Principles of Accounting Volume 1

19th Edition

ISBN: 9781947172685

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

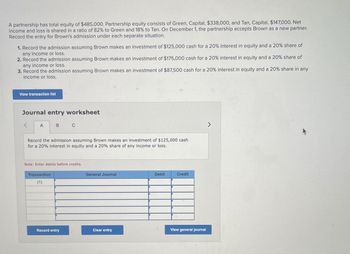

Transcribed Image Text:A partnership has total equity of $485,000. Partnership equity consists of Green, Capital, $338,000, and Tan, Capital, $147,000. Net

income and loss is shared in a ratio of 82% to Green and 18% to Tan. On December 1, the partnership accepts Brown as a new partner.

Record the entry for Brown's admission under each separate situation.

1. Record the admission assuming Brown makes an investment of $125,000 cash for a 20% interest in equity and a 20% share of

any income or loss.

2. Record the admission assuming Brown makes an investment of $175,000 cash for a 20% interest in equity and a 20% share of

any income or loss.

3. Record the admission assuming Brown makes an investment of $87,500 cash for a 20% interest in equity and a 20% share in any

income or loss.

View transaction list

Journal entry worksheet

<

A

B

C

Record the admission assuming Brown makes an investment of $125,000 cash

for a 20% interest in equity and a 20% share of any income or loss.

Note: Enter debits before credits.

Transaction

(1)

General Journal

Debit

Credit

View general journal

Record entry

Clear entry

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- The partnership of Tatum and Brook shares profits and losses in a 60:40 ratio respectively after Tatum receives a 10,000 salary and Brook receives a 15,000 salary. Prepare a schedule showing how the profit and loss should be divided, assuming the profit or loss for the year is: A. $40,000 B. $25,000 C. ($5,000) In addition, show the resulting entries to each partners capital account. Tatums capital account balance is $50,000 and Brooks is $60,000.arrow_forwardThe partnership of Tasha and Bill shares profits and losses in a 50:50 ratio, and the partners have capital balances of $45,000 each. Prepare a schedule showing how the bonus should be divided if Ashanti joins the partnership with a $60,000 investment. The partners new agreement will share profit and loss in a 1:3 ratio.arrow_forwardThe partnership of Magda and Sue shares profits and losses in a 50:50 ratio after Mary receives a $7,000 salary and Sue receives a $6,500 salary. Prepare a schedule showing how the profit and loss should be divided, assuming the profit or loss for the year is: A. $10,000 B. $5,000 C. ($12,000) In addition, show the resulting entries to each partners capital account.arrow_forward

- Arun and Margot want to admit Tammy as a third partner for their partnership. Their capital balances prior to Tammys admission are $50,000 each. Prepare a schedule showing how the bonus should be divided among the three, assuming the profit or loss agreement will be 1:3 once Tammy has been admitted and her contribution is: A. $20,000 B. $80,000 C. $50,000. In addition, show the resulting journal entries to each of the three partners capital accounts.arrow_forwardOn February 3, 2016 Sam Singh invested $90,000 cash for a 1/3 interest in a newly formed partnership. Prepare the journal entry to record the transaction.arrow_forwardJuan contributes marketable securities to a partnership. The book value of the securities is $7,000 and they have a current market value of $10,000. What amount should the partnership record in Juans Capital account due to this contribution? A. $10,000 B. $7,000 C. $3,000 D. none of the abovearrow_forward

