Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

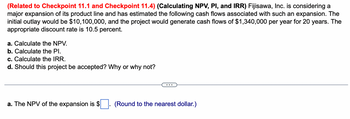

Transcribed Image Text:(Related to Checkpoint 11.1 and Checkpoint 11.4) (Calculating NPV, PI, and IRR) Fujisawa, Inc. is considering a major expansion of its product line and has estimated the following cash flows associated with such an expansion. The initial outlay would be $10,100,000, and the project would generate cash flows of $1,340,000 per year for 20 years. The appropriate discount rate is 10.5 percent.

a. Calculate the NPV.

b. Calculate the PI.

c. Calculate the IRR.

d. Should this project be accepted? Why or why not?

---

a. The NPV of the expansion is $____. (Round to the nearest dollar.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Aurum, Inc. is considering the purchase of new mining equipment. The equipment will cost $1,500,000 and will produce an incremental cash flow of $400,000 per year over its five-year life. The disposal value is expected to be $20,000. The company has a required rate of return of 10%. What is the NPV of the project?arrow_forwardGarfield Inc is considering a new project that requires an initial investment of $37,700 and will generate a net income of $5,331 per year, if the project’s profitability index is 1.8, What is the present value of the project’s future cash flows. Round to the nearest dollar.arrow_forwardGTO Incorporated is considering an investment costing $210,720 that results in net cash flows of $30,000 annually for 10 years. (PV of $1, FV of $1, PVA of $1, and FVA of $1) (Use appropriate factor(s) from the tables provided.) (a) What is the internal rate of return of this investment? (b) The hurdle rate is 8.5%. Should the company invest in this project on the basis of internal rate of return? Answer is complete but not entirely correct. a. Internal rate of return 8 × % b. Should the company invest in this project on the basis of internal rate of return? Noarrow_forward

- What is The net present value of the project (Round to three decimal places.)arrow_forwardUse the NPV method to determine whether Kyler Products should invest in the following projects: Project A: Costs $280,000 and offers seven annual net cash inflows of $52,000. Kyler Products requires an annual return of 12% on investments of this nature. Project B: Costs $385,000 and offers 9 annual net cash inflows of $75,000. Kyler Products demands an annual return of 10% on investments of this nature. (Click the icon to view Present Value of $1 table.) (Click the icon to view Present Value of Ordinary Annuity of $1 table.) Read the requirements. Requirement 1. What is the NPV of each project? Assume neither project has a residual value. Round to two decimal places. (Enter any factor amounts to three decimal places, X.XXX. Use parentheses or a minus sign for a negative net present value.) Caclulate the NPV (net present value) of each project. Begin by calculating the NPV of Project A. Project A: Years 1-7 0 Present value of annuity Investment Net present value of Project A Calculate…arrow_forwardKeuka Corporation is considering a project that costs $1 million and will produce benefits for 5 years. The first year cash inflow can be rather accurately estimated at $240,000, measured in today's dollars. If the actual first-through fifth-year cash flows are assumed to be the same size ($240,000), what would the NPV of the investment be if the appropriate discount rate is 15% ? Round to the nearest whole number. If the answer is negative, put your answer in parentheses. NPV = Sarrow_forward

- A project requires an initial investment of $225,000 and is expected to generate the following net cash inflows: Year 1: $95,000 Year 2: $80,000 Year 3: $60,000 Year 4: $55,000 Required: Compute net present value of the project if the minimum desired rate of return is 12%. Calculate the following: Payback Period NPV IRRarrow_forwardConsider two investment projects, both of which require an upfront investment of $10 million and pay a constant positive amount each year for the next 12 years. Under what conditions can you rank these projects by comparing their IRRS? (Select the best choice below.) A. Ranking by IRR will work in this case so long as the projects' cash flows do not decrease from year to year. B. Ranking by IRR will work in this case so long as the projects' cash flows do not increase from year to year. C. Ranking by IRR will work in this case so long as the projects have the same risk. D. There are no conditions under which you can use the IRR to rank projects.arrow_forwardUse the NPV method to determine whether Stenback Products should invest in the following projects: Project A: Costs $260,000 and offers eight annual net cash inflows of $54,000. Stenback Products requires an annual return of 14% on investments of this nature. Project B: Costs $395,000 and offers 10 annual net cash inflows of $77,000. Stenback Products demands an annual return of 12% on investments of this nature. (Click the icon to view Present Value of $1 table.) (Click the icon to view Present Value of Ordinary Annuity of $1 table.) Read the requirements. Requirement 1. What is the NPV of each project? Assume neither project has a residual value. Round to two decimal places. (Enter any factor amounts to three decimal places, X.XXX. Use parentheses or a minus sign for a negative net present value.) Caclulate the NPV (net present value) of each project. Begin by calculating the NPV of Project A Net Cash Inflow Project A: Years 1-8 0 Present value of annuity Investment Net present value…arrow_forward

- (Net present value calculation) Big Steve's, makers of swizzle sticks, is considering the purchase of a new plastic stamping machine. This investment requires an initial outlay of $105,000 and will generate net cash inflows of $21,000 per year for 8 years. a. What is the project's NPV using a discount rate of 8 percent? Should the project be accepted? Why or why not? b. What is the project's NPV using a discount rate of 16 percent? Should the project be accepted? Why or why not? c. What is this project's internal rate of return? Should the project be accepted? Why or why not? a. If the discount rate is 8 percent, then the project's NPV is $ (Round to the nearest dollar.)arrow_forwardCash flows from a new project are expected to be $5,000, $8,000, $14,000, $22,000, $24,000, and $32,000 over the next 6 years, respectively. Assuming qn initial cost of $60,000, and a discount rate of 16%, what is the project's IRR?arrow_forward(Net present value calculation) Dowling Sportswear is considering building a new factory to produce aluminum baseball bats. This project would require an initial cash outlay of $4,000,000 and would generate annual net cash inflows of $900,000 per year for 9 years. Calculate the project's NPV using a discount rate of 8 percent. If the discount rate is 8 percent, then the project's NPV is $ ?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education