FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

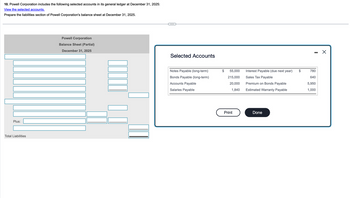

Transcribed Image Text:10. Powell Corporation includes the following selected accounts in its general ledger at December 31, 2025:

View the selected accounts.

Prepare the liabilities section of Powell Corporation's balance sheet at December 31, 2025.

Plus:

Total Liabilities

Powell Corporation

Balance Sheet (Partial)

December 31, 2025

Selected Accounts

-

☑

Notes Payable (long-term)

55,000

Bonds Payable (long-term)

215,000

Interest Payable (due next year)

Sales Tax Payable

$

780

640

Accounts Payable

20,000

Premium on Bonds Payable

5,950

Salaries Payable

1,840

Estimated Warranty Payable

1,000

Print

Done

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- 10. Sullivan Corporation includes the following selected accounts in its general ledger at December 31, 2025: Viewthe selected accounts. "Notes Payable (long - term) $65, 000 Bonds Payable (long - term)S 195, 000 Accounts Payable$ 19,600 Salaries Payable $ 1,840 Interest Payable (due next year) $ 740 Sales Tax Payable $ 680 Premium on BondsPayable $ 5,600 Estimated Warranty Payable S 1,000 Prepare the liabilities section of Sullivan Corporation's balancesheet at December 31, 2025.arrow_forwardMC21. Bay Corporation trial balance included the following account balances at December 31, 2021: Accounts payable - P4,500,000; Bonds payable, due December 31, 2022 P7,500,000; Discount on bonds payable - P900,000; Notes Dividends payable on January 31, 2022 - P2,400,000; payable due January 31, 2025 - P6,000,000. How much is included in the current liabilities section of Bay Corporation's December 31, 2021 statement of financial position?arrow_forwardSandhill Industries, Inc. reports the following liabilities (in thousands) on its January 31, 2025 balance sheet and notes to the financial statements. Accounts payable $3,220.9 Accrued pension liability-long-term 1,425.2 Property taxes payable 1,368.1 Bonds payable 2,171.2 Current portion of long-term debt 2,202.2 Income taxes payable 245.2 Notes payable-long-term 9,456.7 Mortgage payable 445.6 Federal income taxes payable 568.1 Salaries and wages payable 2,772.6 Unused operating line of credit 3,547.6 Warranty liability-current 1,827.3 Prepare the liabilities section of Sandhill's balance sheet at January 31, 2025. (Round answers in thousands to 1 decimal place, e.g. 52.7.) Current Liabilities Accounts Payable Property Taxes Payable Current Portion of Long-Term Debt Income Taxes Payable Federal Income Taxes Payable Salaries and Wages Payable Warranty Liability Total Current Liabilities Long-term Liabilities Bonds Payable Accrued Pension Liability Notes Payable Mortgage Payable Total…arrow_forward

