projects S and L are given below Net Cash Flows ($) Discount Rate (%) NPVS NPVL Year (t) Project S Project L 0% $800 $1100 0 $(3000) $(3000) 5 554.32 1 1500 400 10 161.33 2 1200 900 15 (90.74) (259.24) 3 800 1300 20 (309.03) (565.97) 4 300 1500 a) Calculate the payback period in years for the Project S and Project L i) Payback for Project S: ii) Payback for Project L: c) Calculate NPVS for 5% and NPVL for 10%. Fill the table i) NPVS at 5%: ii) NPVS at 10%: d) What is the IRR for S? (Write down the equation for IRR and then Use an excel worksheet to calculate IRR Equation: Answer: e) What is the IRR for S? (Write down the equation for IRR and then Use an excel worksheet to calculate IRR Equation: Answer: f) What is the cross-over rate? (Write down the equation for IRR and then Use…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education