Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

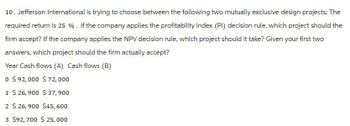

Transcribed Image Text:10. Jefferson International is trying to choose between the following two mutually exclusive design projects: The

required return is 25 %. If the company applies the profitability index (PI) decision rule, which project should the

firm accept? If the company applies the NPV decision rule, which project should it take? Given your first two

answers, which project should the firm actually accept?

Year Cash flows (A) Cash flows (B)

0 $ 92,000 $ 72,000

1 $ 26,900 $ 37,900

2 $ 26,900 $45,600

3 $92,700 $ 25,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Darin Clay, the CFO of MakeMoney.com, has to decide between the following two projects: Year 0 1 2 3 Project Million -$ 2,800 10 + 320 1,120 2,000 Project Billion -$10 /0 +1,200 2,000 3,200 The expected rate of return for either of the two projects is 13 percent. What is the range of initial investment (/o) for which Project Billion is more financially attractive than Project Million? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Initial investmentarrow_forwardSuppose your firm is considering investing in a project with the cash flows shown below, that the required rate of return on projects of this risk class is 13 percent, and that the maximum allowable payback and discounted payback statistics for your company are 3 and 3.5 years, respectively. Time: 0 1 2 3 4 5 Cash flow: −$255,000 $61,800 $80,000 $133,000 $118,000 $77,200 Use the MIRR decision rule to evaluate this project. (Do not round intermediate calculations and round your final answer to 2 decimal places.) Should this be Accepted or Rejectedarrow_forwardAssume a company is going to make an investment of $300,000 in a machine and the following are the cash flows that two different products would bring in years one through four. The company's required rate of return is 12%. What is the NPV for Option A? What is the NPV for Option B? What is the IRR for Option A? What is the IRR for Option B? PLEASE NOTE #1: The dollar amounts will be with "$" and commas as needed and rounded to two decimal places (i.e. $12,345.67). Round your IRR answers, in percentage format, to two decimal places (i.e. 12.34%). Given the above answers, which project should the company invest in? Project . PLEASE NOTE #2: Your answer is either "A" or "B" - capital letter, no quotes.arrow_forward

- A Company is considering two mutually exclusive projects whose expected net cash flows are in the table below. The company's WACC is 15%. What is the NPV for Project Y? What is the NPV for Project Z? What is the IRR for Project Y? What is the IRR for Project Z? Which Project, if any, should you choose? Time Project Y Project Z 0 S (420.00) S(950.00) 1 S(572.00) $270.00 2 S(189.00) S270.00 3 S(130.00) $270.00 4 $1,300.00 $270.00 5 $720.00 $270.00 6 $980.00 $270.00 7 $(225.00) $270.00 Pleaseshow in excel I think im getting the wrong valuesarrow_forward7arrow_forwardProfitability index. Given the discount rate and the future cash flow of each project listed in the following table, . use the Pl to determine which projects the company should accept. What is the Pl of project A? i Data Table (Round to two decimal places.) (Click on the following icon o in order to copy its contents into a spreadsheet.) Cash Flow Project A -%241,900,000 $150,000 $350,000 Project B Year 0 $2,300,000 $1,150,000 $950 000 $750,000 $550,000 Year 1 Year 2 Year 3 $550,000 Year 4 $750,000 $950,000 4% Year 5 $350.000 Discount rate 18% Print Donearrow_forward

- 2. A firm considers investing in a project. In Year 0 it needs to make an investment of $50,000. If it is expected to earn $50,000, $60,000, $70,000 in years 1,2,3 respectively, decide whether the firm should make the investment. Consider the required rate of return of 8%. You may use xis to make calculations. Make recommendations for both cases.arrow_forwardSuppose your firm is considering investing in a project with the cash flows shown below, that the required rate of return on projects of this risk class is 11 percent, and that the maximum allowable payback and discounted payback statistics for your company are 3 and 3.5 years, respectively. Time: Cash flow: 0 1 3 4 -$233,000 $65,600 $83,800 $140, 800 $121,800 MIRR Use the MIRR decision rule to evaluate this project. Note: Do not round intermediate calculations and round your final answer to 2 decimal places. 5 $81,000 %arrow_forwardA risky $420,000 investment is expected to generate the following cash flows: Year 1 2 3 4$ 102,700 $ 163,030 $ 160,824 $ 135,200 If the firm’s cost of capital is 12 percent, should the investment be made?. Use a minus sign to enter a negative value, if any. Round your answer to the nearest dollar.NPV: $ Should The investment be made? An alternative use for the $420,000 is a four-year U.S. Treasury bond that pays $25,200 annually and repays the $420,000 at maturity. Management believes that the cash inflows from the risky investment are equivalent to only 70 percent of the certain investment, which pays 6 percent. Should the investment be made? Use Appendix B to answer the question. Do not round other intermediate calculations. NPV: $ Should The investment be made?arrow_forward

- A company is considering a 4-year project with the following cash flows: C0 =-$20,000 C1 =C2 =C3 =C4 =$7,000 If the company’s opportunity cost of capital is 12%, then compute the following for the project: a) the project’s NPV b) the project’s IRR c) determine if the project will have more than 1 IRR d) The project’s PI e) Should the project be rejected because its payback period is longer than two years? f) Should the project be rejected because its IRR is greater than its required rate of return?arrow_forwardSuppose your firm is considering investing in a project with the cash flows shown below, that the required rate of return on projects of this risk class is 10 percent, and that the maximum allowable payback and discounted payback statistics for your company are 3.0 and 3.5 years, respectively. Time: 0 1 2 3 4 5 Cash flow: -S 245,000 $ 66,800 $ 85,000 $ 142,000 $ 123,000 $ 82, 200 Use the Pl decision rule to evaluate this project. Note: Do not round intermediate calculations and round your final answer to 2 decimal places. Should it be accepted or rejected? (Click to select)arrow_forwardSuppose your firm is considering investing in a project with the cash flows shown below, that the required rate of return on projects of this risk class is 13 percent, and that the maximum allowable payback and discounted payback statistics for your company are 2.5 and 3.0 years, respectively. Time: 0 1 2 3 4 5 Cash flow: −$ 225,000 $ 64,800 $ 83,000 $ 140,000 $ 121,000 $ 80,200 Use the IRR decision rule to evaluate this project. Note: Do not round intermediate calculations and round your final answer to 2 decimal places.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education