- The accountant for Jaemin Corporation prepared the following schedule of liabilities as of December 31,2022. Accounts payable and accrued expenses 1,650,000Notes payable — trade 1,200,000Notes Payable — bank 8,000,000Wages and salaries payable 350,000Interest payable ?10% mortgage note payable 6,000,00012% mortgage note payable 4,500,000Bonds payable 10,000,000 The following additional information pertains to these liabilities: a. The bank notes payable include two separate notes payable to Minhyung Bank:(1) A P2,000,000, 8% note issued March 1, 2022, payable on demand. Interest is payable eachsix months. Jaemin already made the first semi-annual interest payment on August 31, 2022. (2) A 2-year, P6,000,000, 11 % note issued January 2, 2021. On December 30, 2022, after paying the accrued interest, Jaemin negotiated a written agreement with the Minhyung Bank to replace this note with a 2-year, P6,000,000, 10% note. The new note was issued January 2, 2023.b. The 10% mortgage note was…arrow_forwardMetlock, Inc. reports the following liabilities (in thousands) on its December 31, 2022, balance sheet and notes to the financial statements. Accounts payable $4,264.0 Mortgage payable $6,747.0 Unearned rent revenue 1,059.0 Notes payable (due in 2025) 336.0 Bonds payable 1,954.0 Salaries and wages payable 859.0 Current portion of mortgage payable 1,993.0 Notes payable (due in 2023) 2,564.0 Income taxes payable 266.0 Warranty liability—current 1,418.0 Create a balance sheet for the liabilities section of the balance sheet.arrow_forwardOn December 31, 2019, Gliezel company provided the following information:Accounts payable, including deposits and advances from customer of 300,0001,500,000Notes payable, including note payable to bank due on December 31, 2021of 600,0001,800,000Stock dividend payable480,000Credit balances in customers accounts240,000Serial bonds payable in semiannual installment of 600,0006,000,000Accrued interest on bonds payable180,000Contested BIR tax assessment – possible obligation360,000Unearned rent income120,000Compute the total current liabilities.arrow_forward

- On December 31, 2019, the bookkeeper of Tiger Company provided the following information: What is the total current liabilities on December 31, 2019? * Accounts payable, trade Dividends payable 3,600,000.00 600,000.00 Withholding tax payable 185,000.00 Notes payable, including note payable on bank due Dec 2024 of P200,000 1,800,000.00 Bank overdraft 300,000.00 Accrued interest on bonds payable 125,000.00 Bonds Payable,6% 5,000,000.00 Stock dividends payable 140,000.00arrow_forwardWhat is the Required 1-3?arrow_forwardOn December 31, 2021, Yohan Company provided the following information: Accounts Payable, Including deposits and advances from customer of P250,000 1,250, 000 Notes payable, including note payable to bank due on December 31, 2022 of 500,000 1.500,000 Share dividend payable 400,000 Credit balances in customer's account 200,000 Serial bonds payable in semi annual installment of 500,000 5,000,000 Accrued interest on bonds payable 150,000 Contested BIR tax assessment - possible obligation 300,000 Unearned rent income 100,000 Required: Compute the total current liabilities on December 31,2021arrow_forward

- 19. The following balances were reported by Nagpapangap Company on December 31, 2020 and 2019: 2020: Accounts payable - P3,500,000; Notes payable - P4,000,000 2019: Accounts payable - P2,500,000; Notes payable - P1,500,000 On July 1, 2020, the company issued a one-year, 12% note for a bank loan of P1,000,000. All other notes payable arose from purchases of merchandise. Total payment to suppliers in 2020 amounted to P11,000,000, after purchase discount of P250,000. During 2020, company returned defective merchandise costing P500,000. What is the amount of gross purchases for 2020 under the accrual basis?Choices: P14,250,000 P11,000,000 P12,450,000 P18,250,000arrow_forward4. Determine the ending balance of AccountsReceivable as of December 31, 2019. 5. What is the net realizable value of thereceivables at the end of 2019? 6. The company has a notes receivable ofRp24,000 at January 15, 2019 for 3 months at10% interest rate. Prepare journal entry as ofApril 15, 2019, on its due date.arrow_forwardOn December 31, 2021, the bookkeeper of Grand Company provided the following information: Accounts payable, including deposits and advances from customers Of P500,000 Notes payable, including note payable to bank due on December 31, 2023 for P1,000,000 Share dividends payable P2,500,000 3,000,000 800,000 Credit balance in customers' accounts 400,000 Serial bonds, payable in semi annual installments of P1,000,000 Accrued interest on bonds payable 10,000,000 300,000 Contested BIR tax assessment 600,000 Unearned rent income 100,000 In the December 31, 2021 statement of financial position, how much current liabilities should be reported?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education