FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

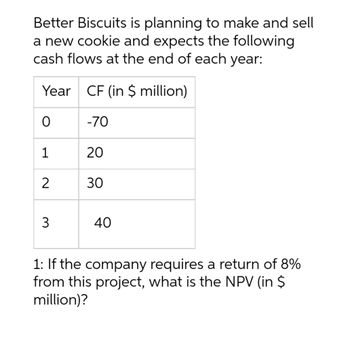

Transcribed Image Text:Better Biscuits is planning to make and sell

a new cookie and expects the following

cash flows at the end of each year:

Year CF (in $ million)

O

1

2

3

-70

20

30

40

1: If the company requires a return of 8%

from this project, what is the NPV (in $

million)?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Growth Enterprises believes its latest project, which will cost $80,000 to install, will generate a perpetual growing stream of cash flows. Cash flow at the end of the first year will be $6,000, and cash flows in future years are expected to grow indefinitely at an annual rate of 5%.. a. If the discount rate for this project is 10%, what is the project NPV? Note: Do not round intermediate calculations. Answer is complete and correct. NPV $ 40,000 b. What is the project IRR? Note: Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places. IRR Answer is complete but not entirely correct. 0.00%arrow_forwardCapstone Investments is considering a project that will produce cash inflows of $11,000 in 1 year, $22,000 in 2 years, and $33,000 in 3 years. The company assigns the project a discount rate of 6%? What is the present value of these cash inflows?arrow_forwardFastTrack Bikes, Inc. is thinking of developing a new composite road bike. Development will take six years and the cost is $213,000 per year. Once in production, the bike is expected to make $319,500 per year for 10 years. Assume the cost of capital is 10%. a. Calculate the NPV of this investment opportunity, assuming all cash flows occur at the end of each year. Should the company make the investment? b. By how much must the cost of capital estimate deviate to change the decision? (Hint: Use Excel to calculate the IRR.) c. What is the NPV of the investment if the cost of capital is 14%? Note: Assume that all cash flows occur at the end of the appropriate year and that the inflows do not start until year 7. a. Calculate the NPV of this investment opportunity, assuming all cash flows occur at the end of each year. Should the company make the investment? The present value of the costs is $ (Round to the nearest dollar.) The present value of the benefits is $. (Round to the nearest…arrow_forward

- A firm expects to make payments of 1.1, 1.5, 1.2, 1.4 and 1.9 million for a particular supply over each of the next 5 years. What is the present value of this mixed cash flow stream if the annual rate is 10%?arrow_forwardYour company is considering a capital project that will require a net initial investment of $244,978. The project is expected to have a 7- year life and will generate an annual net cash inflow of $40,860. Using the present value tables, what is the internal rate of return? (Round answers to O decimal places, e.g. 25.) Click here to view the factor table. Internal Rate of Return %arrow_forwardYou are evaluating a project that will cost $502,000, but is expected to produce cash flows of $127,000 per year for 10 years, with the first cash flow in one year. Your cost of capital is 10.7% and your company's preferred payback period is three years or less. a. What is the payback period of this project? b. Should you take the project if you want to increase the value of the company? a. What is the payback period of this project? The payback period is years. (Round to two decimal places.) b. Should you take the project if you want to increase the value of the company? (Select from the drop-down menus.) If you want to increase the value of the company you take the project since the NPV is will not willarrow_forward

- A new D8 will cost you $600,000. You estimate maintenance to be $14,000 at the end of each year (including year of sale), but major repairs at the end of year 4 will cost an additional $15,000. The machine will be sold for an estimated $300,000 at the end of year 5. Calculate the annual cost of this investment at a 10% compound interest rate. Your solution must be accompanied by a sketch of the cash flow diagram.arrow_forwardYou have built a Free Cash Flow model for a company, and calculate that the FCF for the fifth year from today is $1,000 (i.e. an investor who owns the enterprise would receive FCF of $1,000 exactly five years from today). Assuming FCF grows at 3% each year forever from that point onwards, and that the WACC is 8%, calculate the PV today of the Terminal Value that is based on this perpetuity. (For the purposes of this question, only value FCF after the fifth year.)arrow_forwardShannon Industries is considering a project which has the following cash flows: Year Cash Flow 0 ? 1 $2,000 2 3,000 3 3,000 4 1,500 The project has a payback of 2.5 years. The firm's cost of capital is 12 percent. What is the project's net present value NPV? Round it to a whole dollar, e.g., 1234.arrow_forward

- Caspian Sea Drinks is considering buying the J - Mix 2000. It will allow them to make and sell more product. The machine cost $1.92 million and create incremental cash flows of $582, 193.00 each year for the next five years. The cost of capital is 9.20 %. What is the profitability index for the J - Mix 2000?arrow_forwardMidlife Crisis Inc. (MCI) has two assets: epsilon1,60 in cash and an investment project. The cash is invested in the risk-free asset which earns 5% per year. The project requires an investment of £800 today and generates an expected cash flow of £1,600 one year from now. This opportunity recurs perpetually each year. Thus, for example, one year from now MCI can again invest £800 and generate epsilon1,600 one year subsequent to that investment. MCI has 800 shares outstanding. The market equity risk premium is 5% per year, and the investment project has a CAPM beta of 1. Assume a Modigliani and Miller world. When answering this question, state any additional assumptions you may need to make. Show your calculations. (a) Should MCI invest in the project? Explain. (b) Suppose MCI's CFO decides to pursue the project. What is the value of MCI? (c) Suppose MCI's CFO decides to take the project and always pay out all free cash flow as a dividend. What is MCI's cum-dividend price expected to be…arrow_forwardSuppose a company could invest in a machine that would be able to produce $1,000,000 worth of saleable merchandise in one year, $2,000,000 for another two years then $1,000,000 for another three years. If the required rate of return for the company is 8%, what is the value of the machine's future cash flows to the company today?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education