- A partnership has total equity of $491,000. Partnership equity consists of Green, Capital, $342,000, and Tan, Capital, $149,000. Net income and loss is shared in a ratio of 85% to Green and 15% to Tan. On December 1, the partnership accepts Brown as a new partner. Record the entry for Brown's admission under each separate situation. Record the admission assuming Brown makes an investment of $127,000 cash for a 20% interest in equity and a 20% share of any income or loss. Record the admission assuming Brown makes an investment of $179,000 cash for a 20% interest in equity and a 20% share of any income or loss. Record the admission assuming Brown makes an investment of $88,500 cash for a 20% interest in equity and a 20% share in any income or loss.arrow_forwardBook A partnership has total equity of $464,000. Partnership equity consists of Green, Capital, $324,000, and Tan, Capital, $140,000. Net income and loss is shared in a ratio of 85% to Green and 15% to Tan. On December 1, the partnership accepts Brown as a new partner. Record the entry for Brown's admission under each separate situation. 1. Record the admission assuming Brown makes an investment of $118,000 cash for a 20% interest in equity and a 20% share of any income or loss. 2. Record the admission assuming Brown makes an investment of $161,000 cash for a 20% interest in equity and a 20% share of any income or loss. 3. Record the admission assuming Brown makes an investment of $84,000 cash for a 20% interest in equity and a 20% share in any income or loss.arrow_forwardAfter the tangible assets have been adjusted to current market prices, the capital accounts of Grayson Jackson and Harry Barge have balances of $44,920 and $60,890, respectively. Lewan Gorman is to be admitted to the partnership, contributing $32,080 cash to the partnership, for which he is to receive an ownership equity of $36,650. All partners share equally in income. Required: a. On December 31, journalize the entry to record the admission of Gorman, who is to receive a bonus of $4,570. Refer to the chart of accounts for the exact wording of the account titles. CNOW journals do not use lines for journal explanations. Every line on a journal page is used for debit or credit entries. CNOW journals will automatically indent a credit entry when a credit amount is entered. b. What are the capital balances of each partner after the admission of the new partner? c. Why are tangible assets adjusted to current market prices, prior to admitting a new partner? Chart of…arrow_forward

- After the tangible assets have been adjusted to current market prices, the capital accounts of Grayson Jackson and Harry Barge have balances of $64,900 and $86,500, respectively. Lewan Gorman is to be admitted to the partnership, contributing $43,300 cash to the partnership, for which he is to receive an ownership equity of $50,500. All partners share equally in income. Required: a. On December 31, journalize the entry to record the admission of Gorman, who is to receive a bonus of $7,200. Refer to the chart of accounts for the exact wording of the account titles. CNOW journals do not use lines for journal explanations. Every line on a journal page is used for debit or credit entries. CNOW journals will automatically indent a credit entry when a credit amount is entered. b. What are the capital balances of each partner after the admission of the new partner? c. Why are tangible assets adjusted to current market prices, prior to admitting a new partner?arrow_forwardAfter the tangible assets have been adjusted to current market prices, the capital accounts of Grayson Jackson and Harry Barge have balances of $42,590 and $59,110, respectively. Lewan Gorman is to be admitted to the partnership, contributing $30,890 cash to the partnership, for which he is to receive an ownership equity of $36,030. All partners share equally in income. a. On December 31, journalize the entry to record the admission of Gorman, who is to receive a bonus of $5,140. Refer to the chart of accounts for the exact wording of the account titles. CNOW journals do not use lines for journal explanations. Every line on a journal page is used for debit or credit entries. CNOW journals will automatically indent a credit entry when a credit amount is entered. JOURNAL DATE DESCRIPTION POST. REF. DEBIT CREDIT 1 2 3 4…arrow_forwardAdmitting New Partner Who Contributes Assets After the tangible assets have been adjusted to current market prices, the capital accounts of Brad Paulson and Drew Webster have balances of $87,000 and $148,000, respectively. Austin Neel is to be admitted to the partnership, contributing $58,000 cash to the partnership, for which he is to receive an ownership equity of $75,000. All partners share equally in income. a. Journalize the entry to record the admission of Neel, who is to receive a bonus of $17,000. For a compound transaction, if an amount box does not require an entry, leave it blank. b. What are the capital balances of each partner after the admission of the new partner? Partner Brad Paulson Drew Webster Austin Neel Balance c. Why are tangible assets adjusted to current market prices prior to admitting a new partner? Tangible assets should be adjusted to current market prices so that the to being admitted. does not share in any gains or losses from changes in market pricesarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning